A key market metric on Binance has dropped to its lowest stage because the begin of the present cycle, with analysts suggesting the transfer might signify a contrarian purchase sign for Bitcoin.

Understanding the ratio

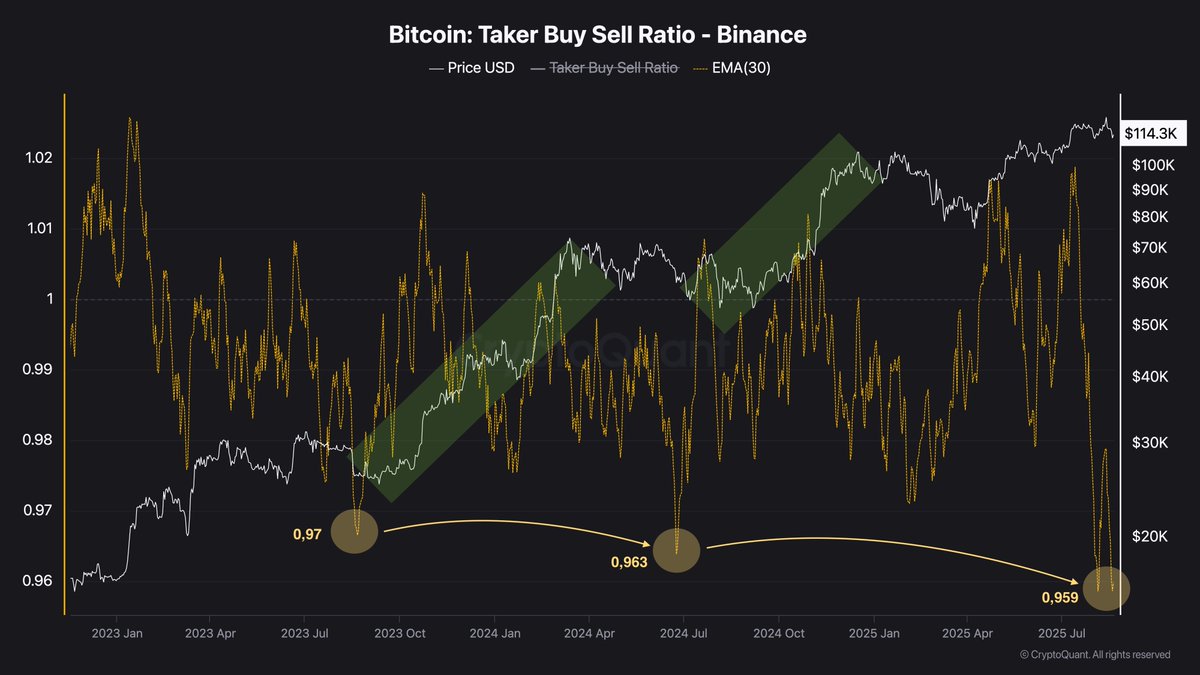

The Taker Purchase-Promote Ratio, tracked by CryptoQuant, measures the stability of shopping for versus promoting stress in Binance’s derivatives order books. A studying above 1 signifies that aggressive purchase orders dominate, typically signaling bullish sentiment. Conversely, a price under 1 displays stronger promoting exercise, generally tied to bearish market phases.

Present studying close to 0.95

In line with market analyst Darkfost, the ratio has now slipped to round 0.95 – its lowest stage on Binance throughout this cycle. Comparable dips in July 2023 (0.97) and April 2024 (0.963) preceded notable worth rebounds in Bitcoin.

Whereas the studying signifies that sellers at the moment outweigh patrons in futures buying and selling, historic patterns counsel such excessive lows typically mark factors of market exhaustion somewhat than the beginning of extended declines.

Contrarian sign for Bitcoin

Regardless of short-term bearishness implied by the ratio, the market tends to maneuver towards the bulk, notably when sentiment turns into overly one-sided. Analysts argue this dynamic makes the present 0.95 studying a contrarian bullish indicator, particularly as Bitcoin trades above $114,000.

The chart overlay reveals that previous lows within the ratio have ceaselessly aligned with native bottoms in Bitcoin’s worth, providing gas for hypothesis that one other rebound part may very well be forming.

With sentiment metrics at cycle lows and technical patterns pointing towards exhaustion in promoting stress, the Taker Purchase-Promote Ratio is as soon as once more flashing inexperienced – a reminder that in crypto markets, weak spot in futures positioning can typically precede the subsequent leg increased.

Supply hyperlink