Trusted Editorial content material, reviewed by main trade consultants and seasoned editors. Advert Disclosure

The value of Bitcoin started the brand new month on a tough notice, persevering with its tumultuous run from October. On the afternoon of Friday, November 7, the premier cryptocurrency briefly fell beneath the psychological $100,000 stage for the second time up to now week.

The struggles of the Bitcoin value in latest weeks have been attributed to a shift within the habits of buyers, particularly a category often known as the long-term holders (LTHs). A outstanding crypto knowledgeable on X has come ahead with extra insights as to the affect of the LTH habits on BTC value.

BTC Obvious Demand Development Turns Adverse

In his newest submit on the X platform, CryptoQuant’s Head of Analysis, Julio Moreno, acknowledged that the Bitcoin long-term holders have certainly been offloading their property over the previous few weeks. The crypto knowledgeable, nonetheless, famous that this elevated promoting exercise by LTHs just isn’t one thing new.

In line with Moreno, it’s fairly regular for Bitcoin long-term buyers to shave off a few of their holdings throughout the bull markets, as they give the impression of being to take some earnings whereas costs are excessive. What has been completely different this time round is that there was no corresponding demand to mop up these offloads.

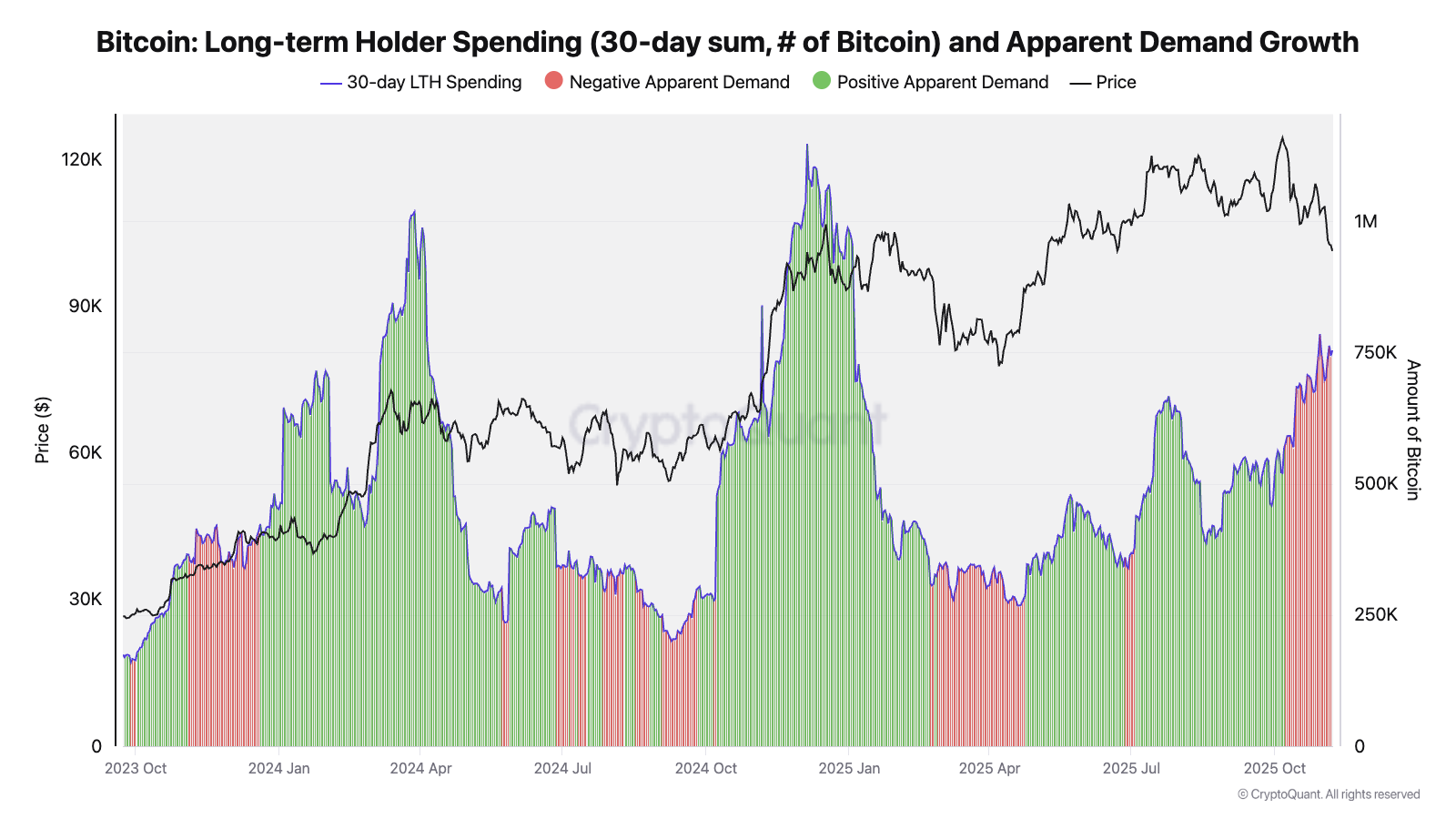

To again this, Moreno shared a chart comprising the long-term holder spending and obvious demand development up to now few years. For context, obvious demand development measures the distinction between how a lot of an asset (Bitcoin, on this case) is being acquired in comparison with the amount being created (mined).

Supply: @jjc_moreno on X

The CryptoQuant Head of Analysis famous that the Bitcoin value had reached new all-time highs up to now in periods of elevated long-term holders promoting—albeit with constructive obvious demand development. As noticed within the chart, this occurred throughout all-time-high rallies of January-March 2024 and November-December 2024.

The highlighted chart additionally exhibits that the Bitcoin long-term holders have been promoting since October, which isn’t significantly misplaced. Nonetheless, the obvious demand development has been contracting, implying that there was no purchase strain to soak up the LTH provide at larger costs.

Finally, this on-chain commentary means that much less focus needs to be positioned on the promoting exercise of the Bitcoin long-term holders. If there’s to be a turnaround for the worth of BTC over the approaching weeks, a constructive obvious demand development would must be in place first.

Bitcoin Worth At A Look

As of this writing, the flagship cryptocurrency has recovered again above $100,000 and is valued at round $103,700, reflecting an virtually 3% bounce up to now 24 hours.

The value of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.