Michael Saylor, founding father of Technique, urged this week {that a} rumored transfer by the US to impose tariffs on gold imports may push cash out of the metallic and into Bitcoin.

Associated Studying

In line with a Bloomberg interview, Saylor argued that Bitcoin can’t be taxed on the border as a result of it “lives in our on-line world, the place there aren’t any tariffs.”

He stated the coin’s lack of bodily weight and its pace of settlement make it extra engaging than gold in a world the place import duties on bullion are being mentioned.

Saylor Frames Bitcoin As Tariff-Proof Asset

Studies have disclosed that others within the trade agree. Simon Gerovich, president of Metaplanet, known as gold “heavy, gradual, and political,” and labeled Bitcoin “mild, quick, and free.”

Primarily based on reviews, Metaplanet — a Japanese firm that manages a Bitcoin treasury — purchased practically $54 million in Bitcoin just lately, bringing its complete holdings to 17,595 BTC, roughly $1.78 billion at present values.

These numbers matter to buyers watching whether or not company treasuries will change allocation from saved metallic to digital cash.

Market Response And Worth Strikes

Markets reacted in numerous methods. Gold futures hit an all-time excessive after the tariff information, as merchants scrambled to cost the attainable value impression of latest import guidelines.

Bitcoin, in the meantime, traded roughly sideways in the identical interval, shifting down by lower than 1% within the final 24 hours. The cut up response exhibits {that a} coverage shock can push some capital into metallic whereas different consumers could sit on the sidelines or look to crypto for a special type of hedge.

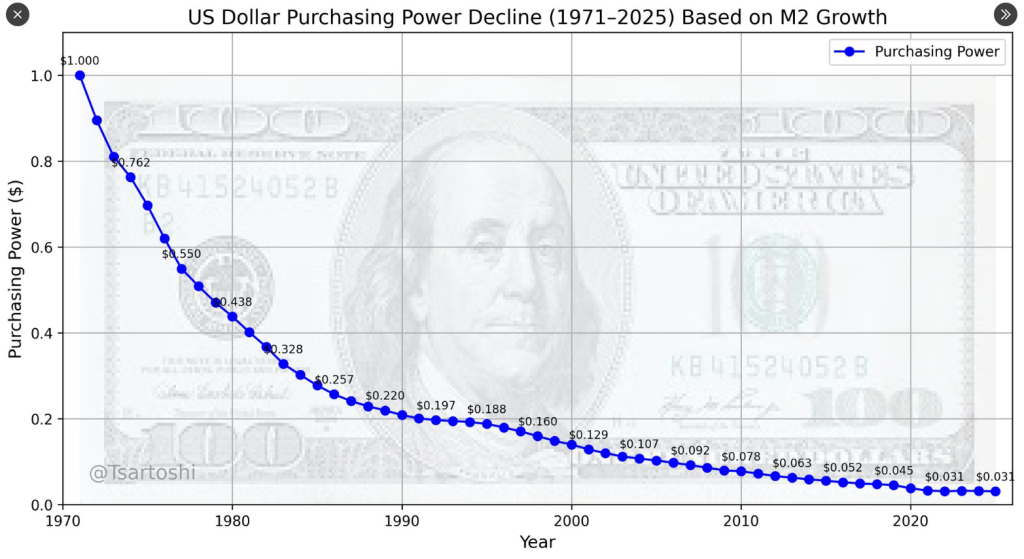

That is the buying energy of the U.S. Greenback

That is the last word chart sample for all fiat currencies

Some suppose Gold is a superb retailer of worth (preserving its buying energy) – and it’s

However the final retailer of worth will show to be Bitcoin $BTC pic.twitter.com/4rdar3TRtT— Peter Brandt (@PeterLBrandt) August 8, 2025

Brandt Highlights Greenback Decline Over A long time

Veteran dealer Peter Brandt added gas to the controversy by posting a long-run chart that traces the US greenback’s buying energy from $1.00 in 1971 to about $0.031 in 2025, primarily based on M2 cash development.

Associated Studying

Brandt pointed to a roughly 95% decline in that interval and stated this development exhibits fiat forex can lose worth over many years. He argued that whereas gold has held worth for a few years, Bitcoin is now positioned to function a retailer of worth going ahead.

In line with market watchers, the tariff discuss has modified the short-term temper however not resolved which asset is the higher long-term refuge.

Institutional consumers like Technique and Metaplanet are making public bets on Bitcoin, and that shapes expectations. On the identical time, gold’s file excessive reminds buyers that demand for tangible shops of worth can spike on coverage danger.

Featured picture from Unsplash, chart from TradingView