Solana (SOL) and SUI have each garnered important consideration within the crypto market, sparking discussions about their competitors.

Whereas each crypto initiatives present promise, the truth is that Solana is at present outperforming SUI. Regardless of the hype, they will not be in as shut a contest because the market perceives.

Solana Wins The Instituions Again

Solana has regained robust institutional curiosity, signaling a optimistic shift for the “Ethereum killer.” Whereas April was a slower month for SOL, institutional traders have returned with renewed confidence in Could.

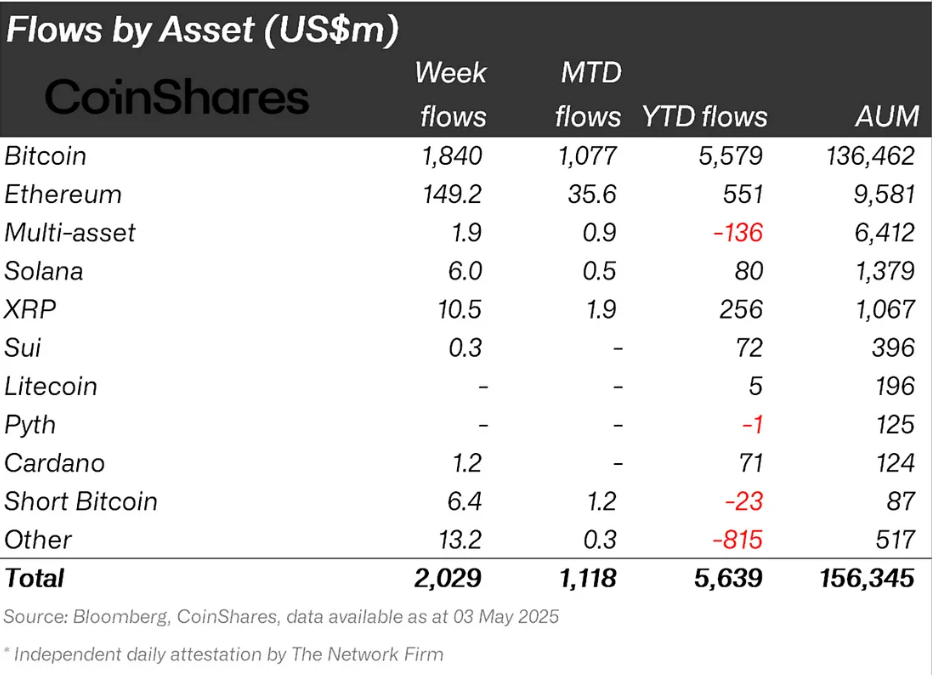

Within the week ending Could 3, Solana noticed $6 million in inflows, in comparison with SUI’s $0.3 million. Moreover, SOL has overtaken SUI in year-to-date (YTD) flows, accumulating $80 million in comparison with $72 million for SUI.

The inflow of institutional capital into Solana reinforces its standing as a high contender within the blockchain house. Nonetheless, SUI’s development can not go utterly missed both. Alvin Kan, COO at Bitget Pockets, mentioned the rationale behind the surge in curiosity in SUI with BeInCrypto.

“The latest uptick in institutional inflows to SUI seems to mirror rising curiosity in scalable and technically differentiated blockchains. With excessive throughput capability, a novel programming language like Transfer, and increasing use circumstances akin to Bitcoin restaking by way of SatLayer, SUI affords infrastructure that aligns with long-term funding theses. Backing from gamers like Franklin Templeton and Grayscale suggests this can be greater than a short-term development.”

However, SUI has made notable strides within the DeFi house, outpacing Solana’s development over the previous month (April 12 to Could 12). SUI noticed a exceptional 76% improve in complete worth locked (TVL), reaching $2.0 billion.

As compared, Solana skilled a 40% improve, bringing its TVL to $9.38 billion. Regardless of this, Solana stays the dominant platform within the DeFi house, having dealt with $35 billion price of transactions by way of decentralized exchanges (DEXs) because the starting of Could.

Solana’s established presence within the DeFi ecosystem provides it an edge over SUI when it comes to adoption and utilization. Ben Nadraski, the Founder and CEO of Solstice Labs, additional mentioned the rationale for Solana’s win with BeInCrypto.

“Solana is at present dominating internet new capital flows from an L1 perspective, together with a breakthrough 300 million every day transactions, 4 million+ energetic addresses… SUI, as talked about above, is attracting institutional curiosity, however they’re within the early levels of their institutional development and have a number of steps of validation nonetheless to be seen out there,” Nadraski advised BeInCrypto.

One other essential growth stays the potential of the launch of a Solana ETF in addition to an SUI ETF. Shaun Lee, Analysis Analyst at CoinGecko, advised BeInCrypto that Solana may win this race too.

“It’s possible {that a} SOL ETF will likely be accepted earlier than a SUI ETF, because the SEC is already reviewing a number of functions for spot SOL ETFs from the likes of GrayScale, VanEck, Franklin Templeton, and extra. A call for these functions is predicted for early October. On high of that, Solana futures ETFs are already out there for buying and selling within the US, an indication that regulators are comfy with SOL-based merchandise. “

SOL and SUI Value Efficiency is Not Too Completely different

Each SUI and Solana have seen average development over the previous week, with SOL rising 22% and SUI gaining 26%. Buying and selling at $4.13, SUI is making an attempt to safe $4.05 as help following a month-long uptrend. The lack to carry this degree may point out challenges in sustaining development.

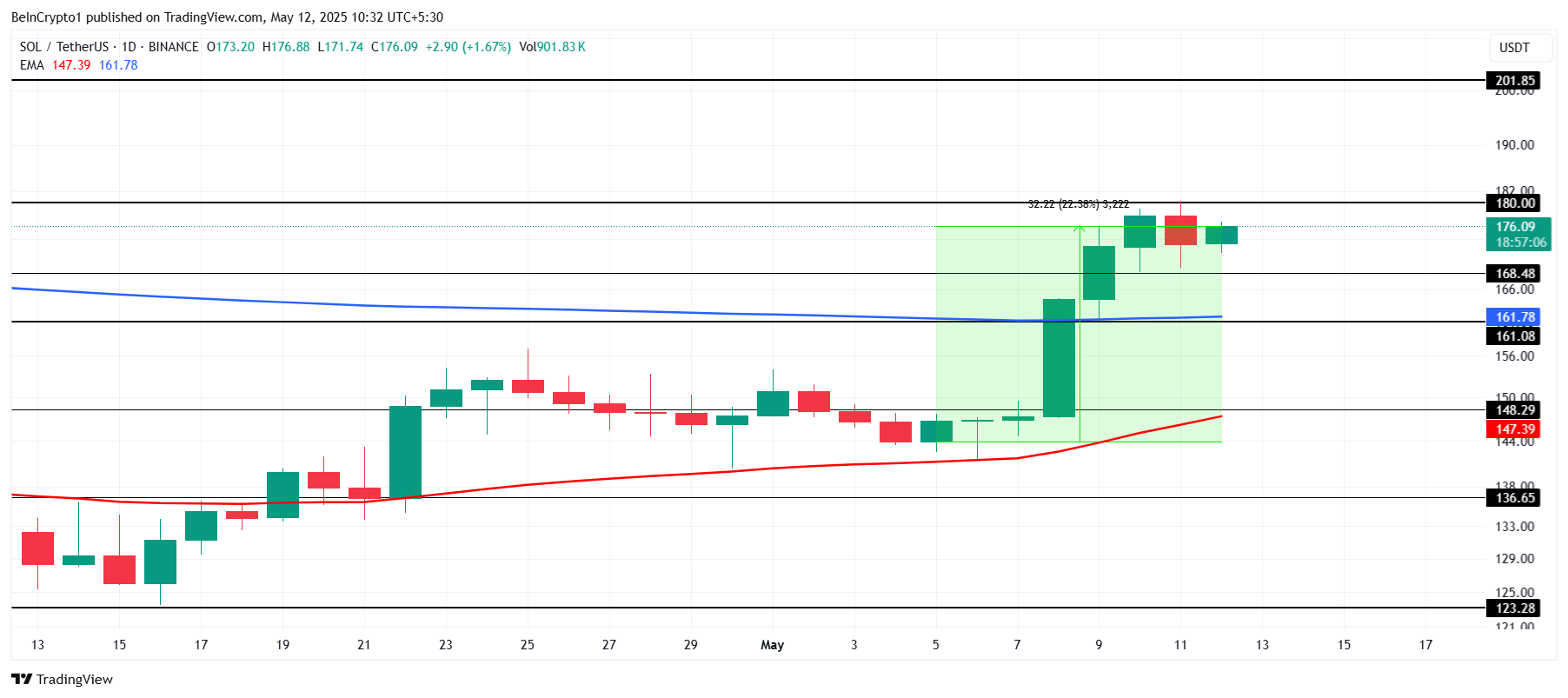

In the meantime, Solana is buying and selling at $176 and is on the verge of ending its ongoing Loss of life Cross. Nonetheless, the value has didn’t breach the essential $180 resistance, which is important for reaching $200. Till this degree is overcome, Solana might wrestle to regain full bullish momentum.

Whereas SUI’s efficiency is promising, Solana’s dominance, supported by institutional funding and its lead in DeFi, means that SUI is unlikely to develop into a “Solana killer” anytime quickly.

The put up Can Sui’s Value Rally Dent Solana’s Dominance? Analysts Say Not Anytime Quickly appeared first on BeInCrypto.

Supply hyperlink