Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Bitcoin is now trading above short-term highs after reclaiming the $87,000 level just a few hours ago. This move signals growing strength among bulls, but a full bullish reversal will only be confirmed once higher resistance levels are broken. Global tensions remain high, with a trade war between the US and China continuing to weigh on financial markets. Despite this macro uncertainty, Bitcoin appears to be stabilizing and preparing for a possible breakout.

Top crypto analyst Axel Adler shared fresh insights that support this view. As of today, Bitcoin’s “foundation” Realized Price (RP) continues to climb gradually, despite a small local dip since February 2025. Meanwhile, the speculative premium (measured by the MVRV ratio) is compressing, and the total annual network return fluctuates around 46%. According to Adler, these metrics align with a classic accumulation phase—when fundamentals remain strong, but sentiment lags.

This imbalance often creates conditions for the next bullish expansion. If investor confidence returns and macroeconomic conditions stabilize, Bitcoin could be poised for a major breakout. For now, all eyes are on whether BTC can hold above $87K and push toward new highs.

Bitcoin Enters Pivotal Week At Key Resistance Level

Bitcoin is now facing critical resistance after reclaiming short-term highs, and this week could prove pivotal. Following last week’s tight consolidation range, bulls are positioning for a breakout as selling pressure fades and broader markets attempt to stabilize. With Bitcoin holding above key support levels near $87,000, the tone has shifted—investors are cautiously optimistic that the worst may be behind.

Axel Adler shared a compelling on-chain breakdown supporting the bullish case. According to Adler, Bitcoin’s “foundation” Realized Price (RP) continues to rise steadily, with only a small local decrease since February 2025. Simultaneously, the speculative premium, measured by the MVRV ratio, is compressing. Combined with a stable annual network return of around 46%, this suggests Bitcoin is in a classic accumulation phase.

In accumulation phases, fundamentals outpace sentiment. The imbalance often leads to explosive upside when market psychology finally catches up. Adler also points out that the local decline in YoY RP shows that coins are moving into hands with a lower cost basis—an indicator of capitulation and long-term positioning.

Currently, YoY RP stands at about 61%, implying the network continues to accumulate capital, albeit at a slower pace than during all-time highs. While new money is still flowing in, it reflects October 2024 levels—suggesting capital inflows are healthy, but patient. If sentiment shifts, Bitcoin may be ready to break out of resistance and begin a new leg upward.

BTC Holds Above Key Level: Bulls Eye $90K Breakout

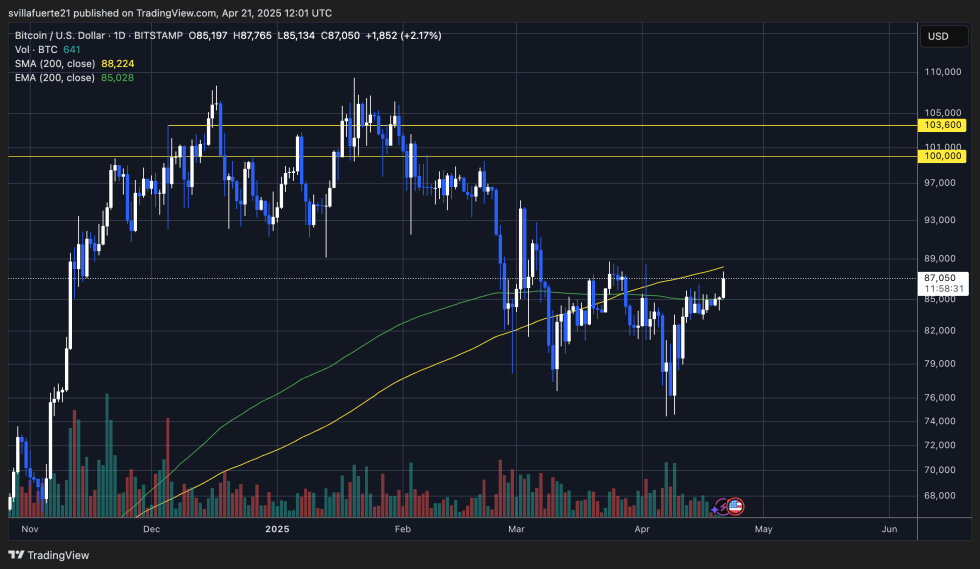

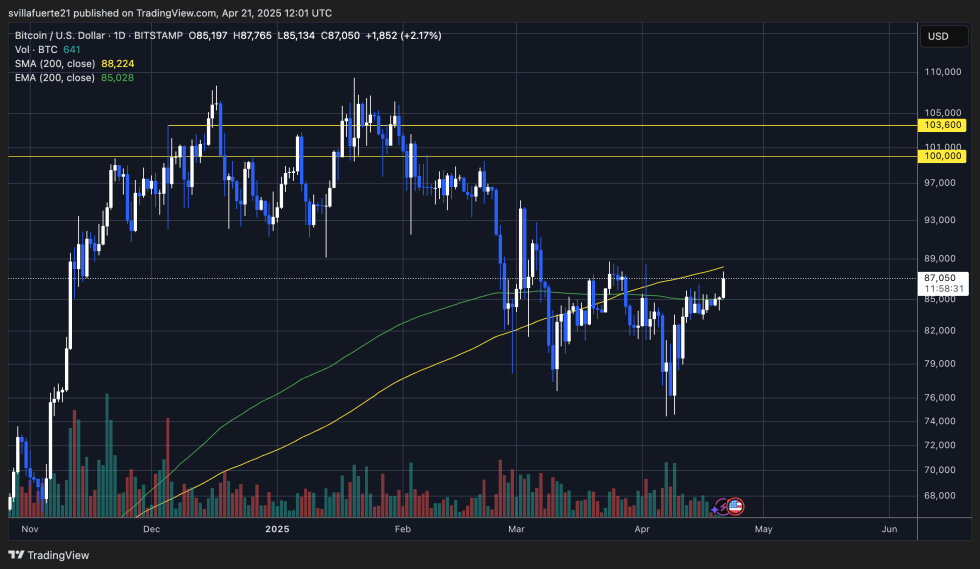

Bitcoin is trading at $87,000 after reclaiming the 200-day exponential moving average (EMA), signaling renewed bullish momentum. The price is now testing the 200-day simple moving average (MA) near $88,000, a level that has acted as strong resistance in recent months. Bulls must push above this barrier to confirm strength and set the stage for a sustainable recovery.

If BTC manages to break and hold above the $90,000 level, it would mark a significant technical milestone, validating a trend reversal and potentially triggering a surge toward new highs. This breakout could also draw back sidelined capital and reignite retail and institutional interest amid broader market volatility.

However, the bullish scenario hinges on follow-through. If Bitcoin fails to reclaim $90K decisively, the rally may fade, and the market could re-enter a correction phase. A breakdown below $84K would put the $80K support at risk, with further downside likely if that level fails to hold.

For now, BTC remains at a critical junction. The next few trading sessions will be decisive in determining whether bulls have enough strength to reclaim dominance—or whether another leg down lies ahead.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.