Trusted Editorial content material, reviewed by main trade consultants and seasoned editors. Advert Disclosure

Bitcoin has been navigating a turbulent setting over the previous few days, as escalating geopolitical tensions proceed to drive market uncertainty. On Friday at daybreak, Israel launched a navy strike towards Iran, triggering speedy retaliations which have since stored world monetary markets on edge. The battle, coupled with broader macroeconomic instability, has intensified volatility and stalled bullish momentum throughout main danger belongings.

Regardless of the stress, Bitcoin stays resilient. After briefly tagging the $112,000 all-time excessive final week, BTC has since retraced however remains to be buying and selling above a vital help zone. In keeping with a current technical evaluation shared by prime analyst Jelle, Bitcoin’s earlier all-time excessive stage remains to be holding as help, providing a key psychological and structural anchor for bulls. This worth zone is important to keep up as a way to protect the bigger uptrend construction and probably put together for one more try at worth discovery.

Traders now flip their consideration to macro catalysts similar to oil costs, bond yields, and central financial institution coverage expectations, which proceed to affect liquidity flows throughout markets. For Bitcoin, holding present ranges might function a basis for a stronger transfer as soon as exterior pressures ease and market circumstances stabilize.

Bitcoin Consolidates Close to Highs Amid World, Macroeconomic Headwinds

Bitcoin has entered a consolidation section following a strong transfer from the $74,000 stage to its all-time excessive of $112,000. This sharp rally, which unfolded over a matter of weeks, has now paused as merchants and institutional buyers assess the rising complexity of the macro setting. From surging US Treasury yields and sticky inflation to escalating geopolitical tensions—most notably the Israel-Iran battle—the present backdrop presents vital headwinds for danger belongings like Bitcoin.

But, regardless of this turbulence, Bitcoin has proven notable power by holding above important help ranges. In keeping with Jelle, Bitcoin’s earlier all-time excessive remains to be appearing as sturdy help, which may function a launchpad for additional upside. Jelle famous that BTC closed the earlier every day candle solidly, at the same time as world markets had been rattled by contemporary waves of uncertainty. His conclusion was clear: “Bitcoin needs larger.”

Certainly, whereas the short-term image is clouded by warning, many stay optimistic about Bitcoin’s subsequent transfer. Some forecasts counsel BTC may break above its $112K excessive throughout the coming weeks, particularly if macro circumstances—like easing yields or diplomatic progress within the Center East—provide aid to buyers.

The following few weeks shall be pivotal. A clear break above the ATH may ignite a brand new section of worth discovery, whereas a failure to carry present help might set off deeper pullbacks. For now, consolidation above $100K retains the bullish construction intact.

BTC Worth Evaluation: Weekly Construction Reveals Energy

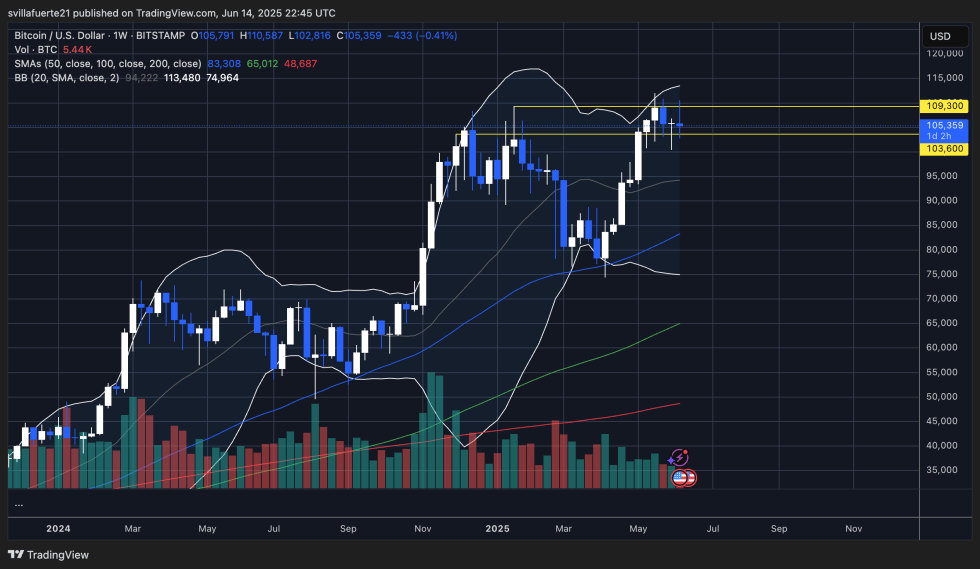

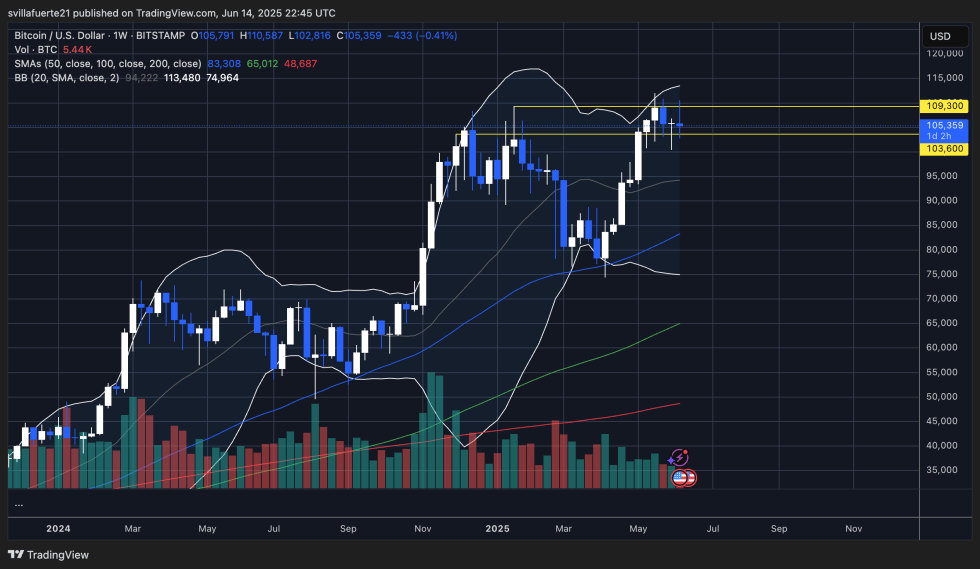

Bitcoin’s weekly chart displays a section of consolidation just under the $112,000 all-time excessive, following a pointy rally from sub-$75K ranges. After a number of checks of the $109,300 resistance zone, BTC continues to carry above the earlier ATH vary, with present help round $103,600 holding agency for now. This conduct indicators that bulls stay in management regardless of current geopolitical and macroeconomic stress.

The Bollinger Bands are tightening after a interval of growth, usually a sign of upcoming volatility. The value motion stays comfortably above the midline of the bands and all key transferring averages (50, 100, and 200-week SMA), indicating sustained bullish momentum over the medium time period.

What stands out is the resilience of BTC within the face of worldwide headwinds. Even with elevated volatility as a result of Israel-Iran battle and sticky US inflation fears, Bitcoin’s weekly closes stay constructive. So long as BTC continues to print larger lows and defend the $103,600–$105,000 help zone, the trail towards a breakout into worth discovery stays legitimate.

A clear weekly shut above $109,300 can be a major bullish set off, probably focusing on the $120K–$125K zone within the close to time period. Till then, consolidation inside this vary stays the dominant construction.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.