Key Takeaways

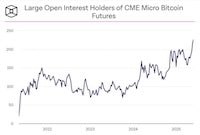

- Massive CME Bitcoin futures holders hit a document 217 in Could.

- This marks a 36% rise since January, indicating stronger institutional adoption.

- GameStop and Trump Media not too long ago added Bitcoin to their treasuries.

The variety of massive open curiosity holders in CME Bitcoin futures reached a document 217 by the tip of Could, up from round 160 at the beginning of 2025—a 36% enhance.

The info suggests a rising shift in institutional technique, with extra companies treating Bitcoin as a core portfolio asset somewhat than a short-term commerce.

Institutional buying and selling focus

The Block tracks institutional merchants holding no less than 25 micro Bitcoin contracts, or over 2.5 BTC, which excludes most retail exercise and focuses on subtle market individuals.

Rising institutional curiosity

Institutional curiosity in Bitcoin has been climbing steadily since early 2024, however current acceleration seems tied to rising international uncertainty.

The return of President Donald Trump and his aggressive commerce insurance policies have reportedly fueled investor demand for various belongings seen as uncorrelated with geopolitical or financial threat.

Main Bitcoin acquisitions

GameStop and Trump Media added momentum to this development with main Bitcoin acquisitions in late Could.

GameStop revealed it had acquired 4,710 BTC for its treasury on Could 28, whereas Trump Media introduced a $2.32 billion non-public increase on Could 27, with the funds earmarked for future Bitcoin purchases.

Strategic institutional allocation

These strikes align with continued spot Bitcoin ETF inflows and rising market confidence.

The info factors to a maturing method amongst establishments, which now seem to view Bitcoin holdings as a strategic allocation.

Bitbo Dashboard → / Authentic Article

Supply hyperlink