- Bitcoin bulls are combating to push previous $95K, with $100K in sight however robust resistance forward.

- Altcoins like Ether, Solana, and Cardano present bullish indicators, however key resistance ranges nonetheless loom.

- Analysts warn of a potential Bitcoin pullback to $87K if momentum fades and sentiment weakens.

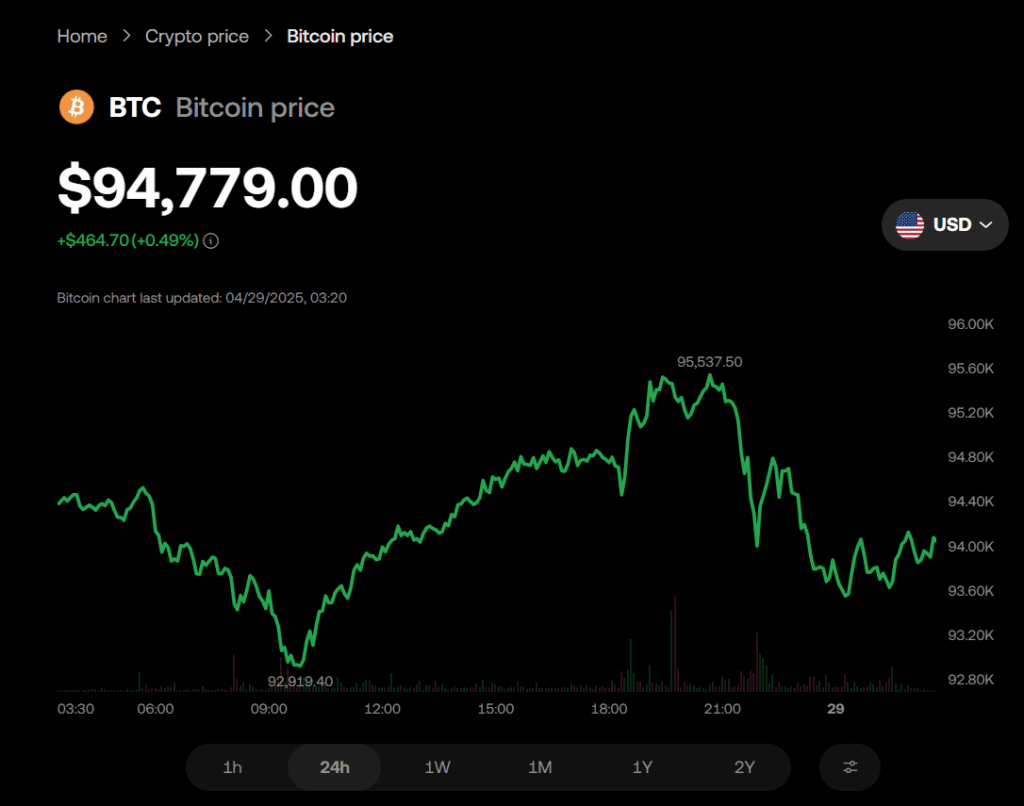

Bitcoin (BTC) remains to be hovering slightly below $95,000, with bulls doing the whole lot they will to maintain the momentum alive. However let’s be actual — bears aren’t backing down both. Merchants are questioning: will BTC break by means of that large psychological wall at $100K, or are we staring down the barrel of a pullback?

One good signal? Spot Bitcoin ETF inflows within the U.S. have been climbing steadily since April 21, in response to Farside Buyers. John D’Agostino, Coinbase Institutional’s head of technique, informed CNBC that large establishments jumped into Bitcoin this month, utilizing it as a hedge towards inflation and macro dangers — mainly treating it like digital gold.

However… Sentiment’s Getting Shaky

Not everyone’s satisfied this rally can hold operating. The Crypto Worry & Greed Index dropped from 72 to 60 between April 23 and 25, although Bitcoin stayed near $95K. Some analysts are waving pink flags and even tossing out $87K as a potential pullback goal.

The large query now: if Bitcoin can keep robust, may it fireplace up a broader rally in altcoins too?

Bitcoin Value Outlook

Bitcoin’s hanging round $95K, and that’s a very good signal for bulls who’re nonetheless holding tight, betting on a surge increased. The 20-day EMA at $87,437 is trending up, and RSI’s near the overbought zone — each hinting that consumers are nonetheless in cost.

A powerful shut above $95K may push BTC towards $100K, the place sellers will certainly dig in. If bulls can defend $95K after the breakout, we may even see a dash towards $107K. Bears, alternatively, want a decisive drop beneath the transferring averages to flip issues again of their favor.

Ether (ETH) Value Outlook

Ether’s rally is bumping up towards resistance on the 50-day SMA ($1,812), however bulls aren’t letting the value fall beneath the 20-day EMA ($1,696) both. The EMA is flat, but the RSI has climbed into constructive territory.

If ETH punches by means of $1,812, the subsequent cease could possibly be $2,111 — and if bulls break by means of that wall, we’re speaking a potential run to $2,550. If sellers drag it beneath the 20-day EMA, although, a tumble to $1,537 is perhaps on deck.

XRP Value Outlook

XRP’s caught across the 50-day SMA ($2.18) for a pair days now, with bears placing up a critical struggle. Excellent news? Bulls aren’t letting it slip beneath the 20-day EMA ($2.13) simply but.

If consumers can break the resistance line, XRP may rally all the way in which to $3. If not, and the value breaks beneath $2, the get together could possibly be over — with a dive towards $1.60 potential.

BNB Value Outlook

BNB pulled again from $620 however discovered assist on the transferring averages — a shift from promoting on rallies to purchasing on dips, which is large. Patrons now must clear $620 to set off a rally to $644 and even $680.

A drop beneath the transferring averages would wreck this bullish setup and will sink BNB again to $566.

Solana (SOL) Value Outlook

Solana is struggling to remain above $153. Bulls nonetheless have the higher hand, although, with the 20-day EMA ($136) rising and RSI staying constructive.

If consumers can maintain $153, SOL may bounce to $180. But when the value falls beneath the 50-day SMA ($129), SOL may simply get caught between $153 and $110 for a bit.

Dogecoin (DOGE) Value Outlook

Dogecoin bounced off the 20-day EMA ($0.16) on April 24, exhibiting consumers are nonetheless alive. DOGE may quickly check resistance at $0.21 — a break above that will full a double-bottom sample with a goal at $0.28.

If bulls fumble, although, and the value dips beneath the transferring averages, DOGE may commerce sideways between $0.21 and $0.14 for some time.

Cardano (ADA) Value Outlook

Cardano broke above its 50-day SMA ($0.68) on April 23, suggesting the bears are dropping their grip. The 20-day EMA ($0.65) is creeping up too.

ADA may rally towards $0.83 if momentum holds. Any pullback ought to discover assist on the 20-day EMA — if not, we’d see a drop to $0.58.

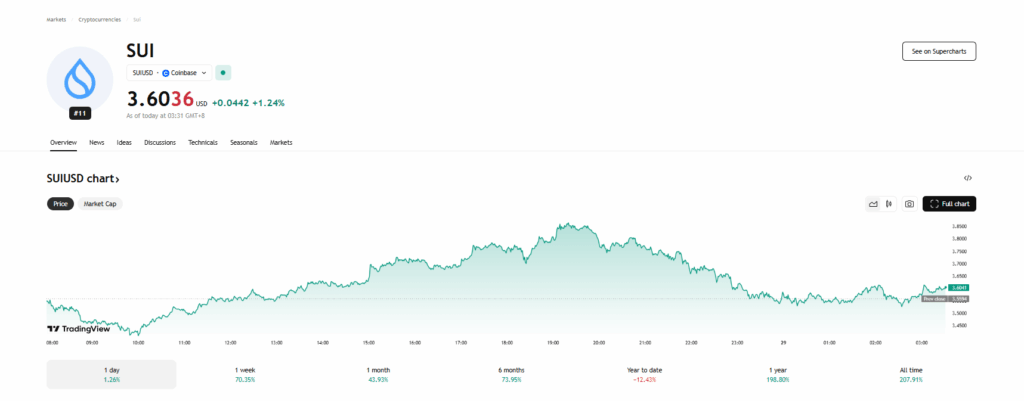

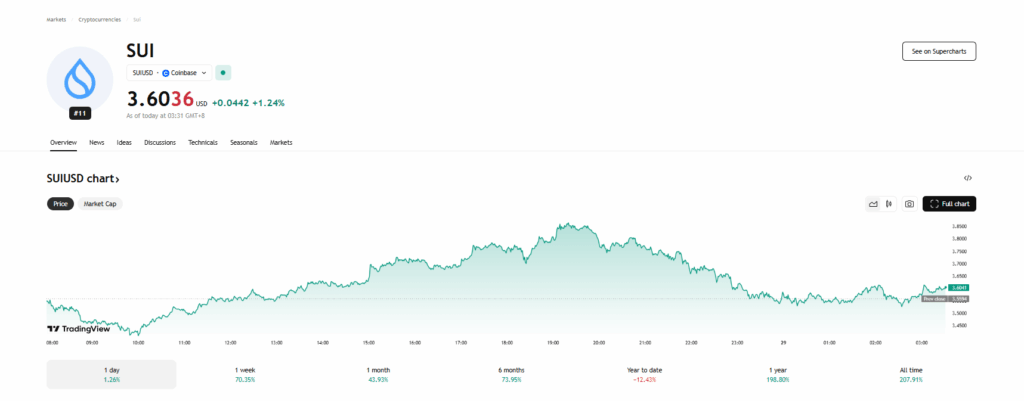

Sui (SUI) Value Outlook

Sui (SUI) shot up after bulls pushed it above the transferring averages on April 22. The RSI is now in overbought territory, hinting {that a} slight pullback could possibly be coming.

If SUI holds regular, although, it may rally towards $4.25 and perhaps even $5. A fall beneath $2.86 would hand management proper again to the bears.

Chainlink (LINK) Value Outlook

Chainlink’s restoration has began, however $16 is standing tall as a robust resistance. If it fails there, anticipate a drop again to the 20-day EMA ($13.53).

A stable bounce from there may give bulls a shot at breaking the descending channel, signaling a pattern change. In any other case, a dip to $11.89 is perhaps within the playing cards.

Avalanche (AVAX) Value Outlook

Avalanche is struggling to clear the $23.50 ceiling, however bulls aren’t letting the bears take management both.

If AVAX breaks and closes above $23.50, a double-bottom sample may launch it towards $31.73. If it may’t, although, it would keep trapped between $23.50 and $15.27 for some time.