- ADA holds sturdy amid commerce tensions: Regardless of renewed strain from Trump’s 50% EU tariff announcement, Cardano’s worth has remained steady round $0.67–$0.85, suggesting market resilience and potential buildup towards a $1 breakout.

- Analysts see bullish indicators forming: Technical evaluation factors to a wholesome consolidation sample with repeated “pump and pause” cycles. Analyst Dan Gambardello believes this “coiling” conduct may result in a powerful transfer if Ethereum additionally breaks out.

- Messari Q1 report exhibits blended outcomes: Whereas ADA’s worth and treasury greenback worth declined, governance milestones just like the Plomin Onerous Fork and a 30% leap in stablecoin market cap replicate regular improvement and robust group dedication.

Over the previous 48 hours, Cardano’s (ADA) worth has bumped up towards the higher fringe of its falling channel—solely to be nudged again down because of renewed market jitters. An enormous a part of that? Donald Trump’s shock name for a 50% tariff on the EU, beginning June 1. Naturally, that spooked some traders.

However right here’s the factor—ADA’s worth didn’t flinch a lot. That calm suggests the market may be getting used to geopolitical noise. Some merchants are even pondering this sluggish, regular consolidation would possibly really be a great factor—possibly even the calm earlier than a breakout towards that shiny $1 mark.

Technicals and Analysts Lean Bullish

Cardano’s been grinding by means of a drawn-out consolidation part inside a falling channel, largely weighed down by international commerce uncertainties. ADA dipped to round $0.50 again in April, however managed a reasonably respectable restoration by mid-Might—tapping the $0.85 zone. That bounce was sparked, partly, by a brand new UK commerce deal that helped sit back a number of the rigidity.

Now, with contemporary EU tariff discuss again in play, investor nerves are creeping up once more. However technically talking, ADA hasn’t damaged beneath any key exponential transferring averages. So so long as these helps maintain, bulls would possibly nonetheless have some battle left in them.

Crypto analyst Dan Gambardello thinks Cardano’s worth construction is exhibiting a extra refined setup in comparison with the final bull run. Again then, it was extra like: large breakout, fast rally. This time? It’s extra of a step-by-step, grind-it-out type of vibe—with “pump and pause” patterns shaping up. Gambardello calls it a “coiling impact,” and says if ADA retains ticking the fitting packing containers, $1 is completely inside attain.

He additionally believes Ethereum’s chart is price watching. If ETH breaks above its long-term trendline, that might be the spark altcoins like ADA must lastly transfer.

Messari’s Q1 Report: Powerful Quarter, However Fundamentals Regular

Messari’s Q1 2025 Cardano report was, effectively, a little bit of a blended bag. It identified the robust surroundings ADA confronted—worth strain led to a dip in market cap and normal sentiment. Nonetheless, there have been some shiny spots.

For one, governance took a step ahead with the activation of the Plomin Onerous Fork—a significant milestone. On prime of that, ADA staking held sturdy. Regardless of the uneven waters, the full quantity of ADA staked solely dropped by 1%, touchdown at a wholesome 21.6 billion tokens.

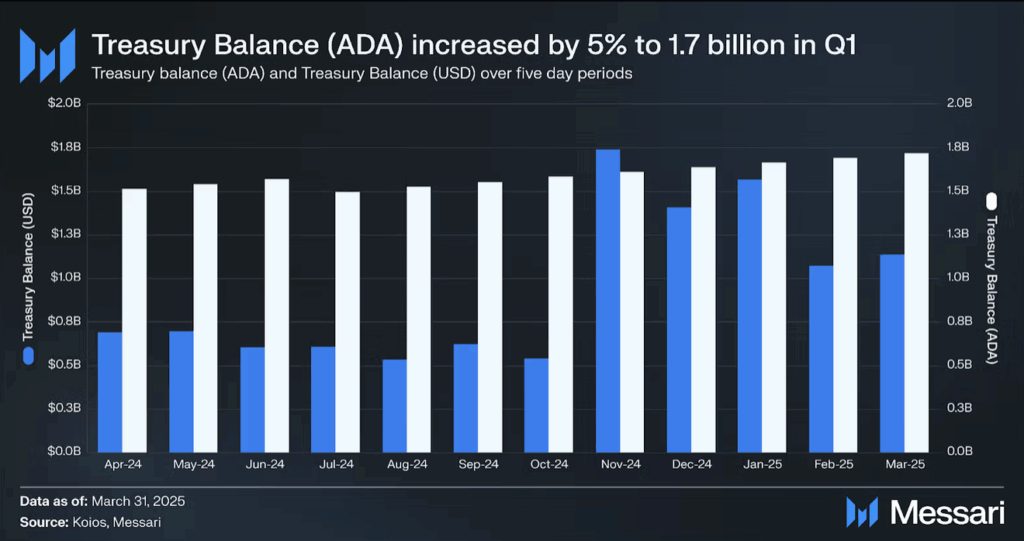

And whereas the ADA treasury’s greenback worth slid 19% to $1.1 billion (thanks to cost volatility), the precise token steadiness rose 5% to 1.7 billion ADA. Not dangerous.

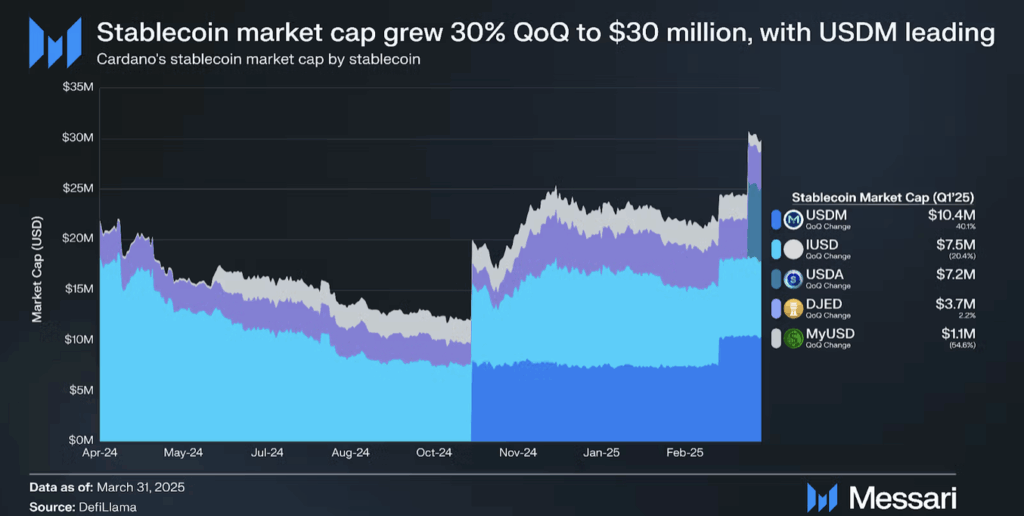

One other standout? The Cardano stablecoin ecosystem. Stablecoin market cap jumped 30% to hit $30.1 million, largely fueled by rising adoption of fiat-backed cash like USDM and IUSD.

Remaining Take

Regardless of political noise, ADA’s worth is hanging in there—and may be setting the stage for a stronger breakout. With bullish construction forming, strong group help, and governance upgrades ticking alongside, Cardano might be in for an even bigger transfer if circumstances keep favorable.

All eyes now are on the $1 degree. Will it crack by means of? Or will the market preserve taking part in it secure a short while longer?