In a landmark choice, the Director of the Federal Housing Finance Company William Pulte has ordered government-sponsored enterprises, Freddie Mac and Fannie Mae, to think about crypto belongings as collateral of their threat assessments for single-family mortgage loans.

Notably, Pulte’s order asks the GSEs to make use of crypto belongings as collateral, with out changing them to U.S. {Dollars}.

Whereas the order doesn’t identify any particular crypto, its standards successfully restrict eligibility to belongings like Bitcoin and main stablecoins.

The BTC worth climbed as much as $107,000 on the information, whereas most large-cap altcoins are within the pink.

In the meantime, a brand new Bitcoin-themed meme coin, BTC Bull (BTCBULL), goes viral on its promise of free Bitcoin simply days forward of its launch.

FHFA Director Orders Bitcoin to Be Thought-about as Mortgage Collateral – Every thing You Must Know

The Trump administration continues to ship on the President’s promise of creating the USA the crypto capital of the world.

For the uninitiated, Fannie Mae and Freddie Mac are government-sponsored enterprises that purchase mortgages from lenders and repackage them into securities. This helps preserve the U.S. housing market liquid, permitting banks to difficulty extra house loans.

Whereas banks originate mortgages, Fannie Mae and Freddie Mac set the foundations for which loans they’ll purchase. So if a financial institution desires to promote a mortgage to Fannie or Freddie (which most do), it should observe their guidelines.

Pending approval from their Boards of Administrators and the FHFA, Bitcoin might quickly be deemed eligible as collateral for single-family mortgages.

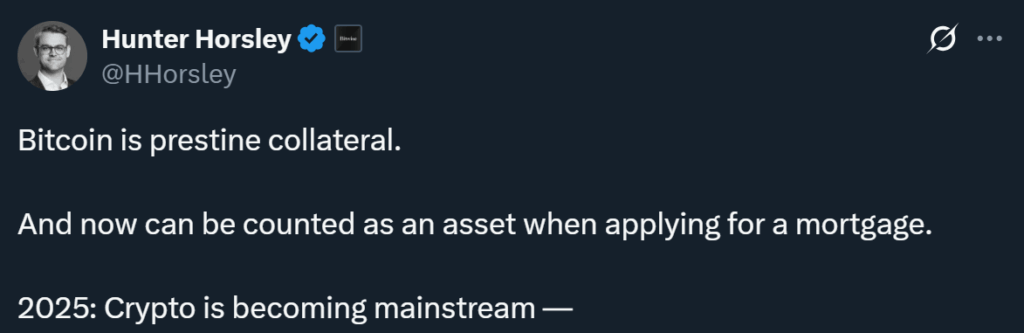

Contemplating Bitcoin’s upside potential and up to date pro-crypto laws, this transfer might supercharge each mainstream and institutional demand for BTC. It might additionally verify its standing as pristine collateral.

In the meantime, that is additionally good news for Bitcoin holders, contemplating tens of millions of BTC now not should be bought.

Unsurprisingly, Bitcoin is as soon as once more outperforming large-cap altcoins, presently up 2.5% over the week. In the meantime, the newest world liquidity knowledge factors to a $170,000 Bitcoin worth goal, and the approval of Pulte’s directive may very well be the catalyst behind it.

Right here’s How Buyers Can Earn Free Bitcoin

Bitcoin’s consideration as eligible mortgage collateral is predicted to spice up demand from each mainstream buyers and on a regular basis households.

Some analysts even anticipate that monetary advisors could start recommending Bitcoin years prematurely as a long-term hedge towards housing market cycles.

There’s a powerful chance that Bitcoin enters a parabolic rally within the coming weeks, notably if Pulte’s directive features momentum. Buyers can guess on this and earn free Bitcoin, due to the BTC Bull meme coin.

BTC Bull is a brand new meme coin that rewards holders based mostly on Bitcoin’s worth milestones. As BTC climbs towards key ranges like $125,000 and $150,000, BTC Bull initiates token burns, group airdrops, and even distributes precise Bitcoin to buyers.

This mannequin creates a direct hyperlink between Bitcoin’s rally and the meme coin’s upside, giving holders an opportunity to profit at a number of ranges.

The undertaking has already raised practically $8 million in its presale section, attracting a number of crypto whales. Its low market cap, mixed with aggressive tokenomics, has made it one of the vital talked-about beta performs for the upcoming bull cycle.

A staking characteristic providing excessive APY can be dwell, offering early buyers with sturdy yield potential even earlier than itemizing.

The BTCBULL presale ends on June thirtieth, and the token is predicted to hit the exchanges inside per week after that. Sidelined buyers now have mere days to get in early on a meme coin that many are calling the following 100x crypto.

Go to BTC Bull Presale

This text has been supplied by one in every of our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind that our business companions could use affiliate applications to generate income by way of the hyperlinks on this article.