- On-chain metrics: Actual exercise

- Not but for worth

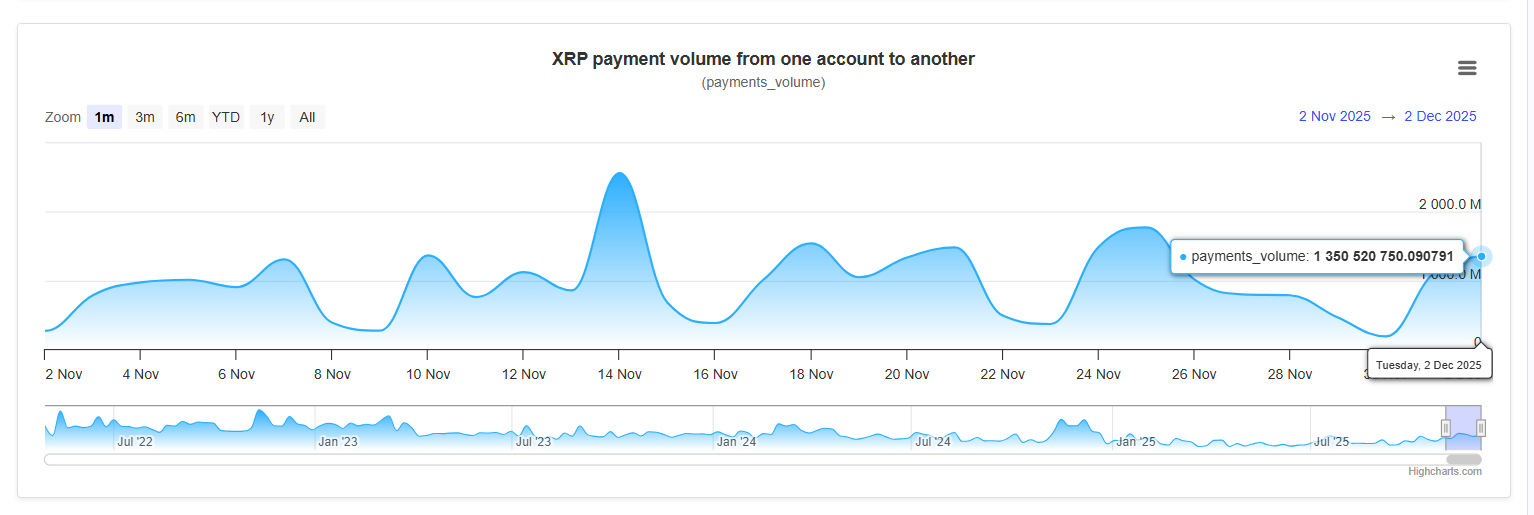

With fee quantity surging by virtually 10x over its baseline earlier within the cycle, the latest XRP Ledger metrics point out one of many strongest on-chain expansions the community has witnessed in months. The metric jumped to 1.35 billion XRP transferred in a single day, marking a surge far above the everyday 150-200 million vary seen by November.

What this development truly means, and whether or not it impacts XRP’s worth — which continues to be struggling inside a clearly outlined declining channel — are the questions.

On-chain metrics: Actual exercise

By November, the payment-volume chart shows a really regular improve that ends in a virtually vertical spike. The sample, which might be associated to institutional settlement, liquidity routing or automated high-volume flows throughout exchanges and custodial companies, signifies widespread community utilization moderately than a single remoted whale.

Such a regular rise in XRPL throughput has traditionally preceded XRP market liquidity expansions, although worth appreciation has not all the time occurred immediately. One other essential level: the bounce is accompanied by rising volatility within the payment-count chart, which means the community is not only transferring bigger sums —extra customers and extra accounts are collaborating. That’s often a stronger long-term bullish sign than easy quantity spikes.

Not but for worth

The XRP chart continues to be extraordinarily pessimistic regardless of the on-chain energy. As soon as extra, the value rejected the descending-channel midline and was unable to take care of momentum above about $2.15. Promoting stress hit instantly afterward, dragging XRP again towards the decrease boundary of the sample.

The EMAs reinforce the story:

- 50 EMA is under 100 EMA (mini-death cross not too long ago verified).

- Value under all main transferring averages.

- RSI is barely sustaining its mid-40s, momentum is missing.

Brief-term worth volatility persists. Falling out of the channel once more would open the door to $1.90-$2.00. However within the medium time period, the community’s exercise spike is significant; networks not often increase this aggressively with out ultimately pulling the asset upward.

Supply hyperlink