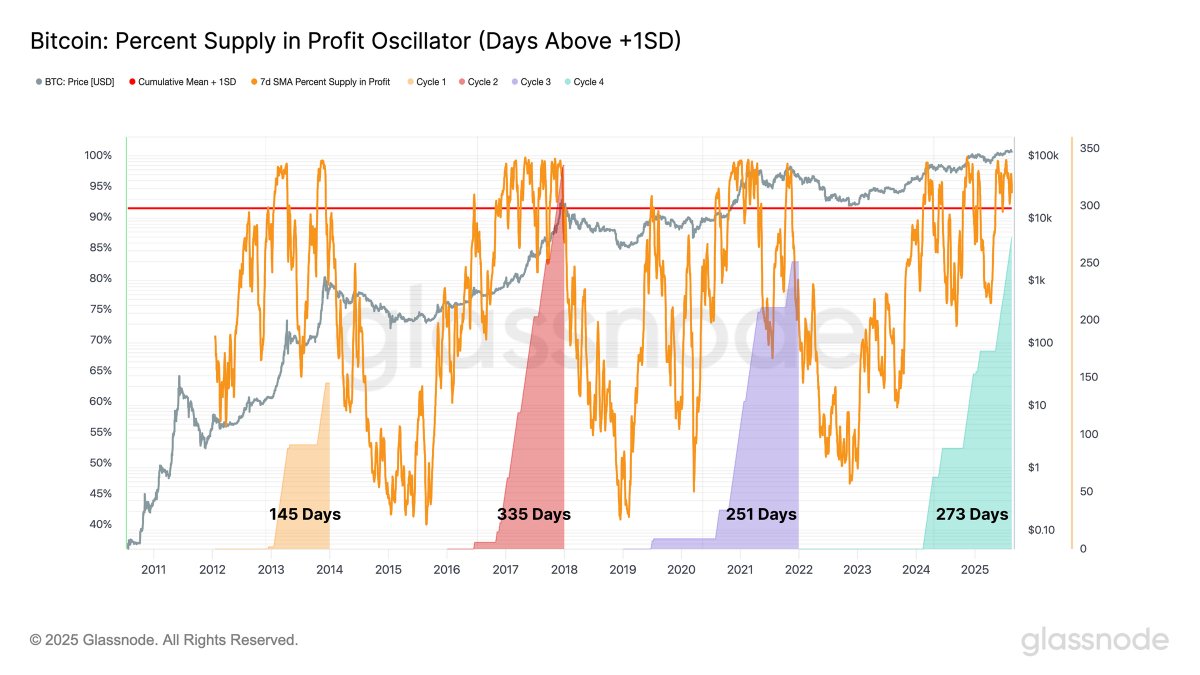

Bitcoin has entered uncommon territory in its present market cycle. In keeping with Glassnode, the asset has now spent 273 consecutive days with a super-majority of provide held in revenue – outlined as staying above the +1 commonplace deviation revenue band.

This streak marks the second-longest interval of sustained profitability in Bitcoin’s historical past, trailing solely the 2015–2018 bull cycle, which lasted 335 days. The present stretch has already surpassed the 251-day report from the 2020–2021 run.

Why it issues

The share of provide in revenue is a crucial measure of market well being, because it signifies what number of cash are held above their value foundation. When nearly all of Bitcoin holders stay in revenue for prolonged durations, it highlights sturdy conviction and reduces strain to promote.

Nonetheless, extended durations of profitability can even sign overheated circumstances, the place complacency or euphoria could start to dominate dealer psychology.

Chart context

- 2015–2018 cycle: Revenue streak lasted 335 days earlier than the market topped.

- 2020–2021 cycle: Noticed 251 days above the band, ending in a pointy correction.

- Present cycle: Now at 273 days, signaling resilience but in addition edging nearer to historic extremes.

The chart additionally exhibits how earlier prolonged profitability streaks coincided with main market tops, suggesting the present cycle may nonetheless have extra upside earlier than displaying exhaustion.

The takeaway

Bitcoin’s capability to maintain such an extended profitability part underlines the power of this bull cycle in comparison with historical past. Whereas not but on the 2018 report, the market is approaching ranges which have traditionally preceded pivotal turning factors.

Merchants and traders will probably be watching carefully to see if Bitcoin breaks the all-time profitability streak – or if historical past repeats with a cooling part forward.

Supply hyperlink