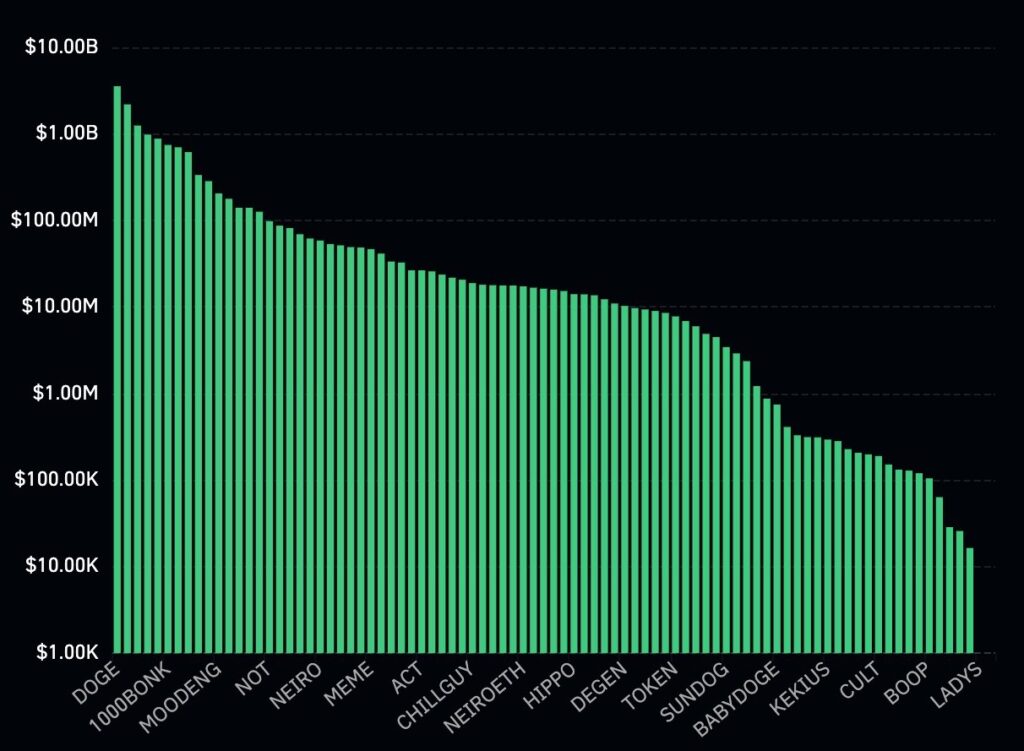

Dogecoin remains the largest meme coin by market value, but recent activity suggests it is no longer setting the pace. As Bitcoin edges upward and trading picks up again, Dogecoin has moved, but without the force seen in many small cap tokens. These low market cap crypto projects have posted strong rallies, often catching momentum even during sharp corrections.

Some of them have come from Telegram channels, some from creator communities, and others from joke tokens with sharp timing. What they share is quick rotation, high visibility, and room to move without much capital. For traders watching volatility return, that has become more important than brand recognition. The meme coin market is still loyal to Dogecoin in name, but in practice, attention is starting to change.

The Rise of Low Cap Meme Coins as Dogecoin Slows

Dogecoin has undoubtedly benefited from Bitcoin’s upward trend in recent months. Its liquidity remains strong, and large wallet holders continue to support the coin as a cultural staple. However, compared to newer tokens such as Fartcoin or community-driven ecosystems like Pudgy Penguins, Dogecoin’s relative performance has lacked the same excitement.

It is not that Dogecoin is failing, but rather that its size has become a double-edged sword. With billions already behind it, any significant move requires enormous capital inflows, which become harder to attract when lower market capitalization coins are offering higher percentage gains.

While Dogecoin leads the meme coin market in terms of volume traded, this cycle seems to be favoring the new entrants. Investors are increasingly willing to back projects that carry a sense of experimentation or novelty, especially when those tokens show strong momentum on social platforms and real traction in short-term trading patterns.

The success of Pudgy Penguins in bridging NFT culture with meme coin dynamics is just one example. Fartcoin, though comical in presentation, has built a visible on-chain footprint that attracts both humor-driven speculation and real-time volume.

This change seems to come from how meme coin investors now approach cycles. They are not only anticipating an altcoin season but are also actively preparing for what could be a concentrated period of meme coin mania. This outlook rewards tokens that are still in their early stages, where market cap ceilings are far away and a small amount of capital can move prices quickly.

Rather than waiting for Dogecoin to reignite, traders are looking at what could run next. Tokens that combine creative identity with active engagement are gaining trust as the next potential stars, and this is quietly reshaping the meme coin hierarchy.

Are Low Cap Projects the Best Meme Coins to Buy Now?

Meme coins that combine strong visual identity, community focus, and low entry prices are gaining traction. Many of these are in their early phases, with presales or small listings that offer real upside potential. Here are some of the most talked-about projects right now that fit this format and remain early enough to matter.

Snorter

Snorter introduces itself as a meme coin, but the project has been built with more intention than its name may suggest. It runs as a Telegram-based bot that offers trading utilities directly within chat environments. This setup mirrors how many low or micro cap traders already operate, moving between chats, early token links, and alerts. Snorter does not try to change that behavior. Instead, it works within it.

What makes this format relevant now is the timing. As Bitcoin steadies after its recent climb, smaller tokens with functional edges are gaining more attention. Traders are watching for signs of renewed movement in meme coins, and Snorter offers a setup that already has tools in place. That adds a layer of value beyond price action alone.

The project is still in its early market phase. Token exposure remains limited, and the presale round has kept the initial price low. That leaves space for entry before wider visibility arrives. It also places the token at a point where organic movement is still possible without requiring large capital flows.

Having gained demand from a wide audience already, the project has made its way to videos of top crypto channels like 99Bitcoins and more already.

Snorter keeps its identity consistent. The aardvark mascot is used across updates and posts, maintaining a steady tone without shifting direction. The humor remains, but the product works.

For a market currently focused on early entries, creative design, and strong community environments, Snorter sits close to that intersection. It does not need to reinvent the category. It simply needs to keep doing what it already does while attention rotates back to this part of the market.

Maxi Doge

Maxi Doge is centered around a singular visual and personality. The character is a trading-obsessed version of Doge, always in motion, often shown mid-chart or lifting weights. Everything produced by the project follows this theme.

The design is deliberate and carries through all touchpoints, which helps it stay familiar even to newer users. That kind of consistency is not often seen in early-stage meme coins, where tone and presentation usually shift quickly.

Its presale raised a notable sum of more than $180k with very little lead-in. Instead of extended marketing or excessive buildup, Maxi Doge was introduced with a focused rollout. The token remains in an early phase. Pricing has stayed near the initial range, and exposure is still limited. This keeps it within reach for traders looking for low-cost entries with visual clarity and active messaging.

There is no claim of advanced features or future use layers. The project is shaped around the character itself, and all activity flows through that format. In current conditions, where Dogecoin’s pace has slowed and smaller tokens are beginning to see stronger moves, this simplicity works. It reflects what meme coin buyers often prefer during early rotation periods.

Maxi Doge does not rely on new mechanics. It holds ground by staying focused. The market is not short on meme coins, but it is short on ones that maintain direction. As attention begins shifting to lower-cap tokens with clean structure and early traction, Maxi Doge is positioned to stay visible without needing to change.

TOKEN6900

TOKEN6900 is not styled to be taken too seriously, but it has found footing among early traders looking for simple structures and open movement. The name is part of its identity, and the project leans into that rather than trying to overcorrect or reframe it. This works for the audience it attracts, which is primarily made up of early-cycle traders and participants in meme coin groups that focus on low market cap entries.

At present, the token is still at the presale and discovery stage. There are no major listings, and pricing remains at the earliest level. That gives it the quality many traders look for when scanning options ahead of wider rotation. With Bitcoin gaining ground and Dogecoin holding its range without sharp movement, attention is naturally pointing toward tokens that can respond faster and do not require significant inflows to move.

The team has not promised features that do not exist. The token does not carry complex roadmaps or speculative partnerships. What it offers is pace, clarity, and familiarity. Its updates have been regular, its design has remained the same, and its content is shaped to suit the kind of online spaces where meme coin activity tends to build.

TOKEN6900 has not been overreached. It has simply entered quietly and remained consistent. For traders waiting for a reacceleration of meme coin activity, projects that are still in early stages with clear tone and unrestricted upside are now drawing the most attention. This one fits that profile cleanly.

Bitcoin Hyper

Bitcoin Hyper takes a familiar reference point and recasts it through a lighter format. While the name draws from Bitcoin, the project itself does not attempt to replicate its function or narrative.

Instead, it builds a meme coin that uses Bitcoin’s cultural weight as a backdrop, while focusing on early-stage token dynamics, fast movement, and thematic consistency. The visuals and tone are straightforward. They are styled around energy, speed, and clean presentation.

The project is still in its earliest phase. Most of the exposure so far has come from presale activity and small group discussions. That places it at the edge of discovery, which is often where strong meme coin entries are made.

There are no wide listings yet, and the token supply has been kept compact to allow easier price movement during early stages. This makes it relevant for traders who are currently shifting their attention from large caps to unlisted or low-profile meme coins.

Bitcoin Hyper does not suggest long-term integration or extended development paths. It focuses on rhythm and timing, with activity built around what can work in the short to mid term.

As Bitcoin’s movement resets the tone of the market and lower cap coins begin to draw speculative volume, meme coins with early-stage structures and clear identity are being tracked more closely.

Having raised $6 million, Bitcoin Hyper falls into that category too. It is still early, but its format is visible enough to be recognized by traders preparing for the next run of meme coin activity.

Conclusion

While larger names continue to hold symbolic relevance, their movement has slowed in comparison to smaller, more agile projects. This change has not come from sentiment alone. It reflects how traders are now approaching cycles. Not through familiarity, but through access, speed, and early structure. As Bitcoin strengthens and liquidity starts to circulate beyond the top tier, there is growing interest in tokens that have not yet exhausted their runway.

The current phase rewards visibility and direction, not just recognition. Projects that maintain a consistent format, engage clearly, and still remain early in their distribution are now being treated as more than speculative side bets. They are becoming the first stop for capital rotation within a segment that has always moved faster than the rest of the market.