The Bitcoin market recorded a minor 0.67% worth achieve within the final 24 hours, amid a short return to the $118,000 worth territory. This modest worth enhance kinds a part of a rebound noticed over the earlier 48 hours, following a major 4% worth correction earlier final week. Looking forward to the brand new week, famend market analyst with X username KillaXBT has recognized two potential worth improvement eventualities for the premier cryptocurrency.

Bitcoin Sees Bounce From Key Demand Zone, However What’s Subsequent?

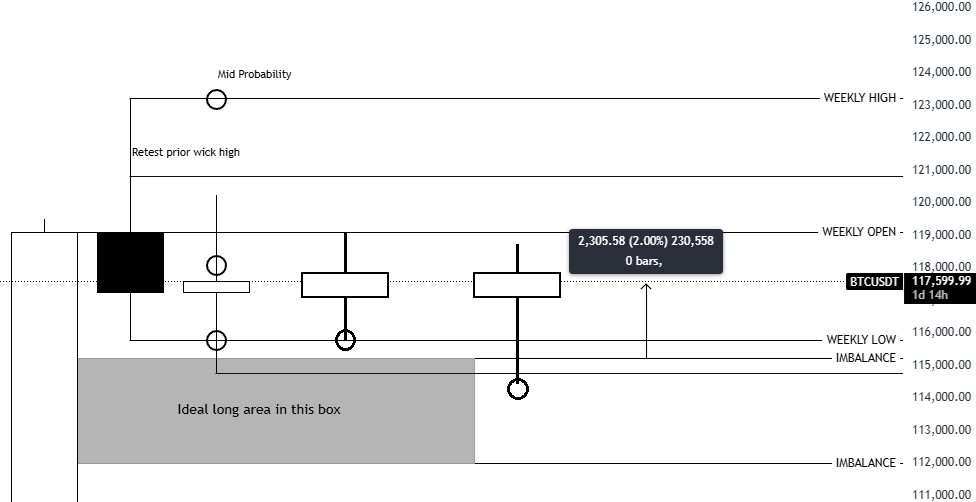

In an X publish on July 26, KillaXBT supplies an in-depth technical evaluation of the Bitcoin market to map out the asset’s potential worth trajectory on this new week. The favored market knowledgeable duly notes that Bitcoin skilled a worth bounce after dipping right into a key demand zone round $115,000, which in addition they described as a super lengthy entry area.

As earlier acknowledged, the crypto market chief has since climbed to $118,000 following this worth rebound. Nevertheless, KillaXBT notes there’s a longtime CME Hole round $117,071, which is more likely to function a worth magnet within the brief time period. For context, CME gaps are worth gaps on the Chicago Mercantile Change (CME) Bitcoin futures chart that happen when Bitcoin’s worth strikes considerably on the spot market when CME markets are closed, sometimes over the weekend.

In view of subsequent week, KillaXBT explains situation 1 during which the Bitcoin market opens on a bullish word. On this case, the analyst states traders ought to anticipate Bitcoin to finally kind the next low, ideally by a sweep of liquidity across the $116,000 space. Nevertheless, if Bitcoin bulls can successfully maintain this worth pocket, it might set off contemporary lengthy setups with cease losses tucked beneath the prior week’s low.

In situation 2, KillaXBT paints a extra aggressive scenario during which Bitcoin performs a double sweep of final week’s wick low round $114,800, thereby effecting a ruthless liquidity seize earlier than an upward reversal. Nevertheless, the market knowledgeable favours the truth of situation 1, following the sooner liquidity seize with the worth dip to $115,000.

The Invalidation Danger

No matter which situation, KillaXBT has highlighted sure developments that might neutralize the prospects of a bullish reversal. Specifically, the analyst explains that failure for the worth to carry above the current wick lows following a retest would power Bitcoin costs to deeper imbalance zones between $112,000 – $113,800.

On the time of writing, Bitcoin trades at $117,900, reflecting a 0.21% achieve within the final seven days.

Supply hyperlink