- LINK is up nearly 60% in a month, breaking key resistance levels with whales buying over 8 million tokens.

- On-chain whale activity spiked massively, with large transactions up 1,400%, signaling continued confidence.

- Despite overbought RSI and some exchange inflows hinting at profit-taking, momentum remains with the bulls—$23 might be next.

Chainlink’s making waves again—and this time, it’s not just a fluke bounce. The token’s blasted through a key bullish pattern, retested the breakout like clockwork, and just kept climbing. Momentum? It’s definitely leaning bullish.

But here’s the real kicker: whales are still buying, even after LINK’s already run up nearly 60% in a month. That kind of confidence doesn’t show up every day.

Big Fish, Big Moves

According to a well-known voice on X, whales have scooped up more than 8 million LINK tokens over the past 30 days. That’s not a small bet. And during that same period? LINK jumped from $12.33 to $19.40, smashing through resistance zones like that descending trendline and the notoriously stubborn $18 level.

At press time, LINK was up another 9% in 24 hours, sitting near $19.41. Volume also picked up—trading activity rose 6.5% compared to the day before. Clearly, retail traders are catching on too.

Whale Activity Is Through the Roof

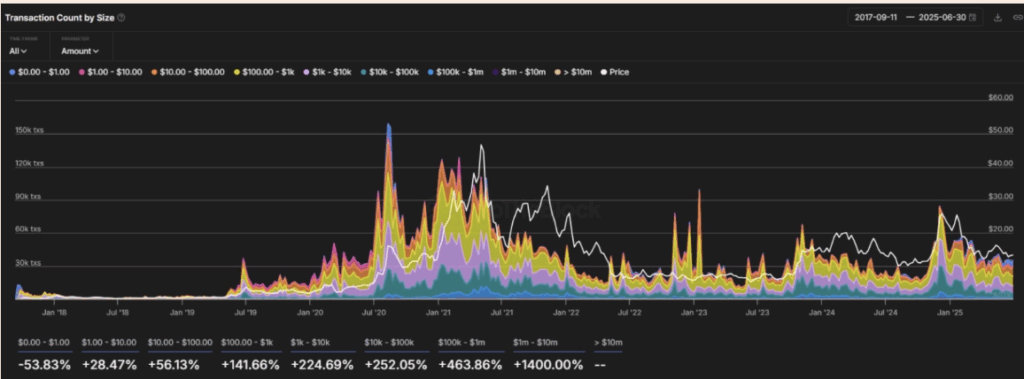

Digging into the on-chain stuff, data from IntoTheBlock shows a crazy spike in large transactions. Transfers in the $1M to $10M range surged over 1,400%, and even the $100K–$1M bracket saw a 463% increase.

That kind of volume doesn’t usually come from retail traders messing around. It’s smart money—and they seem to be gearing up for more upside. If anything, this supports the idea that LINK’s breakout was the real deal, not just some random pump.

What’s Next for LINK?

Technically speaking, LINK’s breakout followed a textbook double-bottom pattern, which is usually bullish. If this trend holds up, we could be looking at a 20% rally that puts LINK near $23. But—and it’s a big but—LINK needs to stay above $18 and avoid any serious dips in sentiment.

One red flag, though: the RSI is hovering around 82, which is deep in overbought territory. That doesn’t mean a crash is coming, but some short-term cooling off wouldn’t be surprising either.

Exchanges Are Seeing More LINK Deposits

Here’s the twist: according to CoinGlass, exchanges just saw about $1.74 million worth of LINK deposited in the last day. That might be some holders getting ready to take profits. If too many people start selling, it could dampen the rally—at least temporarily.

Still, looking at the whole picture—whale activity, technical breakout, rising volume—the bulls seem to be steering this ship for now. If LINK can break past $20 cleanly and hold its ground, the next leg up could come sooner than expected.