- Bitcoin tanked to $113K after Trump ordered nuclear subs moved and launched assaults on the Fed and labor knowledge.

- Over $200M in liquidations hit the market, and BTC futures premiums shrank, signaling risk-off vibes.

- Ray Dalio now recommends allocating as much as 15% in Bitcoin or gold to hedge in opposition to rising U.S. debt.

Bitcoin simply took a nasty spill, dropping underneath $115K on Friday—touchdown at $113,164 earlier than catching its breath. That’s its lowest degree in weeks, and yep, it triggered over $200 million in liquidations for people who have been a little bit too bullish with leverage. The selloff? It got here proper after Donald Trump determined to shake issues up—once more.

Submarine Politics and Bitcoin Jitters

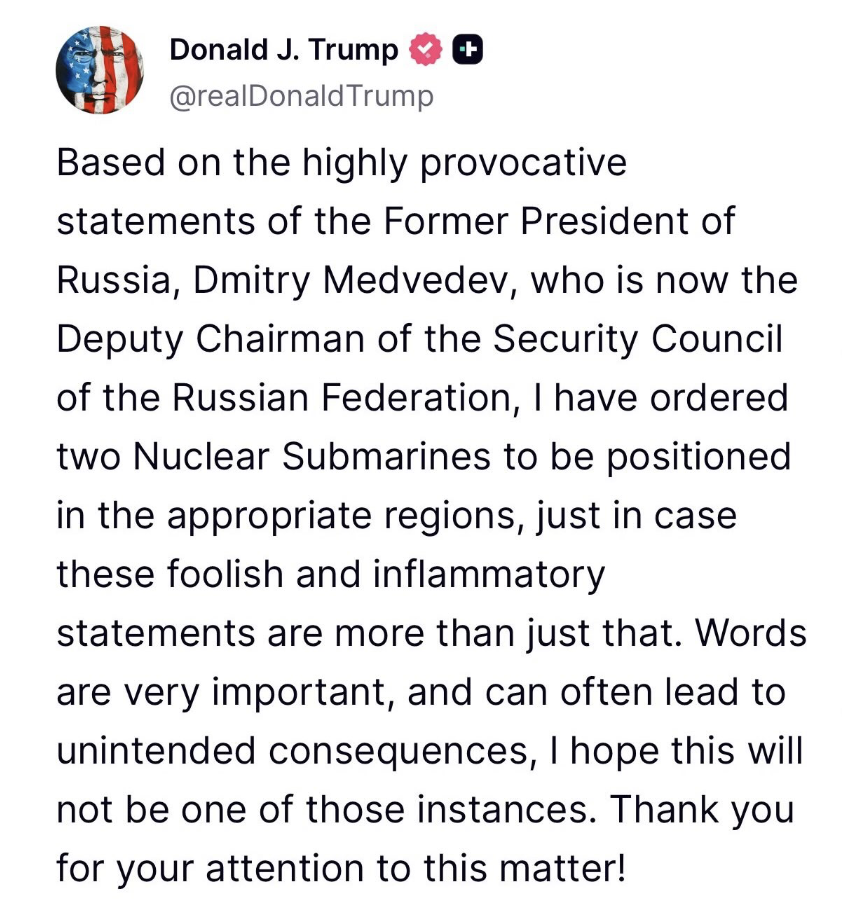

So, right here’s what occurred. Trump received into it with Dmitry Medvedev—Russia’s former prez—who mainly instructed him his Ukraine threats have been nonsense and a shortcut to battle. Trump didn’t take that calmly. He fired again on Reality Social, saying he’s shifting two U.S. nuclear subs into “acceptable areas.”

He didn’t cease there, both. “Phrases are essential,” he stated. “And generally, they blow up into… unintended penalties.” Traditional vague-but-threatening Trump stuff. Markets didn’t like it. Bitcoin instantly began slipping as worry crept in.

Price Rants, Job Claims, and Fed Chaos

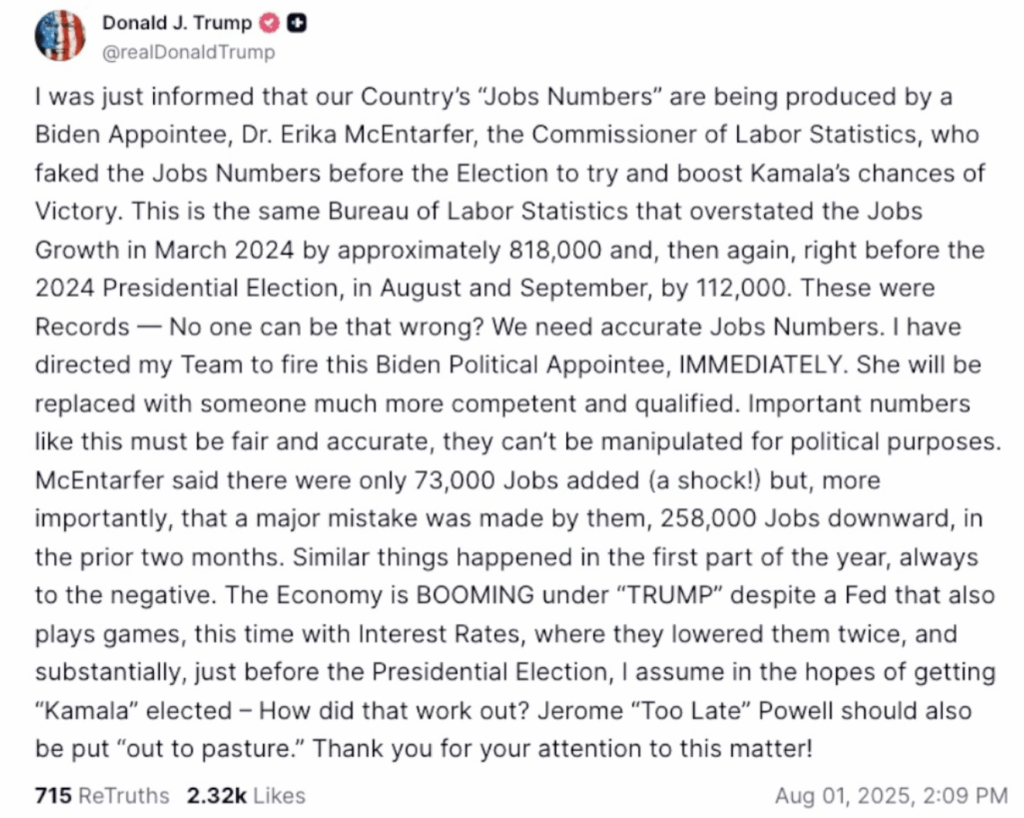

As if geopolitics weren’t sufficient, Trump additionally blasted U.S. financial management. He accused the Labor Division of fudging job numbers to assist Kamala Harris (he’s nonetheless calling her the probably opponent, apparently). He needs Commissioner Erika McEntarfer fired, saying the employment knowledge was “pretend” and a part of some pre-election trickery.

Then he went off on Fed Chair Erika McEntarfe—once more. Referred to as him a “cussed MORON” (sure, caps included), and urged the Fed to chop rates of interest instantly. Trump even demanded the board take over if Powell retains “refusing to behave.” The Fed, for the report, has stored charges flat for 5 straight conferences, nonetheless frightened about inflation.

And simply to essentially stir the pot? Fed Governor Adriana Kugler resigned. She didn’t say why, simply that she’s heading again to Georgetown. Her exit opens up a giant seat that Trump can now fill if reelected. She’d been on the cautious facet currently—preferring to attend out the entire tariffs/inflation mess.

Bitcoin’s Not Loving the Drama

With all that noise, Bitcoin continued to slip. It’s now hovering about 7% under its $123K all-time excessive from mid-July, but it surely’s the vibe that’s shifting. Futures premiums have narrowed to round 6%—down from the highs earlier this month. Translation? Merchants are getting chilly ft. They’re not keen to put huge, leveraged bets proper now.

Additionally price noting—Bitcoin’s behaving extra like a tech inventory currently. That entire “digital gold” concept? Kinda shaky. When political stuff flares up, BTC has been dipping proper together with equities. Gold, in the meantime, has been regular round $3,350. So, some buyers are taking the safer route: money, short-term bonds, much less drama.

Nonetheless, Bitcoin’s removed from lifeless. It’s up huge since January. However proper now, the temper is… cautious.

Dalio Flips (Sorta), Talks Bitcoin Hedge

Even Ray Dalio—the identical man who used to dunk on Bitcoin—has softened. On a latest podcast, he stated buyers ought to take into consideration allocating as much as 15% to Bitcoin or gold, principally as a hedge in opposition to America’s ballooning debt downside.

“The U.S. is getting into a debt doom loop,” Dalio stated, citing a terrifying $12 trillion in projected new debt over the subsequent yr. And whereas Bitcoin continues to be risky and a bit murky regulation-wise, Dalio admits it’s turning into tougher to disregard as a long-term retailer of worth.