Trusted Editorial content material, reviewed by main trade specialists and seasoned editors. Advert Disclosure

The analytics agency Santiment has defined how the important thing Bitcoin holders are displaying conduct that might show to be a bullish signal for the asset.

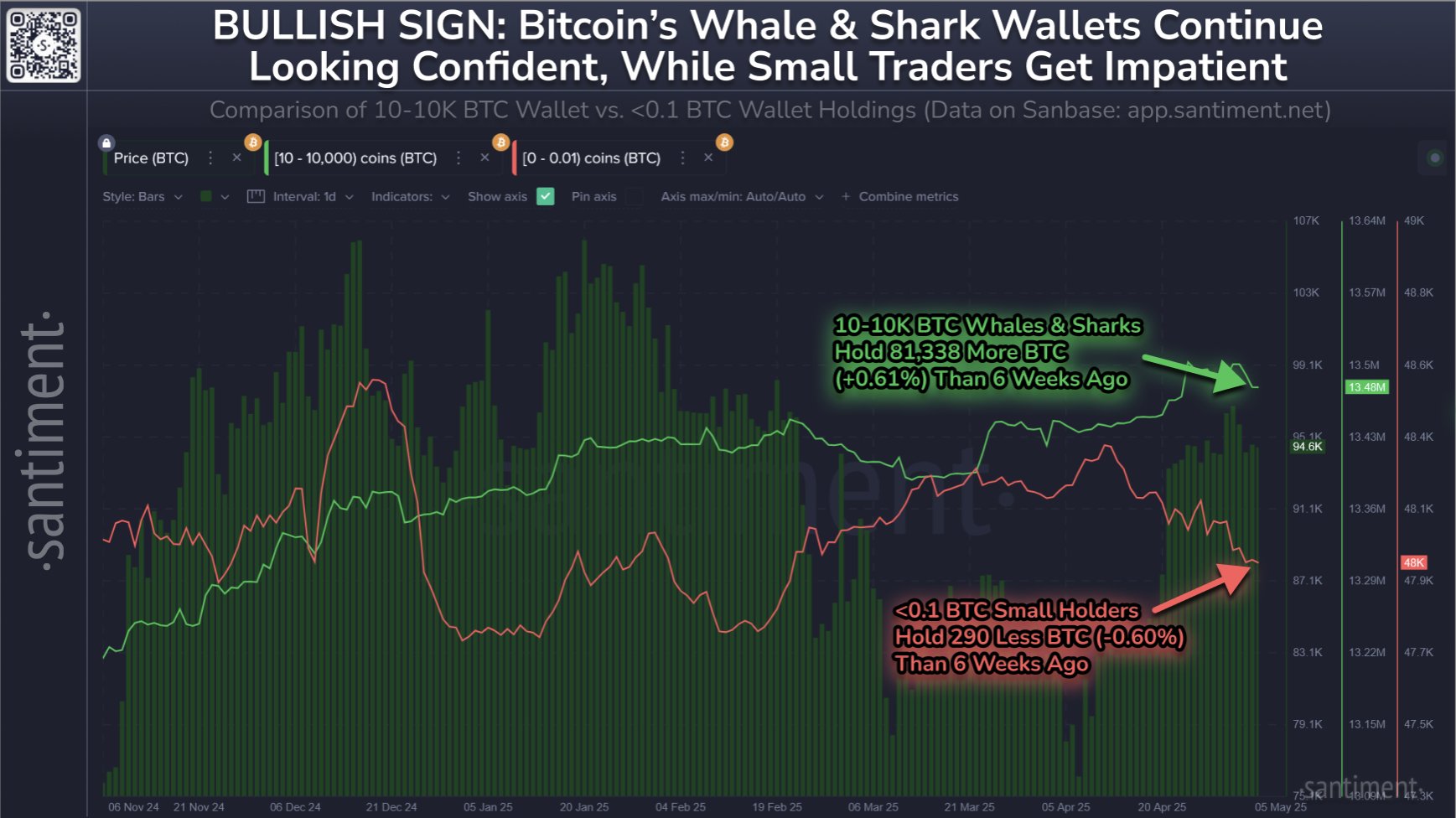

Bitcoin Sharks & Whales Have Loaded Up Throughout The Final 6 Weeks

In a brand new put up on X, Santiment has talked in regards to the newest development within the provide of a few of BTC’s key buyers. The indicator of relevance right here is the “Provide Distribution,” which tells us in regards to the quantity of Bitcoin {that a} given pockets group as an entire is holding. The addresses or buyers are divided into these cohorts primarily based on the variety of cash that they maintain of their stability. The 1 to 10 cash group, for instance, contains all holders who personal between 1 and 10 tokens of the asset.

Within the context of the present matter, the vary of curiosity is the ten to 10,000 BTC one. On the present trade charge, its decrease certain converts to round $969,000 and the higher one to $969 million.

This broad pockets group contains completely different components of the market, together with the sharks and whales, who’re thought-about essential within the ecosystem as a result of their sizeable holdings.

Now, right here is the chart for the Provide Distribution of this holder vary shared by the analytics corporations that exhibits the development in its worth over the previous a number of months:

Seems like the worth of the metric has noticed a internet enhance in latest weeks | Supply: Santiment on X

As displayed within the above graph, the ten to 10,000 BTC holders have seen their provide go up not too long ago. Extra particularly, these giant buyers have added a complete of 81,338 BTC to their wallets during the last six weeks.

In the identical chart, Santiment has additionally hooked up the info associated to the Provide Distribution of the smallest of BTC buyers. It could seem that these retail holders have scaled again on their holdings concurrently the shark and whale accumulation spree.

“When giant wallets steadily accumulate in tandem with retail panic promoting/promoting out of boredom, it’s typically a powerful long-term signal of costs biding their time earlier than one other breakout,” notes the analytics agency.

Whereas the long-term development has been accumulation for Bitcoin’s key buyers, a special development has emerged in a newer view. As is clear from the chart, the stability of this group has registered a decline in the previous few days, an indication that a few of these holders have taken earnings from the restoration rally.

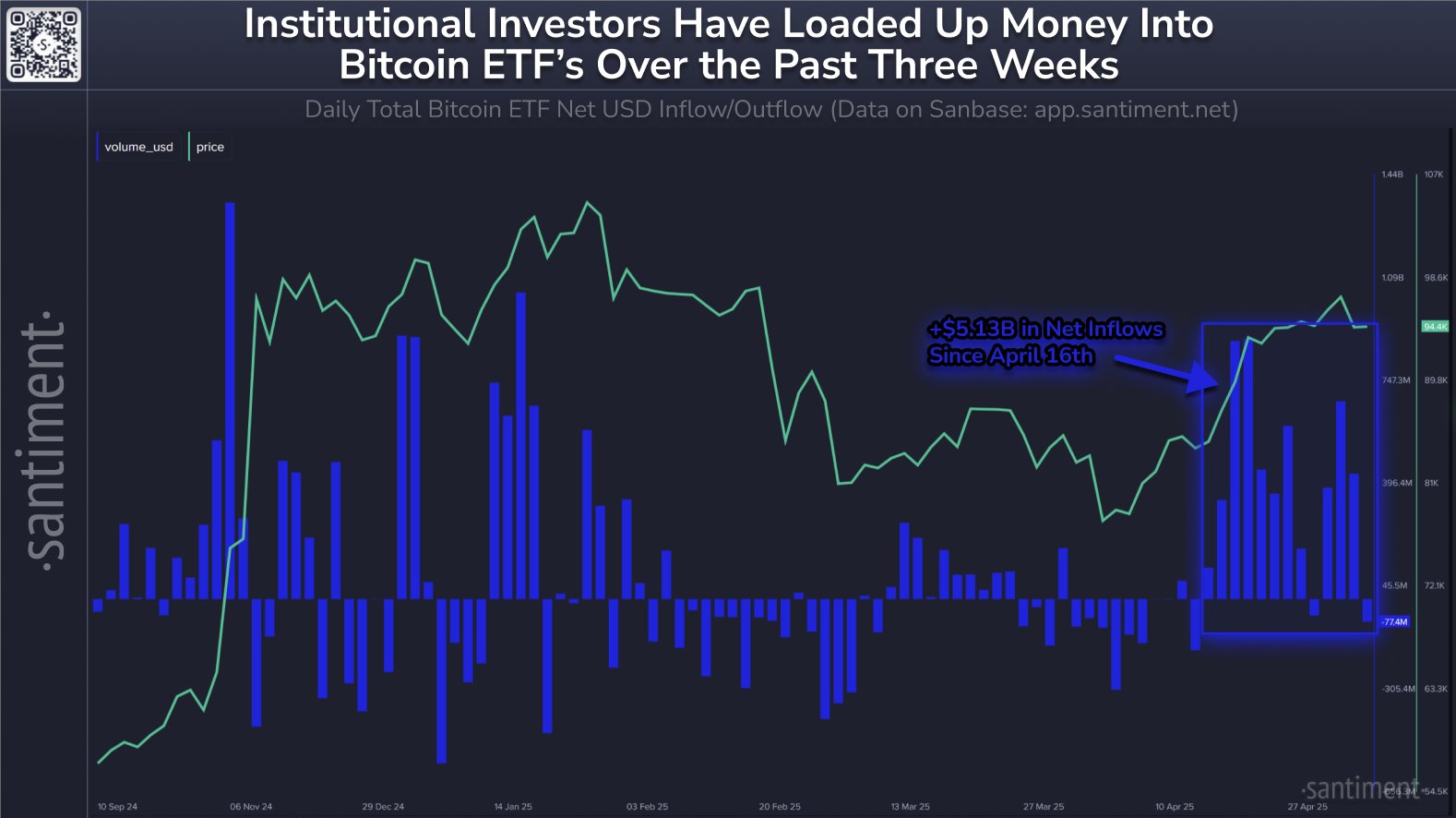

Talking of accumulation, Bitcoin spot exchange-traded funds (ETFs) have loved a excessive quantity of inflows over the previous few weeks, as Santiment has identified in one other X put up.

The development within the every day netflow for the BTC spot ETFs throughout the previous few months | Supply: Santiment on X

“Since April sixteenth, there was $5.13B moved into collective BTC ETF’s, pumping markets,” says the analytics agency.

BTC Worth

Bitcoin has seen a renewal of bullish momentum over the past 24 hours as its worth has damaged again above the $97,000 stage.

The value of the coin appears to have jumped over the previous day | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.internet, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.