Information reveals the Ethereum Open Curiosity has shot up by greater than 4% following the sharp transfer down within the cryptocurrency’s worth.

Ethereum Has Seen A Pullback Over The Previous Day

The cryptocurrency sector as an entire has witnessed a plunge to kick off the brand new month, with Bitcoin and Ethereum each being down by greater than 5% during the last 24 hours. ETH is again within the low $2,800 ranges, having primarily retraced the restoration that it had made over the last week of November.

The sudden worth decline has unleashed a wave of liquidations on the derivatives exchanges, resulting in $158 million in Ethereum-related contracts being flushed. Of those, $140 million of the liquidations concerned lengthy positions alone.

Under is a heatmap from CoinGlass that breaks down the liquidation numbers associated to the varied digital asset symbols.

Apparently, whereas notable liquidations have occurred, derivatives buyers nonetheless haven’t change into discouraged.

ETH Open Curiosity Has Gone Up Since The Dip

As identified by CryptoQuant neighborhood analyst Maartunn in an X submit, the Ethereum Open Curiosity has witnessed a pointy leap following the value decline. The “Open Curiosity” right here refers to an indicator that measures the overall quantity of positions associated to ETH which can be presently open on all centralized derivatives platforms.

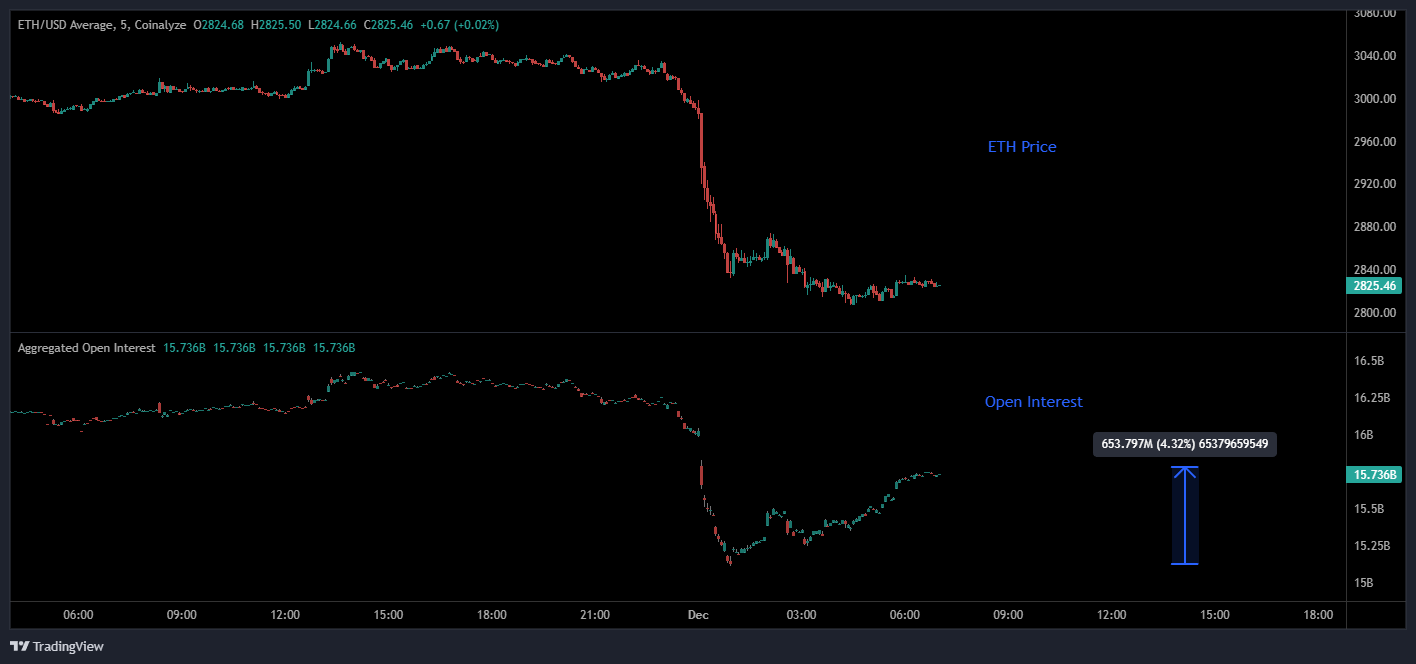

Right here is the chart shared by Maartunn that reveals the development on this metric over the previous couple of days:

As displayed within the above graph, the Ethereum Open Curiosity initially collapsed alongside the value drop as lengthy positions suffered forceful closures. As ETH’s bearish momentum tapered off and the value settled right into a sideways rhythm, nevertheless, the metric noticed a gradual reversal in path, indicating that speculators have began opening up recent positions.

For the reason that dip, the ETH Open Curiosity has gone up by virtually $654 million, equal to a rise of 4.3%. “Appears to be like just like the gamblers are again for one more spherical,” famous the analyst.

Traditionally, a excessive worth on the metric has typically been one thing that has led to volatility for the cryptocurrency. It is because an excessive quantity of positions implies the presence of a excessive quantity of leverage within the sector. In these situations, any sharp swing within the asset can induce numerous liquidations out there. These liquidations solely feed again into the value transfer that prompted them, making it extra intense.

An instance of this sample was already seen in the course of the previous day. With the Ethereum Open Curiosity now rising once more, it stays to be seen whether or not extra volatility will comply with.

Supply hyperlink