Trusted Editorial content material, reviewed by main business consultants and seasoned editors. Advert Disclosure

Bitcoin is now buying and selling roughly 30% under its $126,000 all-time excessive, reflecting a market gripped by promoting strain, uncertainty, and fading confidence. The sharp downturn has shaken traders who anticipated continued upside, and lots of analysts are starting to argue that the cycle has already peaked.

Worth motion stays fragile, with patrons struggling to regain management and momentum indicators pointing to exhaustion reasonably than power. But, regardless of the bearish tone, there are rising indicators that the present part could also be approaching an inflection level.

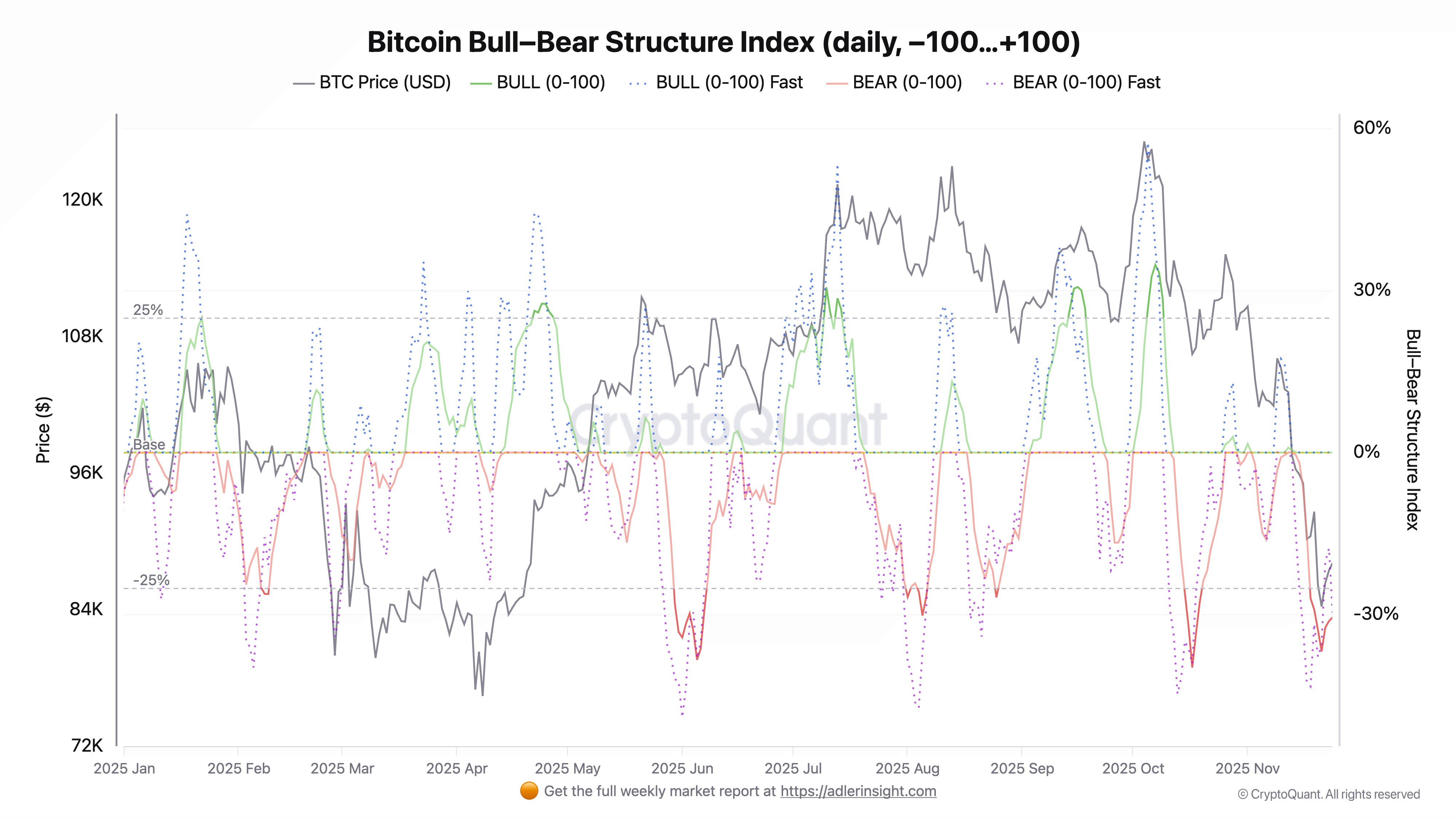

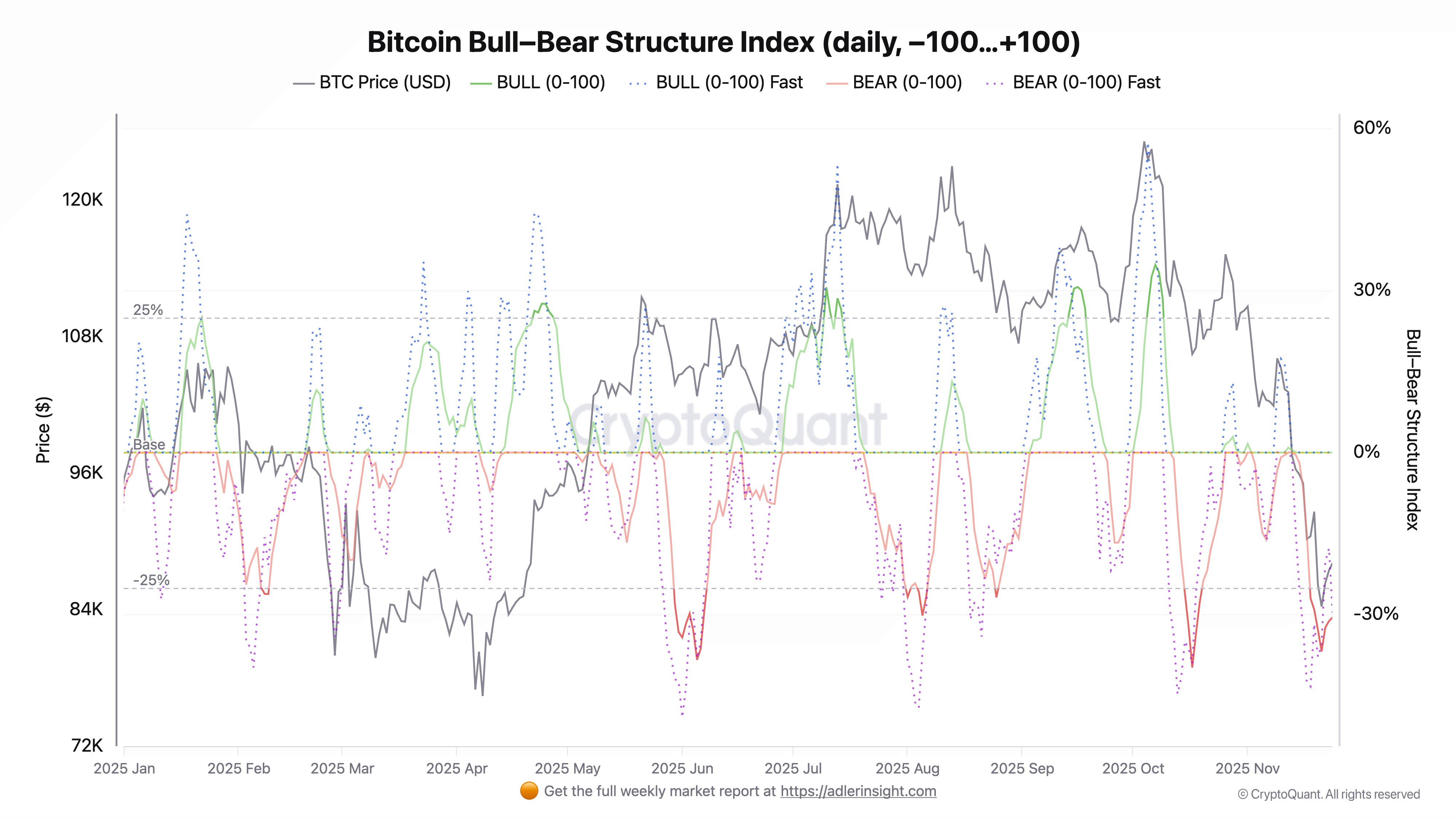

In keeping with high analyst Axel Adler, each the Bitcoin Bull-Bear Index and the Futures Circulation Index stay firmly inside a bearish regime, signaling that market construction nonetheless favors draw back threat. Nonetheless, Adler highlights that Bitcoin is at present buying and selling 11% under its 30-day honest worth of $99.2K, suggesting a notable disconnect between value and underlying derivatives positioning.

This divergence has traditionally appeared close to corrective exhaustion zones reasonably than early-stage declines. Moreover, short-term dynamics throughout each indices point out the primary indicators of an tried reversal, with promoting strain slowly weakening and momentum starting to stabilize.

Bearish Construction Weakens as Bitcoin Makes an attempt to Stabilize

The every day Bitcoin bull and bear construction index exhibits a sustained shift to the bearish facet since November 11, reflecting the strongest draw back momentum of this cycle. The purple BEAR line moved deep into adverse territory at -36%, signaling persistent dominance of promoting strain.

Nonetheless, the indicator is now beginning to reverse, suggesting that essentially the most aggressive part of bearish management could also be fading. On the similar time, Bitcoin is consolidating round $87,000 after briefly plunging to $80,000, marking an early try and stabilize and rebuild help following the sharp decline.

Quick variations of the index spotlight elevated volatility, with the metric rising from -43 to -20 — a transparent signal that bear strain is easing. Though this doesn’t but point out a pattern reversal, it displays a significant discount in draw back depth. Within the futures market, the index stays in a bearish regime as properly, with values rising however nonetheless failing to interrupt above the important thing 55 threshold. A transfer above that stage would sign the primary structural try and transition again right into a bullish part.

The honest worth stage, at present positioned at $99,000, exhibits Bitcoin buying and selling $11,000 under equilibrium, reinforcing undervaluation. Collectively, each indices point out that the market is trying to exit the bearish regime it has been trapped in for greater than a month, although affirmation would require stronger follow-through.

Weekly Construction Exams Key Assist Amid Tried Stabilization

Bitcoin’s weekly chart exhibits the market trying to stabilize after a pointy decline from its all-time excessive close to $126,000. Worth is at present buying and selling round $87,300, reflecting a big drawdown of greater than 30% from the height. The latest candle construction highlights a short lived rebound after tagging lows close to $80,000, suggesting that patrons have stepped in at a important help zone.

The 100-week shifting common, sitting near present ranges, is appearing as an vital dynamic help and has traditionally served as a threshold separating bullish continuation from deeper cyclical breakdowns. Regardless of the bounce, the worth stays under the 50-week shifting common, which is starting to twist downward, signaling weakening pattern power.

Quantity elevated noticeably in the course of the selloff, reflecting capitulation conduct and aggressive repositioning amongst market members.

Associated Studying: Bitcoin Loses $85K as Coinbase Premium Stays Unfavorable for 21 Straight Days – Particulars

If Bitcoin maintains help above this zone and reclaims the 50-week shifting common, a restoration towards the $95,000–$102,000 area turns into believable. Nonetheless, if promoting strain resumes and the worth loses the 100-week shifting common, the subsequent draw back magnet sits close to the $75,000–$78,000 vary.

The weekly construction exhibits a market in correction however not but in a confirmed macro reversal, with the upcoming candles seemingly figuring out whether or not the cycle continues or breaks down additional.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.