Chainlink’s function within the digital asset ecosystem is increasing quickly because it shifts from an oracle supplier right into a foundational layer that underpins the rising world of onchain finance.

With real-world asset (RWA) tokenization hitting new information and main monetary establishments adopting blockchain expertise at scale, the community is more and more positioned on the heart of this transformation.

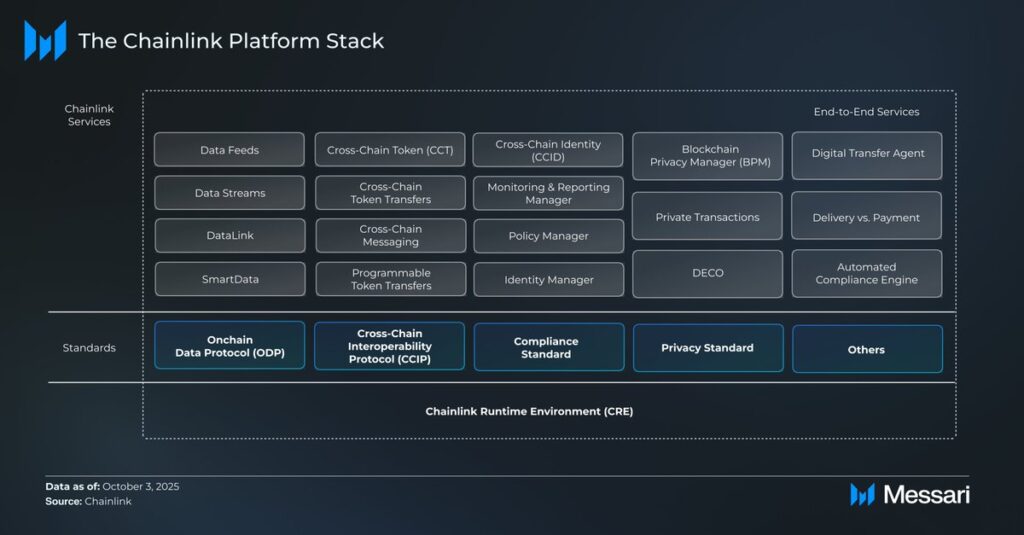

What was as soon as a device designed to feed exterior information into good contracts has change into a complete stack supporting every little thing from cross-chain settlement to identification, privateness, and automatic compliance. Messari’s latest report underscores this evolution, describing Chainlink because the behind-the-scenes framework connecting fragmented blockchains to conventional monetary infrastructure.

On the coronary heart of the enlargement is a set of rising requirements – CCIP for interoperability, the Onchain Knowledge Protocol for information motion, and new privateness and compliance layers – all working throughout the Chainlink Runtime Atmosphere. These elements are shortly changing into important for establishments that want safe, uniform connectivity throughout a number of chains.

Current exercise exhibits this pattern accelerating. Over the previous two days, European asset managers launched cross-chain settlement pilots utilizing Chainlink requirements, whereas banks throughout Asia continued trials involving tokenized collateral. The momentum coincides with document volumes in tokenized treasury property, a good portion of which depend on Chainlink’s information and interoperability rails. Main international gamers—together with J.P. Morgan, Swift, UBS, and Constancy – at the moment are utilizing the community for experiments starting from interbank token motion to programmable structured merchandise.

Chainlink’s affect, nevertheless, extends far past institutional finance. DeFi platforms stay deeply depending on its infrastructure. Lending markets, decentralized exchanges, stablecoin issuers, derivatives protocols, and RWA platforms all use Chainlink not just for pricing but additionally for cross-chain messaging, asset transfers, personal computation, and compliance automation. As modular rollups and app-specific chains proliferate, demand for CCIP because the connective layer between ecosystems continues to climb.

Messari’s evaluation frames Chainlink as one thing a lot bigger than an oracle community: it’s changing into the working system for blockchain-based finance. With RWAs increasing, ETFs transferring onchain, and banks shifting from testing phases to actual deployment, Chainlink’s built-in stack is more and more defining the infrastructure that helps the subsequent technology of world monetary networks.