Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

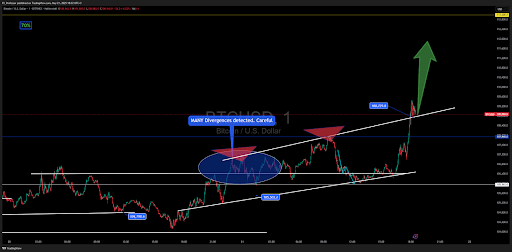

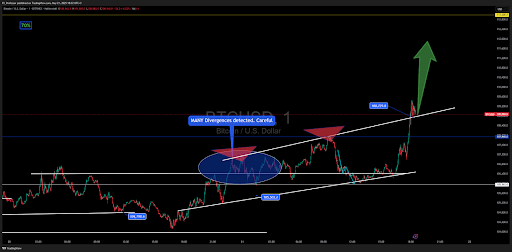

Bitcoin’s value motion prior to now 24 hours has been nothing in need of exceptional. After consolidating for a number of days in a tightening vary, the market broke previous the $105,503 support-turned-resistance zone earlier within the week and kicked off a steep climb prior to now buying and selling day. This has allowed Bitcoin to push into new all-time excessive ranges, and is displaying no indicators of slowing down.

Curiously, technical evaluation reveals the rally comes off an strategy of a golden cross between the 50 and 200-day shifting averages, however FX_Professor provided a distinct tackle the much-celebrated golden cross.

Analyst Disputes Golden Cross Hype As Late Sign

In a latest evaluation printed on TradingView, FX_Professor mentioned a distinct tackle Bitcoin’s golden cross. Whereas most market commentators interpret this crossover of the 50-day easy shifting common above the 200-day as a powerful bullish affirmation, the analyst dismissed it as a delayed indicator. The analyst described it because the afterparty the place retail buyers arrive late to the scene.

Associated Studying

As a substitute of ready for the golden cross to flash inexperienced, FX_Professor famous pre-indicator strain zones as the true sign of worth. Within the case of Bitcoin’s value motion in latest months, the analyst identified the $74,394 and $79,000 area because the zone of accumulation and early positioning, effectively earlier than the golden cross turned seen. As such, by the point the cross appeared not too long ago, Bitcoin’s value motion had already been up considerably.

The golden cross is usually utilized by merchants as a sign to enter an extended place, because it means that the asset’s value is more likely to proceed rising. Nonetheless, this evaluation follows a development amongst skilled merchants who view the golden cross as extra of a lagging affirmation than a set off of a rally.

Early Entry Zones And Construction Matter Extra, Analyst Says

In response to FX_Professor, indicators similar to EMAs or SMAs will be helpful however ought to by no means come earlier than understanding the value construction, trendlines, and real-time strain zones. He shared a snapshot of his personal Bitcoin value chart that mixes customized EMAs with a signature parallelogram methodology to detect the place value stress begins to construct. Seen on the chart are entries forming as early as April when Bitcoin bounced off help round $74,000, lengthy earlier than the crossover affirmation.

Associated Studying

Now, with Bitcoin pushing towards the subsequent goal zone close to $113,000, the analyst’s technique continues to validate itself in actual time. Nonetheless, the affirmation of a golden cross remains to be bullish for Bitcoin’s value motion shifting ahead, even when the value rally is already midway to its peak degree.

On the time of writing, Bitcoin is buying and selling at $110,734. This marks a slight pullback from the brand new all-time excessive of $111,544, which was registered simply three hours in the past. The Bitcoin value remains to be up by 3.1% prior to now 24 hours, and new all-time highs are attainable earlier than the weekly shut.

Featured picture from Getty Pictures, chart from Tradingview.com