Prime Tales of The Week

SEC’s crypto pivot has ‘not been priced in,’ Bitwise exec says

Crypto traders could also be underestimating the extent of the US securities regulator’s new stance on crypto, that means that crypto costs would nonetheless have room to develop, based on Bitwise chief funding officer Matt Hougan.

US Securities and Alternate Fee Chair Paul Atkins revealed a speech he gave on July 31 on the America First Coverage Institute about how blockchain might be built-in into the monetary markets.

Hougan on Tuesday mentioned the speech caught him “off guard” and left him questioning whether or not Atkins’ imaginative and prescient had been priced into the market.

“Probably the most bullish doc I’ve learn on crypto wasn’t written by some yahoo on Twitter. It was written by the chairman of the SEC,” Hougan mentioned. “I can’t think about studying the speech and never eager to allocate a good portion of your capital to crypto, or, when you work in finance, a good portion of your profession.”

Vitalik backs Ethereum treasury companies, however warns of overleverage

Ethereum co-founder Vitalik Buterin threw his help behind Ether treasury corporations, however warned that the development may spiral into an “overleveraged recreation” if not dealt with responsibly.

In an interview with the Bankless podcast launched on Thursday, Buterin mentioned the rising variety of public corporations shopping for and holding Ether was precious as a result of it exposes the token to a broader vary of traders.

“There’s undoubtedly precious providers which are being supplied there,” Buterin mentioned. He added that corporations shopping for into ETH treasury companies as a substitute of holding the token straight provides individuals “extra choices,” particularly these with “totally different monetary circumstances.”

So-called crypto treasury corporations have develop into a scorching development on Wall Avenue, garnering billions of {dollars} to purchase up and maintain swaths of cryptocurrencies, with the preferred performs being Bitcoin and Ether.

Trump to signal govt order punishing monetary establishments for ‘debanking’: Report

US President Donald Trump is about to signal an govt order on Thursday instructing federal financial institution regulators to determine and advantageous monetary establishments that engaged in “debanking.”

In accordance with Bloomberg on Thursday, citing a senior White Home official, regulators might be required to assessment criticism information, whereas monetary establishments beneath the purview of the Small Enterprise Administration might be requested to make efforts to reinstate purchasers who had been unlawfully denied banking providers.

Debanking has been a key concern amongst some political teams, who argue that companies akin to gun producers and fossil gas corporations have been denied banking providers for ideological causes.

It was additionally a standard criticism amongst crypto corporations. In the course of the administration of former President Joe Biden, allegations emerged of a brand new initiative known as “Operation ChokePoint 2.0,” which some believed was an try to drive the crypto companies offshore in the course of the 2022 bear market.

Binance founder Changpeng Zhao seeks dismissal of $1.8B FTX lawsuit

Former Binance CEO Changpeng Zhao requested the courtroom to dismiss a lawsuit by FTX that seeks to get better virtually $1.8 billion from a deal between Binance and FTX, which the defunct change claims was fraudulently transferred.

Zhao instructed a Delaware chapter courtroom that the go well with appears to be like to “nonsensically blame” him for the actions of Sam Bankman-Fried, FTX’s founder, who was jailed for 25 years after a high-profile fraud trial.

Zhao, a resident of the United Arab Emirates, argued that the go well with’s claims “are thus far eliminated” from the US that “the statutes at subject, which lack extraterritorial utility, don’t even apply.”

FTX sued Zhao, Binance and different then-executives in November, claiming that FTX fraudulently transferred round $1.8 billion in crypto to Binance in 2021 to purchase again shares that the change had bought.

US authorities broadcasts ChatGPT integration throughout businesses

US President Donald Trump’s administration has signed a cope with OpenAI to supply the enterprise-level model of the ChatGPT platform to all federal businesses in an effort to “modernize” operations.

Underneath the deal, all US authorities businesses could have entry to the AI platform for $1 per company to facilitate integration of AI into workflow operations, based on a Wednesday announcement from the US Basic Providers Administration (GSA).

The GSA, which is the US authorities’s procurement workplace, mentioned the private-public partnership “straight helps” the White Home’s AI Motion Plan, a three-pillar technique to ascertain US management in AI growth just lately disclosed by the administration.

Winners and Losers

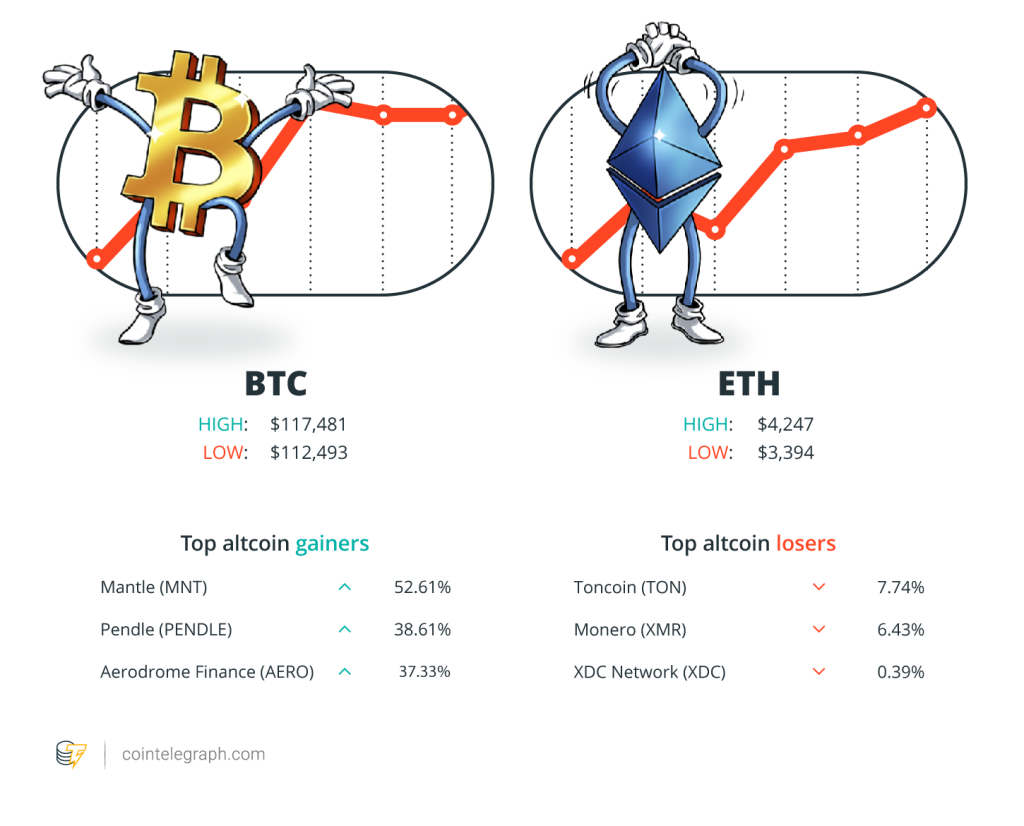

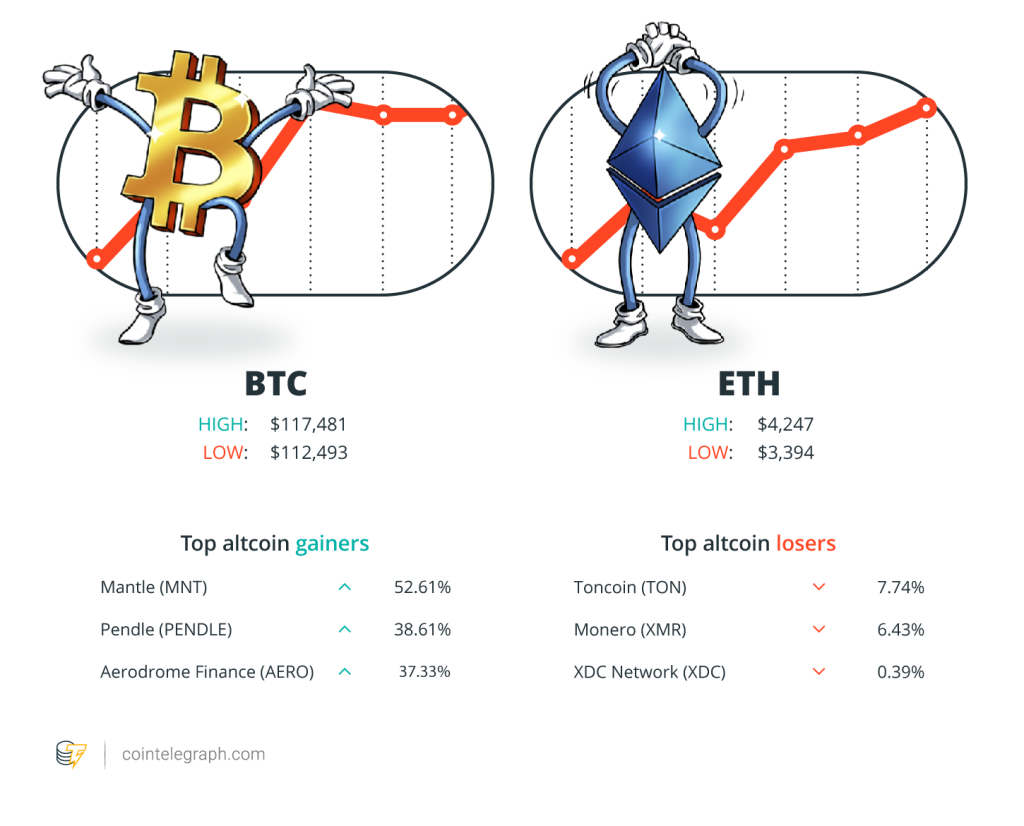

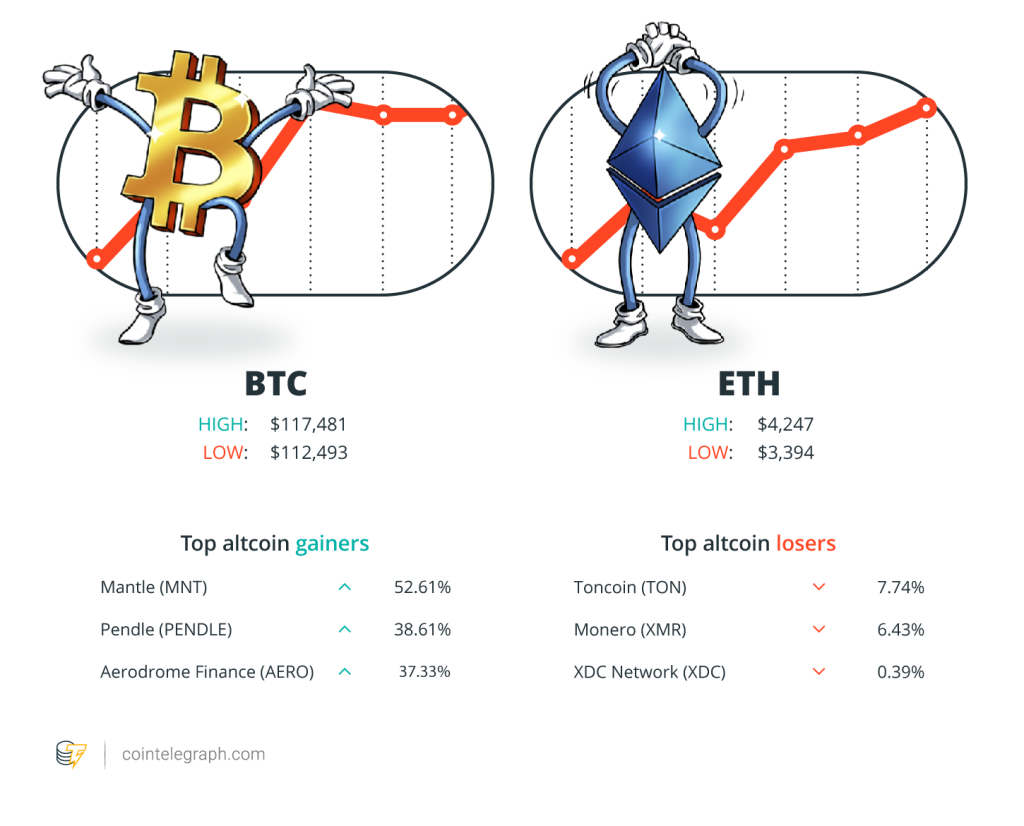

On the finish of the week, Bitcoin (BTC) is at $116,618, Ether (ETH) at $4,156 and XRP at $3.31. The overall market cap is at $3.93 trillion, based on CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Mantle (MNT) at 52.61%, Pendle (PENDLE) at 38.61% and Aerodrome Finance (AERO) at 37.33%.

The highest three altcoin losers of the week are Toncoin (TON) at 7.74%, Monero (XMR) at 6.43% and XDC Community (XDC) at 0.39%. For more information on crypto costs, be sure that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“I’ve realized so much about politics and the way the sport is performed this 12 months. I’m excited about elevating a $100m-$200m PAC, anchored by Nakamoto, to advance Bitcoin priorities.”

David Bailey, CEO of BTC Inc and crypto adviser to US President Donald Trump

“Final time it [Bitcoin] appeared like this it was earlier than the run from $70k to $100k.”

Galaxy, pseudonymous crypto dealer

“Probably the most bullish doc I’ve learn on crypto wasn’t written by some yahoo on Twitter. It was written by the chairman of the SEC.”

Matt Hougan, chief funding officer at Bitwise

“I used to be very shocked. Earth is so small. Mainly, we may virtually see your entire factor from the window, and that’s when it got here to me, the mission’s identify is correct on level.”

Justin Solar, founding father of Tron

“We should always take concrete steps to guard individuals’s means not solely to speak privately, however to switch worth privately, as they might have performed with bodily cash within the days through which the Fourth Modification was crafted.”

Hester Peirce, commissioner on the US Securities and Alternate Fee

“Inside different asset courses, digital belongings and hedge funds have been seeing an acceleration of inflows this 12 months, in sharp distinction to the weak fundraising seen in non-public fairness and personal credit score.”

Nikolaos Panigirtzoglou, managing director at JPMorgan Chase

Prediction of The Week

Bitcoin should have steam for $250K this 12 months: Fundstrat’s Tom Lee

Fundstrat co-founder and BitMine chairman Tom Lee mentioned Bitcoin might attain $250,000 in 2025, regardless of different crypto analysts cautiously pulling again targets.

“I feel Bitcoin ought to actually construct upon this 120 earlier than the top of the 12 months; 200,000, perhaps, 250,” Lee instructed Natalie Brunell on the Coin Tales podcast on Tuesday.

Learn additionally

Options

DeFi abandons Ponzi farms for ‘actual yield’

Options

Contained in the Iranian Bitcoin mining business

Final November, Lee gave a 12-month deadline for Bitcoin to succeed in $250,000.

Whereas analysts like BitMEX co-founder Arthur Hayes and Unchained’s market analysis director Joe Burnett have just lately echoed the same value goal for the 12 months, others have adopted a extra cautious outlook with lower than 5 months left till the top of 2025.

In Might, Bernstein and Commonplace Chartered set their year-end Bitcoin targets at $200,000, whereas 10x Analysis’s Markus Thielen just lately projected a extra modest $160,000.

Prime FUD of The Week

Crypto exec to pay $10M to settle SEC claims over betting on TerraUSD

The creator of a now-defunct lending platform agreed to pay greater than $10.5 million to settle US Securities and Alternate Fee claims that he used investor funds to purchase thousands and thousands price of the stablecoin TerraUSD earlier than it collapsed.

Huynh Tran Quang Duy, often known as Duy Huynh, instructed prospects of his agency, MyConstant, that their cash would go right into a mortgage matching service backed by crypto that might yield 10%, the SEC mentioned in an order on Tuesday.

The company claimed that in actuality, Huynh used $11.9 million of his prospects’ cash to purchase TerraUSD, a stablecoin tied to the Terra blockchain that collapsed in mid-2022 and worn out billions of {dollars} in worth.

MyConstant was considered one of a number of crypto-linked companies damage by Terra’s collapse, which is estimated to have flushed half a trillion {dollars} from the crypto market.

The corporate has confronted regulatory motion since late 2022, when California’s finance regulator accused it of violating the state’s securities legal guidelines and ordered it to stop operations.

James Howells pivots from landfill dig to tokenization in misplaced Bitcoin saga

Twelve years after unintentionally throwing away a tough drive containing 8,000 Bitcoin, James Howells is abandoning his long-running effort to excavate it from a Newport landfill. As a substitute, he plans to launch a brand new token impressed by the misplaced cash.

Learn additionally

Options

How Ethereum treasury corporations may spark ‘DeFi Summer season 2.0’

Options

US enforcement businesses are turning up the warmth on crypto-related crime

Howells, whose quest included authorized battles, drone surveys and a 25-million British pound supply ($33.3 million) to purchase the landfill outright, instructed Cointelegraph he’s shifting focus from bodily restoration to a blockchain-backed undertaking.

Relatively than attempting to dig up the stash, he goals to show the story of the misplaced Bitcoin right into a DeFi token — symbolically “vaulting” what can not be accessed.

In 2013, Howells mistakenly tossed the drive whereas tidying his workplace in Newport, South Wales. He had mined the 8,000 BTC when every coin was price lower than $1. At this time, the misplaced stash is price about $905 million, and his story has develop into a cautionary story for anybody who self-custodies their crypto.

Crypto investor falls sufferer to phishing rip-off, loses $3M with single click on

A cryptocurrency investor misplaced $3 million in a phishing rip-off after signing a malicious blockchain transaction with out verifying the contract deal with, highlighting the chance posed by digital asset scams.

A single mistaken click on was all it took to empty $3 million price of USDT from an investor who did not confirm the contract deal with earlier than signing the blockchain transaction.

“Somebody fell sufferer to a phishing assault, signed a malicious switch, and misplaced 3.05M $USDT,” based on a Wednesday X publish from blockchain analytics platform Lookonchain. “Keep alert, keep secure. One mistaken click on can drain your pockets. By no means signal a transaction you don’t absolutely perceive.”

Prime Journal Tales of The Week

How Ethereum treasury corporations may spark ‘DeFi Summer season 2.0’

Ethereum treasury corporations will compete for yield in DeFi to have the ability to elevate ever extra funds from TradFi traders. The race has already begun.

Philippines blocks massive crypto exchanges, Coinbase scammer’s stash: Asia Categorical

India freezes thousands and thousands in belongings tied to jailed Coinbase scammer, the MAS says Tokenize Xchange might have commingled buyer funds and extra.

Moonbirds flooring value surges: Can Spencer pull a Luca Netz? NFT Creator

The previous NFT blue chip undertaking Moonbirds is surging once more beneath new chief Spencer, an NFT dealer with a builder’s mindset.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Venture.