Ethereum has surged greater than 70% since mid-June, marking one among its most spectacular rallies of the yr. The transfer has been pushed by sturdy momentum, with bulls firmly in management as ETH lately reclaimed the important $3,500 degree. Notably, the uptrend has proven little to no retracement because the preliminary breakout, signaling sustained shopping for curiosity and confidence amongst traders.

Associated Studying

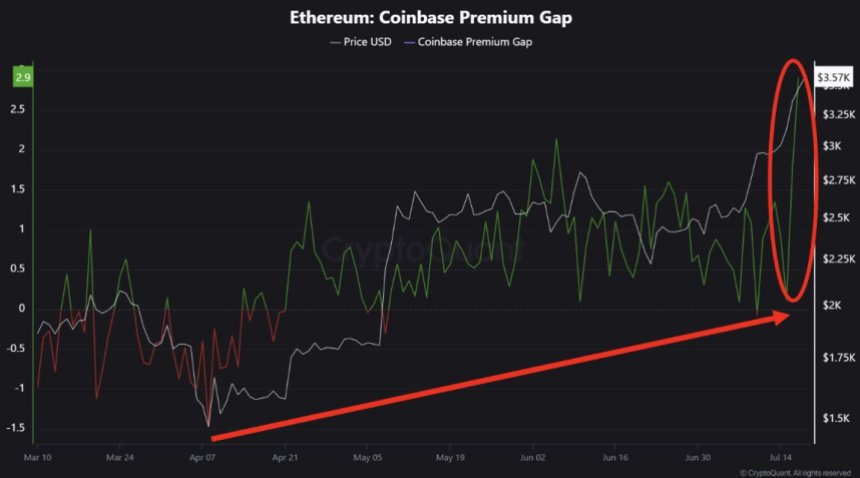

One of the placing developments supporting this transfer comes from CryptoQuant, which highlights the emergence of a big premium on Ethereum traded via Coinbase. That is significantly noteworthy as a result of Coinbase is a platform predominantly utilized by US establishments and high-net-worth people. The premium suggests aggressive spot shopping for by whales, indicating renewed institutional curiosity in Ethereum.

This renewed demand comes because the broader crypto market sees clearer regulatory indicators and rising ETF flows into ETH-related merchandise. As Ethereum continues to outperform and entice capital, merchants are watching intently to see if this momentum will carry right into a broader altcoin rally—and even sign the beginning of a long-awaited altseason.

US Whales Lead the Cost as Ethereum Shopping for Exercise Accelerates

In accordance with a current report by CryptoQuant analyst Crypto Dan, Ethereum is seeing a notable improve in shopping for exercise, significantly from US-based whales. The regular rise in accumulation, mixed with a transparent premium on Coinbase, means that high-net-worth gamers are positioning themselves forward of additional upside.

Supporting this pattern, every day inflows into Ethereum spot ETFs have surged to new all-time highs. This sharp spike displays rising institutional confidence in ETH as a core digital asset, particularly following current regulatory readability within the US. With Ethereum now buying and selling above $3,600, demand continues to outpace provide throughout a number of channels.

What makes this rally particularly fascinating is the present market surroundings. On-chain metrics present that Ethereum just isn’t but considerably overheated. Indicators similar to NUPL (Internet Unrealized Revenue/Loss) counsel room for additional enlargement earlier than extreme euphoria units in. This creates favorable circumstances for ETH to consolidate at increased ranges earlier than doubtlessly breaking out once more.

Nonetheless, the approaching weeks might be essential. If sturdy inflows and bullish momentum persist into late Q3 2025, analysts warn it might set off indicators of overheating. Whereas we aren’t there but, repeated vertical strikes with out retracement ought to immediate warning. Traders might have to reassess threat ranges if the sample continues.