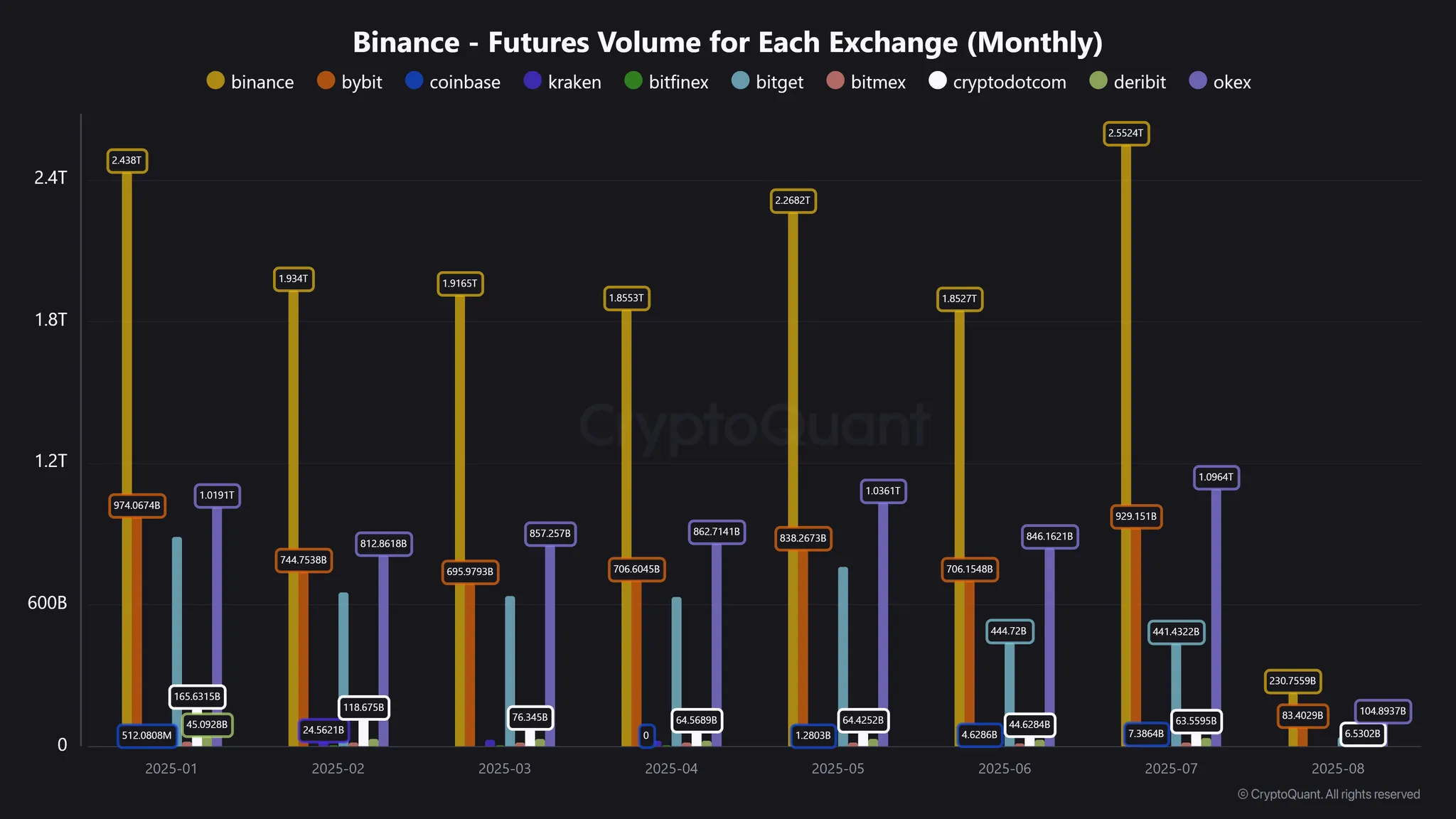

Binance has reasserted its dominance within the crypto derivatives market, recording $2.55 trillion in futures buying and selling quantity in July 2025 — its highest month-to-month whole since January.

In line with CryptoQuant information, this represents a pointy rebound in exercise, pushed by renewed volatility in each Bitcoin and altcoins.

The return of sturdy value swings seems to have reignited consumer engagement, with merchants turning to Binance for its unmatched liquidity and deep order books. July’s surge marks the platform’s seventh straight month as the worldwide chief in futures buying and selling, outpacing rivals like Bybit and OKX by a large margin.

Bybit logged $929 billion in quantity, whereas OKX posted $1.09 trillion, each sturdy numbers however nonetheless far under Binance’s tally. Binance alone accounted for greater than 50% of the whole month-to-month quantity throughout all main centralized futures exchanges, highlighting its central function within the present market cycle.

The spike comes amid a flurry of altcoin breakouts and Bitcoin’s current strikes towards the $115K resistance stage. Analysts recommend that institutional merchants and high-frequency bots are returning to the market as volatility and quantity rise, with Binance remaining the popular venue resulting from its choice of new listings and low latency infrastructure.

Wanting ahead, Binance’s efficiency could proceed to guide the sector if market volatility persists. The alternate’s fast onboarding of trending tokens and expansive leverage choices hold it enticing for merchants in search of short-term alternatives.

As August will get underway, buying and selling volumes are already exhibiting a dip from July’s peak, however Binance stays comfortably forward of its competitors. With momentum constructing in derivatives and spot markets alike, the platform’s lead seems safe for now — particularly if Bitcoin resumes its push towards a brand new all-time excessive.

Supply hyperlink