An analyst has defined how Bitcoin has been monitoring Gold for some time now, which might present hints about what could also be subsequent for BTC.

Bitcoin Has Been Following In Gold’s Footsteps on 2-Day Timeframe

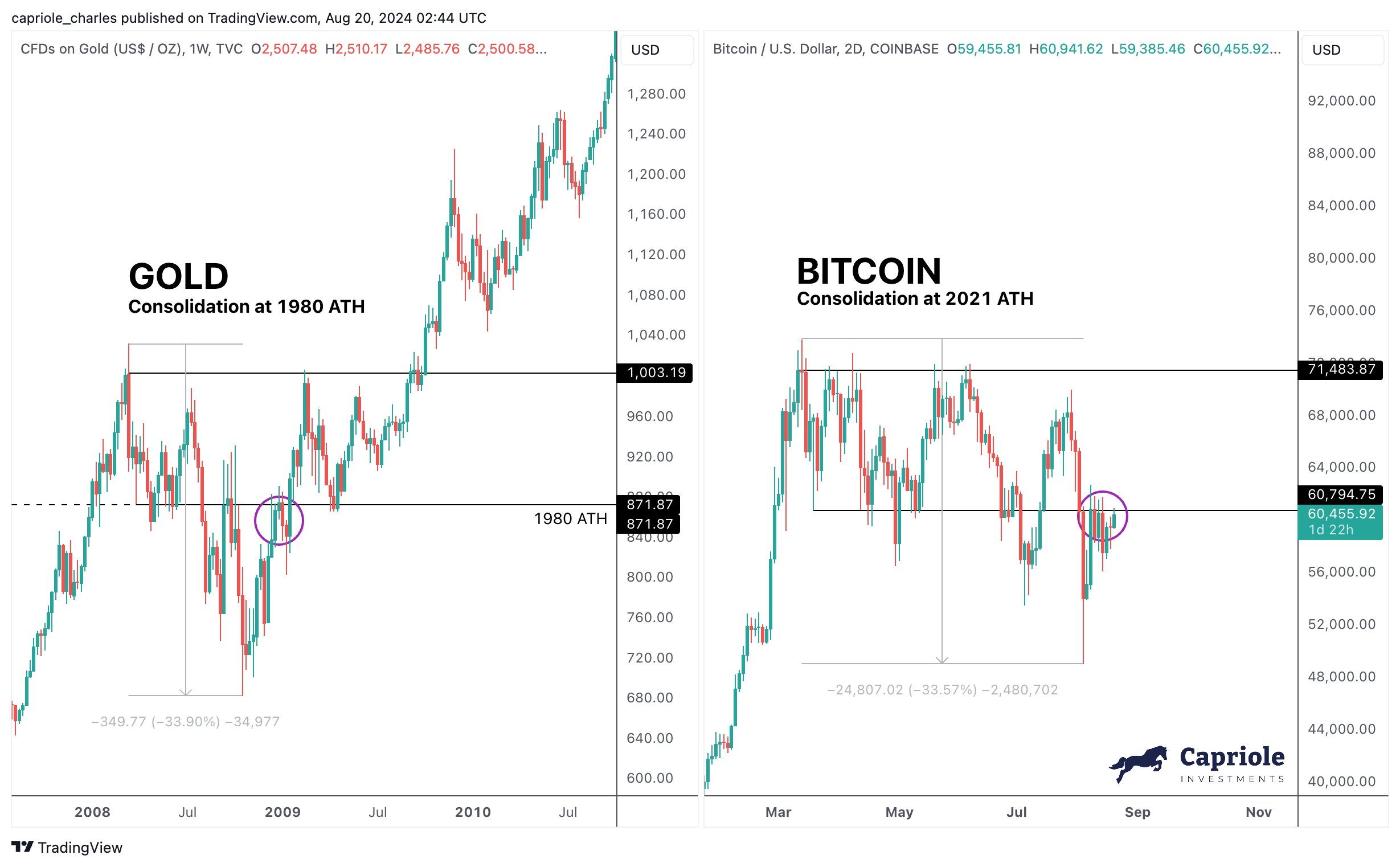

Final yr, Capriole Investments founder Charles Edwards shared in an X put up how Bitcoin was following the identical construction because the Gold all-time excessive (ATH). Beneath is the chart that the analyst posted again then.

From the graph, it’s seen that BTC was consolidating at its 2021 ATH in a way just like Gold’s motion across the 1980 ATH. The latter’s consolidation ended with it breaking out and rallying to a degree two occasions increased.

In a brand new put up, Edwards has shared a late replace on how issues ended up enjoying out for Bitcoin.

Because the consolidation across the respective ATHs already hinted, there certainly ended up being some similarity between the breakouts for the costs of the 2 property as nicely.

However that is all previously, the place does the newest Bitcoin value motion stack up towards Gold? Right here is one other chart posted by the analyst, highlighting the purpose BTC is presently at:

As Edwards has highlighted within the graph, BTC’s breakout because the consolidation section across the ATH has continued to resemble Gold’s, aside from the truth that BTC’s volatility has been roughly twice as excessive, by way of each upward and downward strikes.

That mentioned, the cryptocurrency’s newest shut has seemed much less promising than what the valuable steel displayed at the same stage in its construction. It’s potential that the 2 might diverge from right here, however within the case that they don’t, Gold’s path could present a glimpse into what might lie forward for the coin.

As is obvious from the chart, the normal safe-haven asset noticed a big surge from this level. Primarily based on this, the analyst has famous, “shut again above $110K and this can most likely go bananas.” It now stays to be seen how issues would play out for Bitcoin within the close to future.

In another information, the institutional DeFi options supplier Sentora has shared knowledge associated to how the cryptocurrency’s provide is presently distributed among the many numerous segments of the sector.

It will seem the person traders management round 69.4% of the overall potential Bitcoin provide. The ETFs and different funds personal round 6.1%, whereas companies about 4.4%. About 7.5% of all BTC that there ever shall be has already been misplaced attributable to lacking keys and/or being forgotten.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $104,200, down greater than 4% within the final week.

Supply hyperlink