Bitwise CEO Hunter Horsley declares the four-year crypto cycle lifeless, changed by a mature market construction pushed by Bitcoin ETFs and regulatory shifts.

The crypto market’s long-term fundamentals look promising. That is regardless of the shakeup in October and November. This era left asset costs down. Investor sentiment additionally crashed. That is based on Hunter Horsley. He’s CEO of an funding agency referred to as Bitwise. He’s optimistic for the longer term.

New Market Construction Replaces Bygone Crypto Period

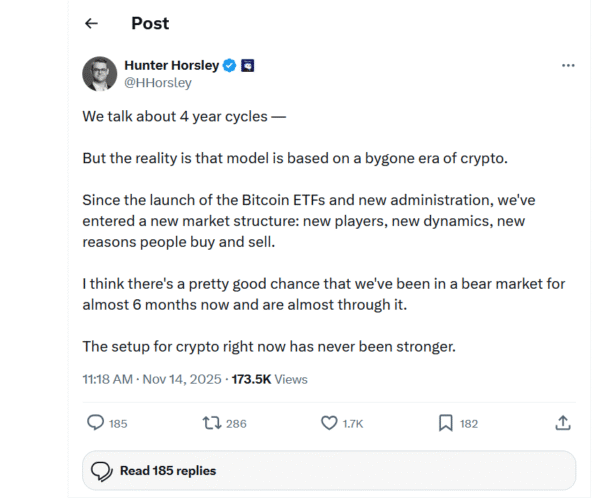

Horsley mentioned the four-year market cycle is lifeless. It has given strategy to a extra mature market construction extra lately. Modified dynamics are resulting from a pro-crypto regulatory pivot. This pivot is going down within the US. He wrote about his views in a Friday X put up.

“Because the introduction of the Bitcoin ETFs and new administration, we’ve seen a brand new market construction,” Horsley wrote. He added, “new gamers, new dynamics, new causes folks purchase and promote.” This represents a basic change.

Associated Studying: BTC Information: Harvard Boosts Bitcoin ETF Place by 257% in Newest 13F | Dwell Bitcoin Information

“We speak about 4 yr cycles – However the actuality is that mannequin relies on a bygone period of crypto.” He confused the truth that the market has developed. “Because the launch of the Bitcoin ETFs and new admin, we’ve received a brand new market construction, new gamers, new dynamics, new causes folks purchase and promote.” He believes {that a} bear market is ending. “I believe there’s a reasonably good likelihood that we’ve been in a bear marketplace for virtually 6 months now and are virtually by means of it.” “The arrange for crypto proper now has by no means been higher.” The Bitcoin value was lately at $94K.

Investor and monetary educator, Robert Kiyosaki, attributed the downturn of the crypto market to low liquidity ranges. He offered his personal viewpoint. Kiyosaki mentioned that the costs of crypto and treasured metals will rise. It will happen after the federal government resorts to printing extra money. This cash could be used to finance funds deficits.

The four-year cycle was primarily based on a “bygone period of cryptocurrency.” That is based on Horsley. New dynamics, such because the introduction of Bitcoin ETFs, have essentially modified the market.

Institutional Adoption and Regulatory Tailwinds Drive New Dynamics

A serious new driver is institutional adoption. Rising institutional involvement is now an vital side. Regulatory readability can be an vital issue. These new gamers convey with them variations in patterns. Their capital flows are vital. That is in distinction to previous cycles. These had been pushed largely by retail traders.

The regulatory surroundings for crypto has modified. In accordance with Horsley, it went from a headwind to a tailwind. This constructive stance is being adopted by regulators. White Home and lawmakers additionally contribute. This makes it simpler for traders to become involved. They’re now allowed to work together extra freely with the asset class. This optimistic regulatory local weather is a game-changer.

Horsley’s considering factors to a extra stabilised and predictable market. That is in comparison with the previous. The affect of institutional capital supplies a brand new foundation. This renders the crypto market much less liable to excessive volatility. Additionally it is much less depending on the vagaries of retail sentiment. This maturity bodes nicely for long-term development. It attracts a bigger array of traders. This strategic transfer out there construction might end in a sustained enlargement.