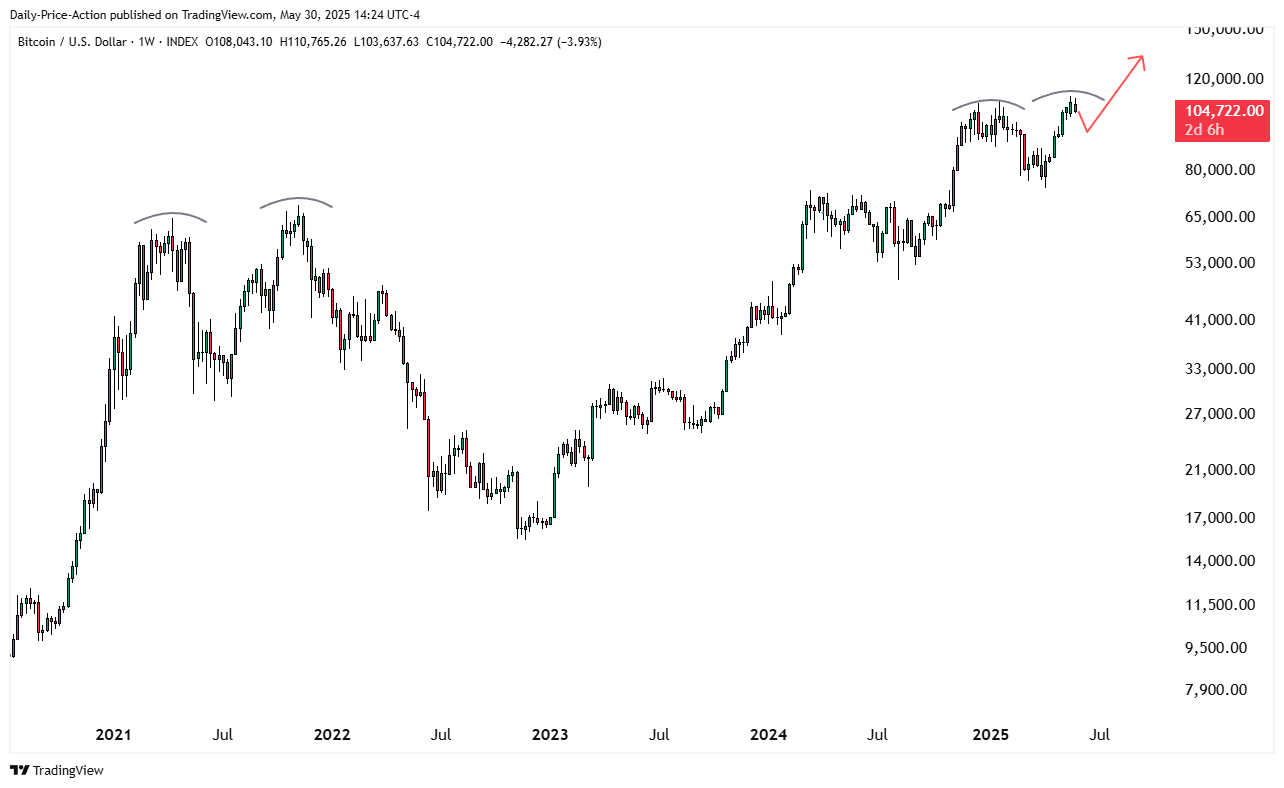

A intently adopted crypto strategist believes that the present Bitcoin pullback is establishing BTC for a transfer to new document highs.

Analyst Justin Bennett tells his 115,000 followers on the social media platform X that BTC’s retracement will seemingly drive merchants to imagine that the bull market is over.

In accordance with the analyst, he expects Bitcoin to appropriate beneath $100,000 earlier than it ignites a contemporary leg up en path to $120,000.

“That is the half the place everybody will get tremendous bearish, anticipating a 2021-style macro prime.

It’s additionally in all probability the place overly aggressive shorts get rekt.

1. The run-up isn’t even near the identical

2. The backdrop couldn’t be extra totally different

3. I doubt they make it this simple.”

In 2021, Bitcoin tried however did not take out resistance at $69,000 twice, triggering a bear market that despatched BTC to bear market lows of $16,000.

As for Bennett’s draw back goal for BTC, he thinks Bitcoin might bounce at $100,000 or $97,000.

“BTC subsequent leg down confirmed.

104,800 flips to key resistance. Assist is $100,000.

Identical outlook for the final 9 days.”

At time of writing, Bitcoin is buying and selling for $104,439.

Trying on the broader crypto market, the analyst says he’s maintaining a tally of the TOTAL chart, which tracks the entire market cap of all digital property. Bennett believes that TOTAL will appropriate and discover help at $3.04 trillion, which aligns together with his anticipated BTC pullback.

“I may very well be flawed. I’m actually not all the time proper. Nonetheless, I’m unsure how some are deciphering this as bullish.

Issues can change, however proper now, sellers are in management.”

A bearish TOTAL chart signifies that buyers are unloading their crypto holdings.

At time of writing, TOTAL is buying and selling at $3.225 trillion.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Value Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney