Aave and Uniswap protocols not too long ago created new information amid indicators of a restoration within the cryptocurrency market.

File-breaking achievements by Aave and Uniswap amid a recovering crypto market increase the query: Are we witnessing the beginning of a brand new DeFi growth, or is that this only a short-term surge?

Whale Exercise Alerts Confidence in Aave

With Ethereum (ETH) surpassing $2,500, a key milestone in a risky crypto market, whale exercise on Aave and milestones from Uniswap paint an image of the decentralized finance (DeFi) ecosystem.

A pockets linked to WLFI not too long ago deposited 50 WBTC into Aave V3 and borrowed 400 million USDC to buy 1,590 WETH at a mean worth of $2,515. This pockets now holds belongings price $15.11 million, together with 3,924 WETH ($9.91 million) and 50 WBTC ($5.19 million). It has a wholesome place on Aave (Well being Charge of two.0), reflecting confidence in ETH’s upside potential.

On the identical day, a whale named nemorino.eth purchased 3,088 WETH at a mean worth of $2,488, securing an unrealized revenue of roughly $124,000. This reinforces bullish sentiment round ETH as giant buyers accumulate close to the $2,500 degree. Nonetheless, not all whales are optimistic.

On Might 12, 2025, EmberCN reported {that a} whale borrowed 5,000 ETH from Aave in 50 minutes and shorted it at $2,491, highlighting divergent funding methods.

Is DeFi Poised for a Increase?

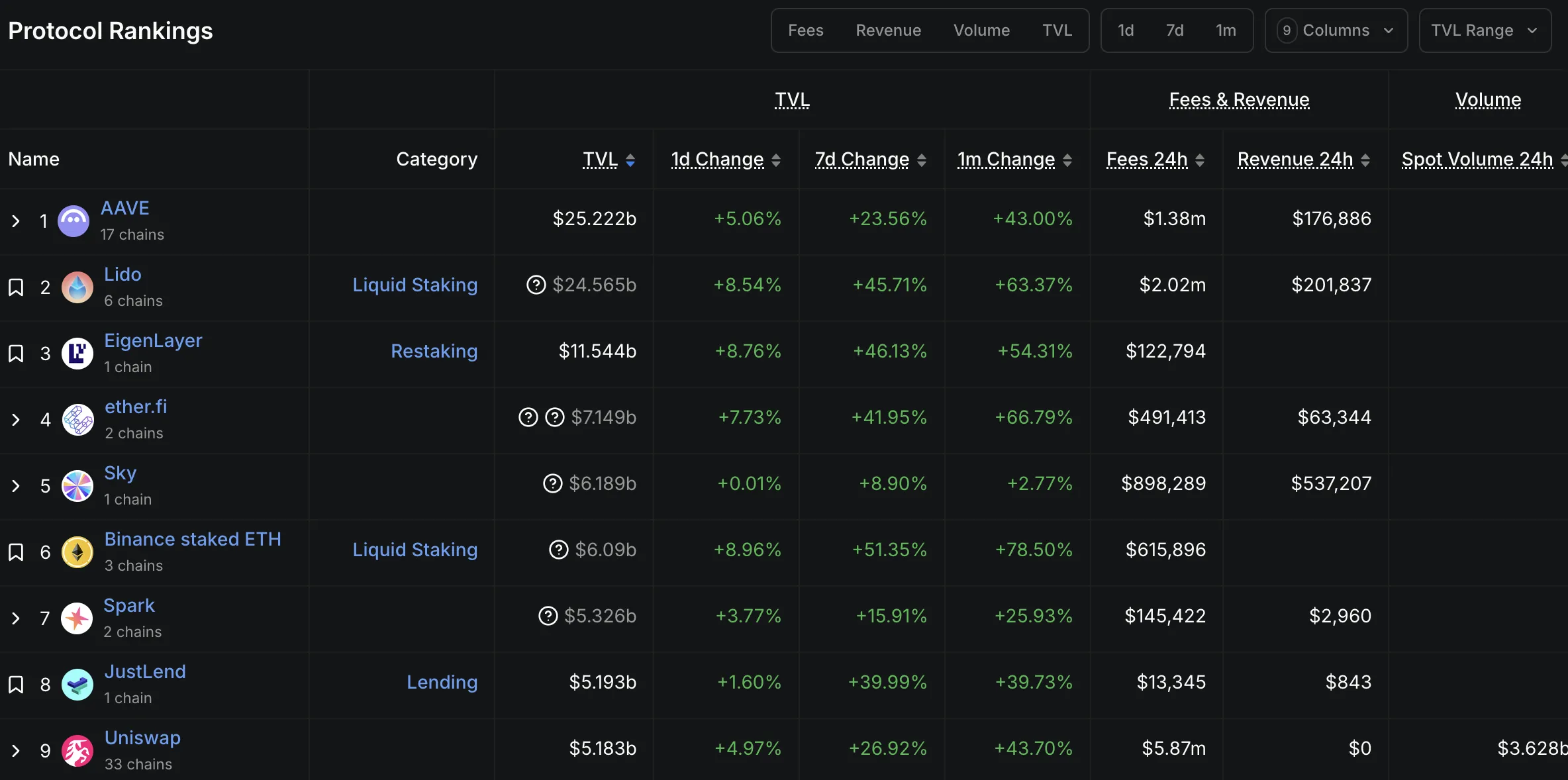

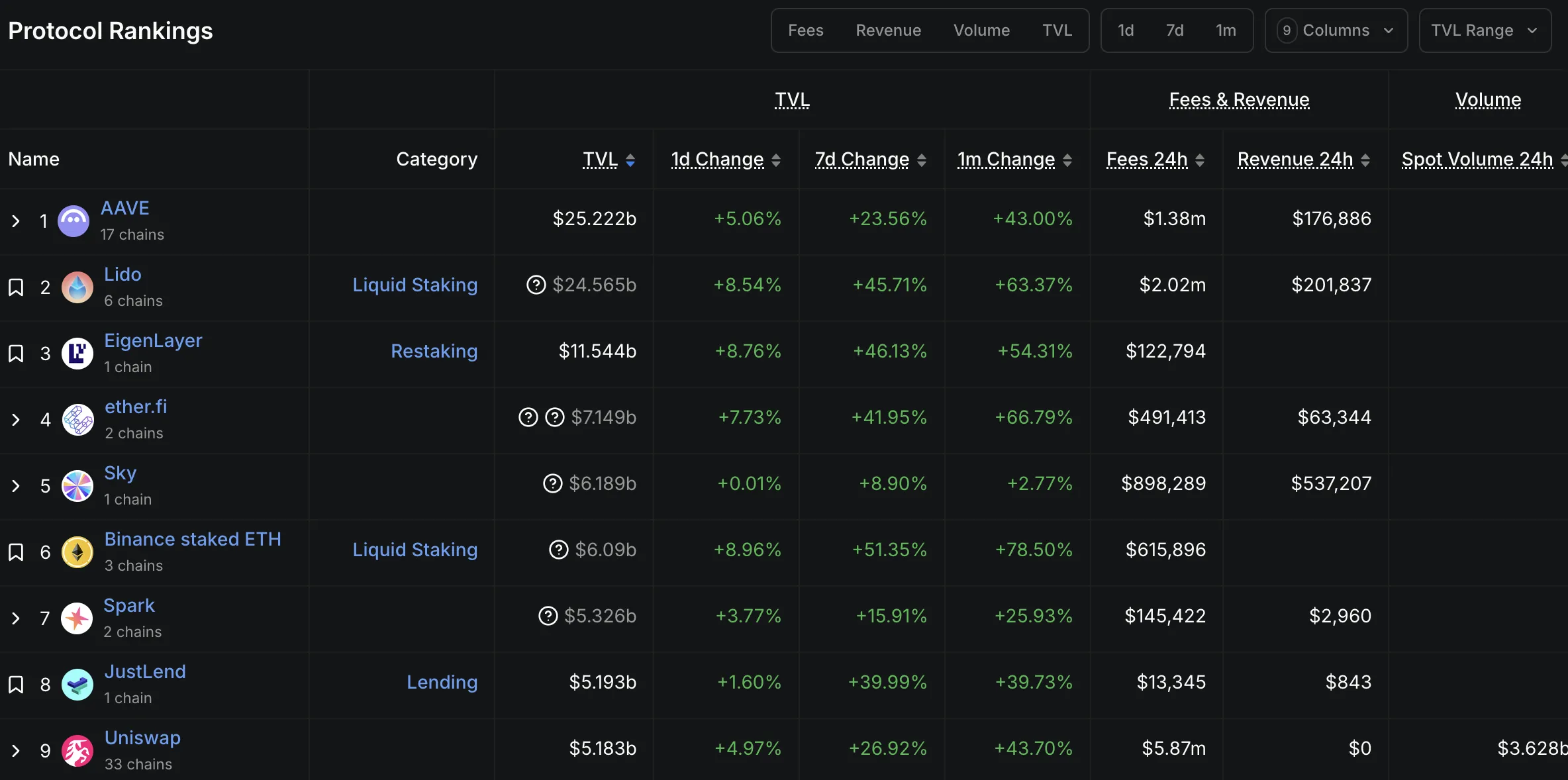

The surge in whale exercise on Aave aligns with outstanding DeFi milestones. Aave’s founder, Stani Kulechov, introduced on Might 11, 2025, that Aave reached a file Complete Worth Locked (TVL) of $25 billion, making it one of many largest DeFi protocols.

In accordance with DeFiLlama knowledge from Might 14, 2025, Aave accounts for over 21% of the DeFi market’s TVL, surpassing rivals like Lido (LDO) and EigenLayer (EIGEN). This development is essentially pushed by giant buyers depositing substantial belongings into the protocol.

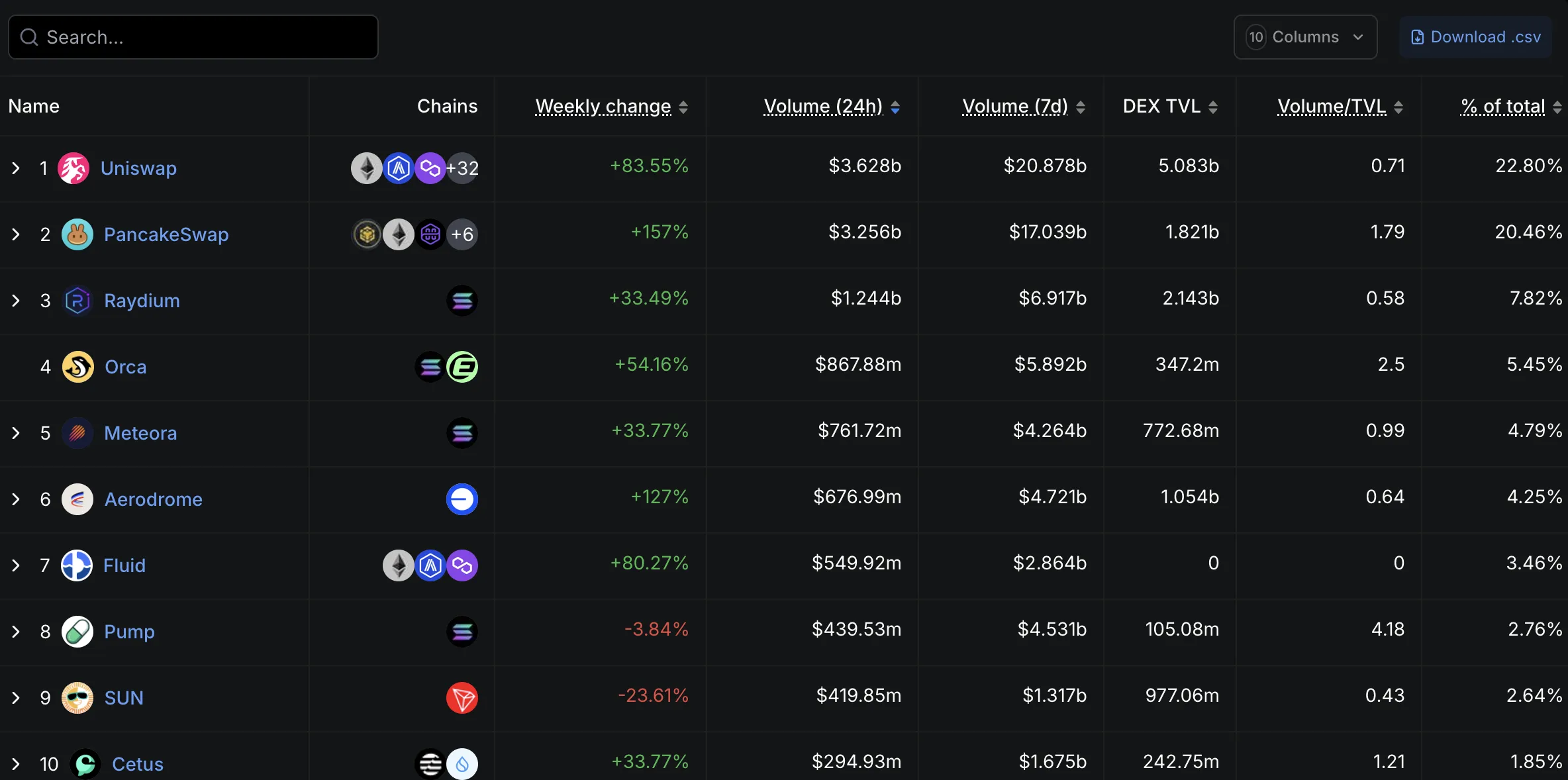

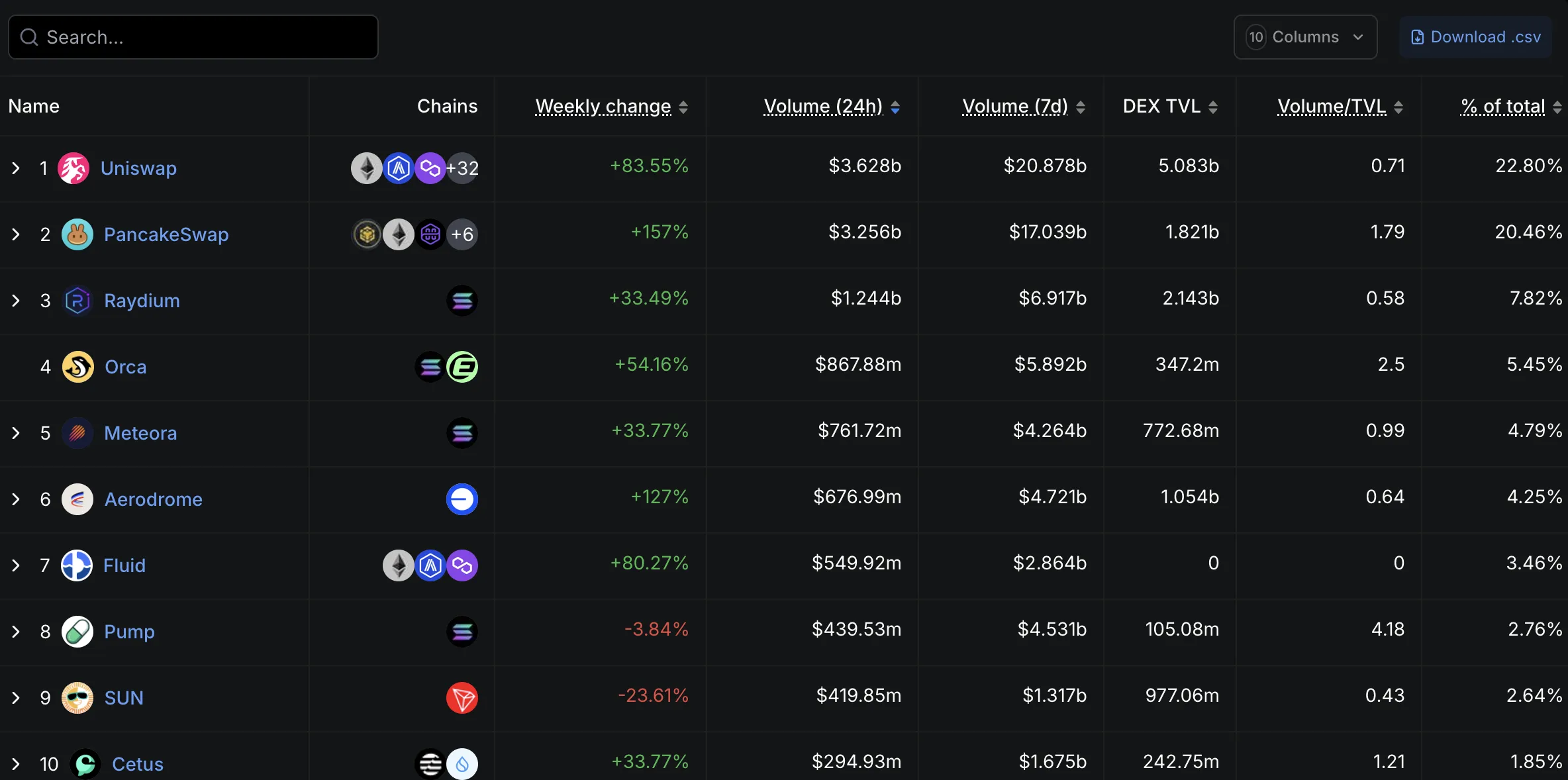

In the meantime, Uniswap, a number one decentralized alternate (DEX), achieved a historic milestone. On Might 12, 2025, Uniswap reported that its all-time buying and selling quantity surpassed $3 trillion, displaying DeFi’s enchantment.

DefilLama knowledge from Might 14, 2025, exhibits that Uniswap processes over $3.6 billion in transactions in 24 hours, capturing 24% of world DEX buying and selling quantity and solidifying its dominance.

These milestones from Aave and Uniswap replicate DeFi’s development and a shift of capital from conventional finance to decentralized protocols.

Implications of Whale Actions and DeFi Development

These developments carry vital implications for ETH and the DeFi ecosystem. Lively whale participation on Aave alerts a powerful perception in ETH, notably as its worth exceeds $2,500. This optimism helps the broader DeFi narrative.

Aave’s $25 billion TVL highlights its function in offering liquidity and supporting complicated funding methods. Equally, Uniswap’s $3 trillion buying and selling quantity exhibits the recognition of DEXs, enabling direct, intermediary-free buying and selling that reduces prices and enhances transparency.

The DeFi growth might propel ETH’s long-term development. The worth surpassing $2,500, coupled with whale exercise, signifies DeFi is changing into a cornerstone of Ethereum’s ecosystem.

The rise of Aave and Uniswap, fueled by file TVL and buying and selling volumes, alongside vital whale exercise, suggests DeFi is coming into a brand new development part. Whereas short-term market fluctuations stay doable, these protocols’ rising institutional curiosity and powerful fundamentals level to a sustained DeFi growth, with Ethereum at its core. Nonetheless, buyers ought to monitor market motion and whale methods, as divergent approaches sign potential volatility.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.