Coinbase’s long-awaited Q1 2025 Earnings Report got here out immediately, disappointing bullish expectations in a number of key areas. Nonetheless, person exercise remains to be robust, with gross USDC steadiness rising 49% QoQ.

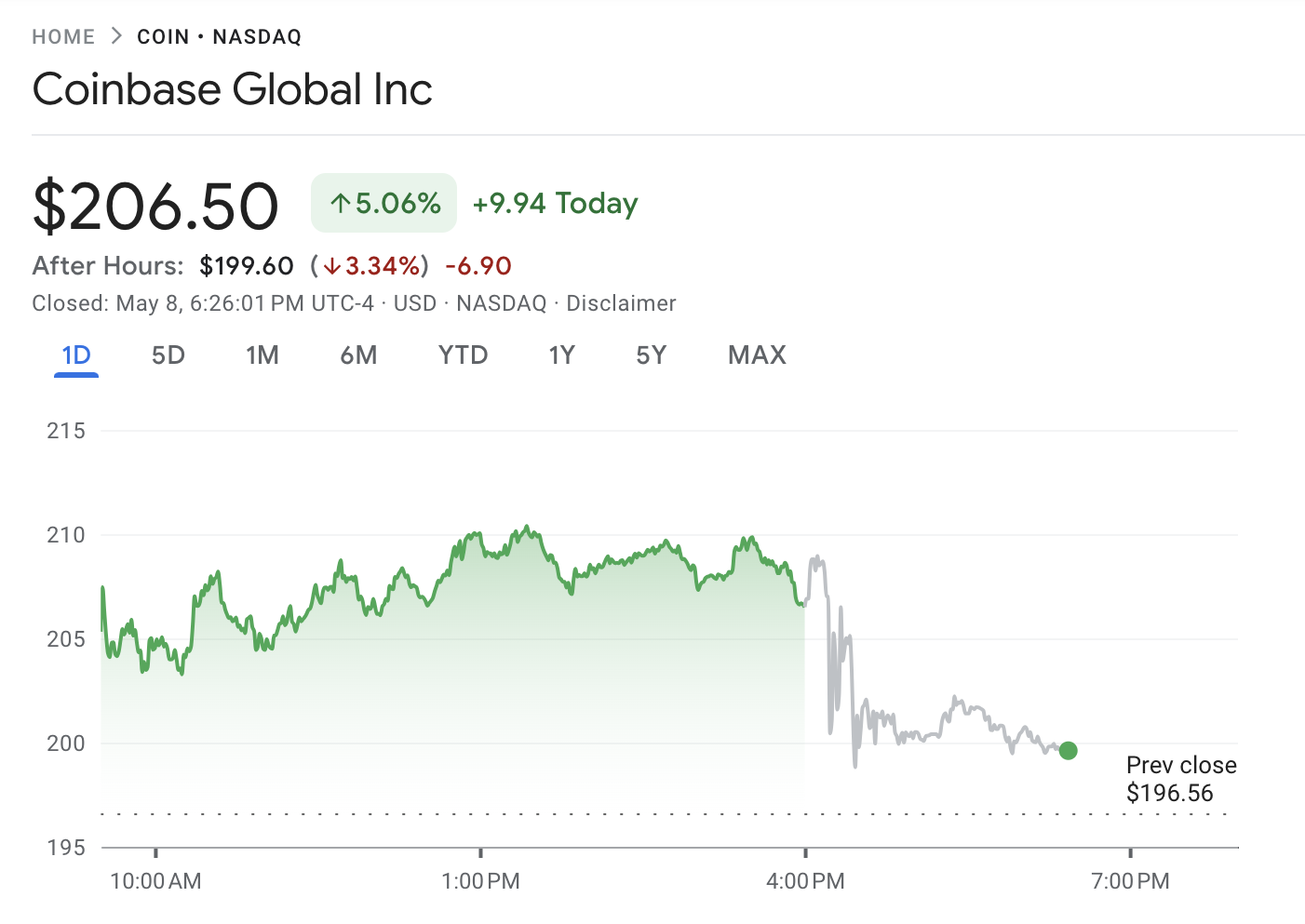

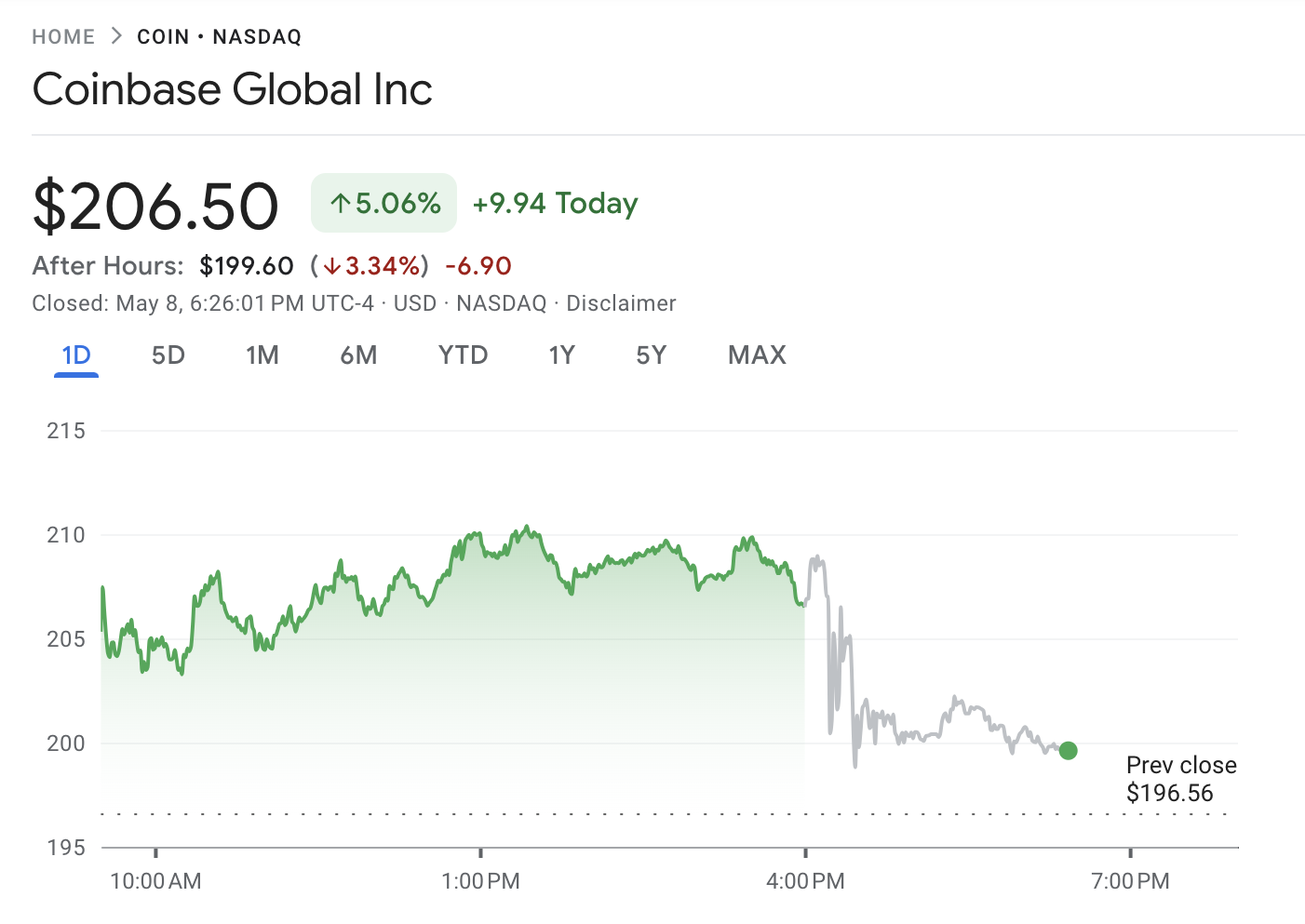

Regardless of a optimistic day beforehand, the corporate’s inventory valuation additionally fell over 3% in after-hours buying and selling.

Coinbase’s Bearish Earnings Report

Coinbase, one of many world’s largest crypto exchanges, can level to a couple progress traits to be optimistic about. For instance, the SEC dropped its case towards the agency, and it acquired the world’s largest crypto derivatives change.

The business had bullish expectations for Coinbase’s Q1 2025 Earnings Report, however the precise outcomes upset.

Total, Coinbase’s Q1 income was virtually $200 million in need of the anticipated $2.2 billion, and its transaction income was $70 million beneath the anticipated quantity.

Earnings per Share had been a meagre $0.24 as an alternative of $2.09, and subscription and companies income additionally underperformed by $4.5 million.

Coinbase already displayed a couple of bearish indicators earlier than immediately’s Earnings Report. For instance, scams have been concentrating on its customers, resulting in huge thefts.

The change’s inventory value additionally fell 30% in Q1, its worst efficiency for the reason that FTX collapse. Earlier immediately, its inventory traded effectively on bullish report expectations however dropped considerably after hours.

Regardless of this outwardly bearish report, Coinbase nonetheless highlighted a couple of positives. Buying and selling quantity did overperform expectations, albeit barely; the change reported $393 billion as an alternative of the anticipated $392.7 billion.

Moreover, the agency’s long-running stake in Circle is paying off, with gross USDC balances in Coinbase merchandise rising to $12.3 billion. This represents a formidable 49% achieve quarter-over-quarter (QoQ).

Between these components, the Deribit acquisition and regulatory breakthroughs, Coinbase maintains its optimism:

“Trying forward, we’re centered on increasing real-world crypto utility, strengthening and lengthening our buying and selling platform, and scaling the infrastructure that can energy the monetary system of the longer term. With rising regulatory readability, we’re accelerating our imaginative and prescient in the direction of financial freedom,” the corporate claimed.

In the end, it’s tough to foretell the place the agency is heading from right here. Though this Earnings Report underperformed expectations, Coinbase nonetheless has a variety of sources at its disposal.

Moreover, Q1 confirmed optimistic developments for the change by way of market growth. Coinbase achieved regulatory licenses in each Argentina and India, additional increasing its person base throughout the globe.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.