Bitcoin stays solely marginally constructive year-to-date, suggesting 2025 has been a interval of consolidation because the asset stabilizes across the $100,000 degree.

A lot of the latest value weak spot seems linked to beforehand dormant cash re-entering circulation, per onchain information.

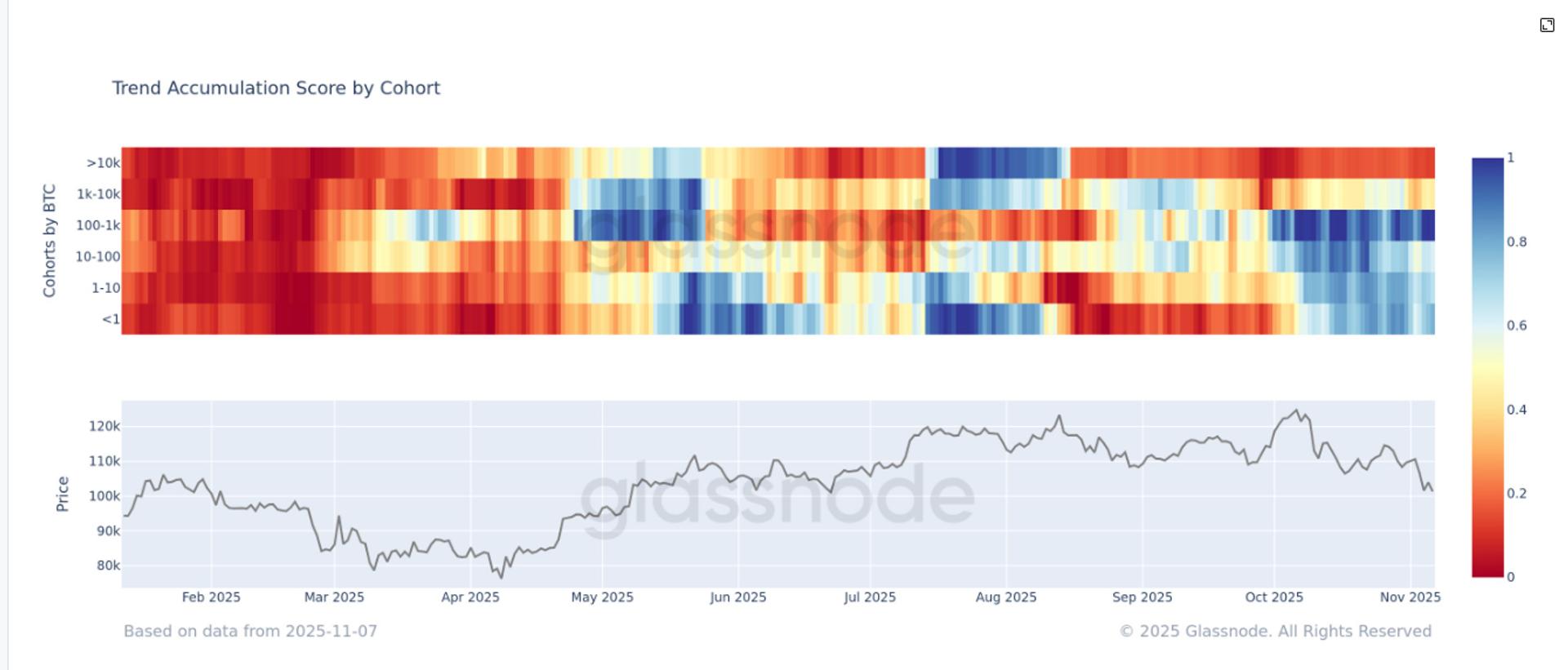

Massive holders, generally generally known as whales, have been the first distributors, driving the present downward stress on value, in response to The Accumulation Development Rating (ATS) by Glassnode.

ATS measures the relative accumulation or distribution conduct throughout completely different pockets cohorts, accounting for each the scale of entities and the quantity of cash they’ve acquired over the previous 15 days.

- A worth close to 1 means that individuals in that cohort are actively accumulating.

- A worth close to 0 signifies that they’re distributing holdings.

- Exchanges, miners, and sure different entities are excluded from the calculation.

Whales holding over 10,000 BTC have been constant sellers since August, marking three months of sustained distribution. In the meantime, wallets within the 1,000–10,000 BTC vary stay impartial round a rating of 0.5, whereas all smaller cohorts (beneath 1,000 BTC) are firmly in accumulation mode, in response to Glassnode information.

Whereas within the first 4 months of the 12 months, all cohorts had been in deep distribution, which contributed to bitcoin’s 30% decline to $76,000 in April in the course of the so-called tariff tantrum.

This information highlights a transparent divide between whales and the remainder of the market individuals and for now, it seems the whales are nonetheless steering the worth motion.

Supply hyperlink