Avalanche (AVAX), one of many main layer-1 blockchain platforms, is drawing consideration with its spectacular month-to-month energetic pockets development.

Nevertheless, regardless of the explosion in energetic addresses, AVAX’s value stays worryingly low. It has dropped over 60% for the reason that finish of 2024 and is now buying and selling at 2021 ranges. This raises an essential query: Is Avalanche being undervalued by the market, or is that this an indication of deeper challenges?

Why is Avalanche’s On-chain Exercise Hovering?

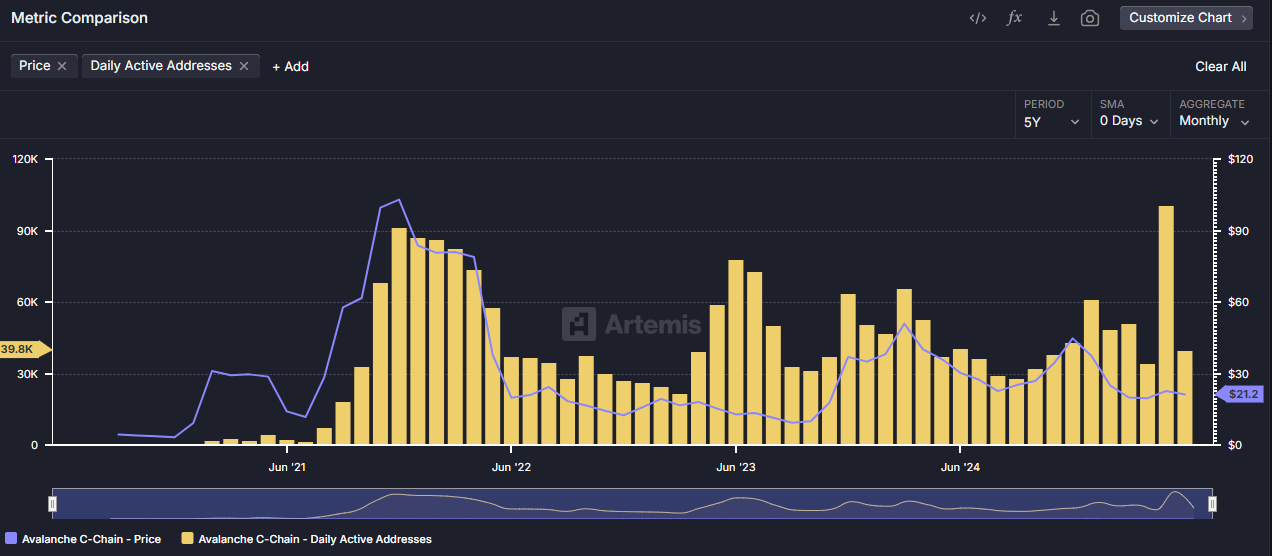

In accordance with knowledge from Artemis, the variety of day by day energetic wallets on the Avalanche C-Chain just lately surged previous 100,000. This determine even surpasses the quantity recorded when AVAX reached its all-time excessive of over $147 on the finish of 2021.

As well as, Token Terminal knowledge reveals that month-to-month energetic wallets on Avalanche jumped from under 500,000 to 2.2 million in only one month.

It is a constructive sign. It reveals rising curiosity from customers and builders within the Avalanche ecosystem. Market observer Wu Blockchain attributed this enhance in exercise to institutional consideration.

“This surge is probably going pushed by the launch of the blockchain recreation MapleStory Universe. In the meantime, BlackRock’s tokenized short-term US Treasury product, sBUIDL, has been adopted as collateral on the Avalanche-based Euler protocol,” Wu Blockchain defined.

Nevertheless, Avalanche faces a paradox. On-chain exercise appears disconnected from AVAX’s market sentiment. The token remains to be priced round $21, over 60% under its late-2024 excessive.

This discrepancy has led some analysts to imagine it could be a great time to build up AVAX.

Crypto investor Crypto Pirates predicts that AVAX has entered a requirement zone and will rebound in June.

“AVAX tapped into my day by day demand degree. From right here, we are able to plan longs all the best way to the weak excessive,” Crypto Pirates stated.

Wanting on the larger image, investor Hasan believes AVAX is now inside a historic demand zone based mostly on its four-year value historical past. Though future volatility stays unsure, Hasan suggests this can be a time to look at and take into account long-term accumulation.

“Efficiency hasn’t been nice but. It rose from $14 to $27 just lately. Proper now, it appears to be attracting demand across the $16 vary. If BTC corrects in June, AVAX may revisit this space. These pondering of investing would possibly wish to wait and reassess if the value returns to that degree,” Hasan commented.

Regardless of a number of constructive developments round AVAX final month, investor sentiment has been dampened by the SEC’s delay of the AVAX ETF software. This has stalled any important value breakout. Moreover, the broader altcoin market remains to be sluggish, as Bitcoin dominance stays excessive at over 63%.

For now, AVAX buyers might have to attend for an actual convergence of sturdy fundamentals and a extra favorable altcoin market atmosphere to appreciate substantial returns sooner or later.

The put up Avalanche On-chain Exercise Explodes—But AVAX Trades Like It’s Nonetheless 2021 appeared first on BeInCrypto.

Supply hyperlink