- Coinbase is launching a Bitcoin Yield Fund on May 1 for institutions outside the U.S., targeting 4–8% annual returns.

- The fund uses a cash-and-carry strategy to generate yield without relying on staking.

- Bitcoin’s recent price jump to $94K was driven by ETF inflows and growing institutional demand.

Coinbase is gearing up to launch its brand new Bitcoin Yield Fund on May 1, aiming squarely at institutional investors based outside the U.S. The exchange — currently the third-largest globally by trading volume — says the fund will offer exposure to Bitcoin with the potential for a net annual return between 4% and 8%.

In a blog post shared on April 28, Coinbase Asset Management explained the thinking behind it: “To address the growing institutional demand for bitcoin yield, Coinbase Asset Management is excited to introduce the Coinbase Bitcoin Yield Fund (CBYF).”

What’s the Strategy Behind It?

The fund’s returns won’t come from staking — since Bitcoin, unlike Ethereum or Solana, doesn’t support native staking. Instead, it’ll use a cash-and-carry strategy, which basically means it’ll capitalize on the price difference between spot and futures markets.

Coinbase says this setup will reduce the kind of investment and operational risks that usually keep institutional investors on the sidelines. Most existing Bitcoin yield funds, according to the company, require clients to shoulder “significant” risks — something CBYF is looking to avoid.

One of the backers? Aspen Digital, an Abu Dhabi-based asset manager that’s regulated by the Financial Services Regulatory Authority — which helps signal legit interest in this offering from globally recognized players.

Institutional Demand is Driving the Market

The move comes as institutional appetite for Bitcoin continues to grow. Coinbase noted that strong interest from big players is one of the major reasons behind the fund’s creation — and maybe even part of what’s been pushing BTC’s price back up.

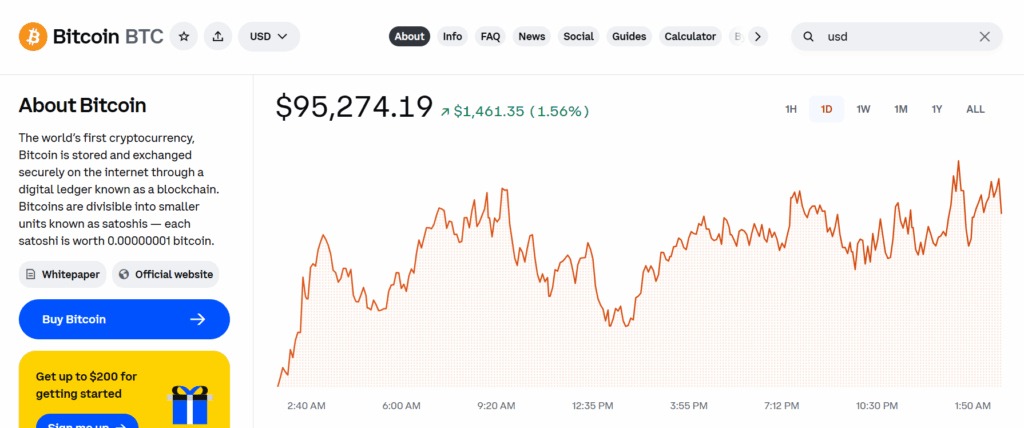

In the week leading up to April 28, Bitcoin jumped over 9%, bouncing back to around $94,000. That surge came alongside massive ETF inflows — more than $3 billion, marking the second-highest weekly inflow ever, based on data from Farside Investors.

Bitget’s chief analyst Ryan Lee pointed out that the rally’s been driven by corporate and ETF buying, not retail. But that could change soon. “Retail interest may surge if Bitcoin breaks $100K,” Lee told Cointelegraph, citing media hype and FOMO as likely triggers. He added that $94,000–$95,000 is the range to watch if you’re looking for that retail comeback.

And if you ask BitMEX co-founder Arthur Hayes, time might be running out. On April 21, he said this could be the “last chance” to buy Bitcoin under $100K — suggesting that U.S. Treasury buybacks could be the next big push that sends BTC soaring.