Be a part of Our Telegram channel to remain updated on breaking information protection

YZY MONEY, a token linked with rapper Kanye West (aka Ye), briefly hit a $3 billion market cap earlier than crashing, OKB surged 50% after a token burn, and BNB climbed 3% to set a brand new all-time excessive at $881 earlier than easing to $859.

In the meantime, an historic whale shifted 400 BTC into Ethereum, with BTC hovering close to $113 and ETH at $4,299 as of 4:41 a.m. EST.

The largest losers on an upbeat day have been Mantle (MNT), Lido (LDO), and SPX6900 (SPX), recording 6.2%, 3%, and three% drops, respectively.

Kanye West-Linked YZY MONEY Token Crashes Submit-Launch

YZY MONEY turned a sensation on the Solana blockchain after it rapidly soared to a $3 billion market capitalization, solely to crash quickly after. Inside hours, YZY misplaced over 55% of its worth as giant buyers bought off.

After the drop to a market capitalization of round $150 million, one dealer misplaced $500,000.

somebody misplaced $ 500K by shopping for Kanye west $yzy token at $1.56 and promoting at $1.05 pic.twitter.com/GEVsANy5Kj

— Zoe🔶 (@queencryptooo) August 21, 2025

There’s hypothesis on social media over attainable insider manipulation, with reviews of huge holders cashing out on the high. Merchants have additionally been hit by an absence of transparency, which shook investor confidence, inflicting many to promote.

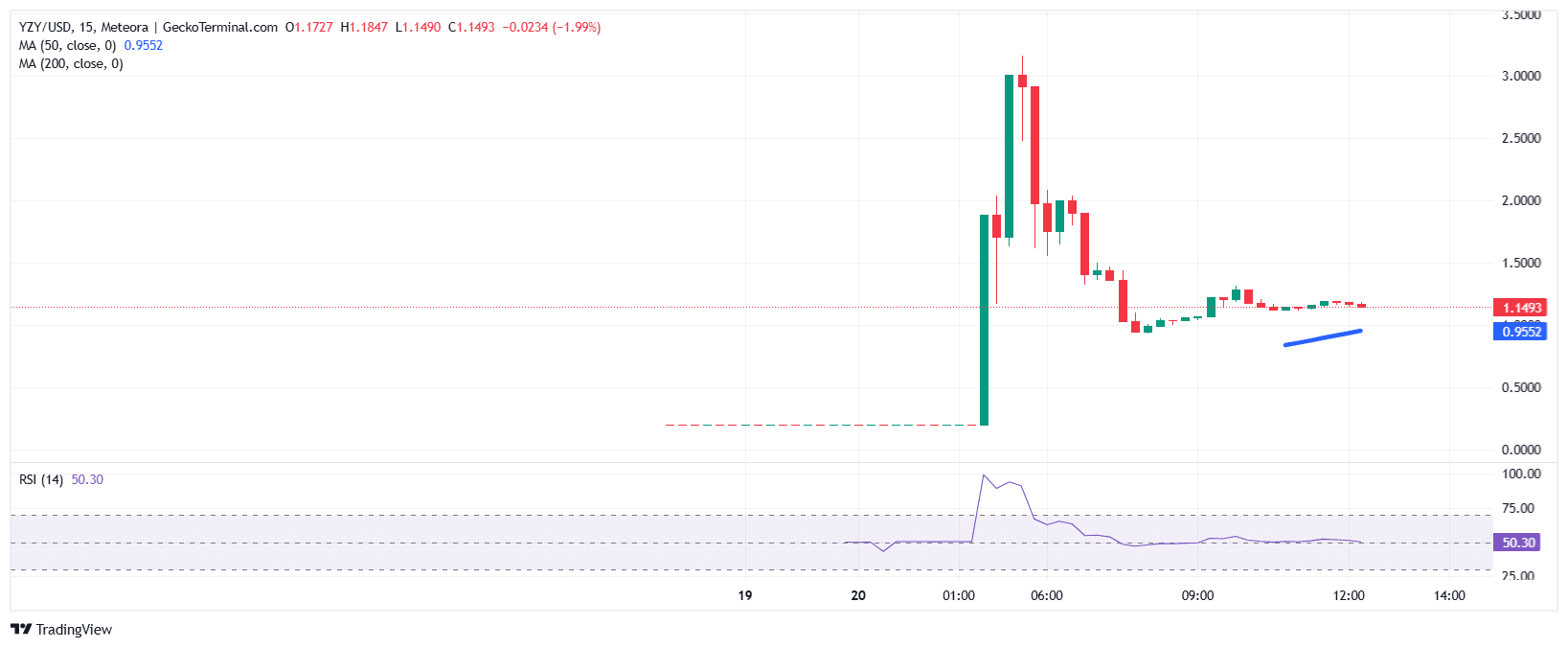

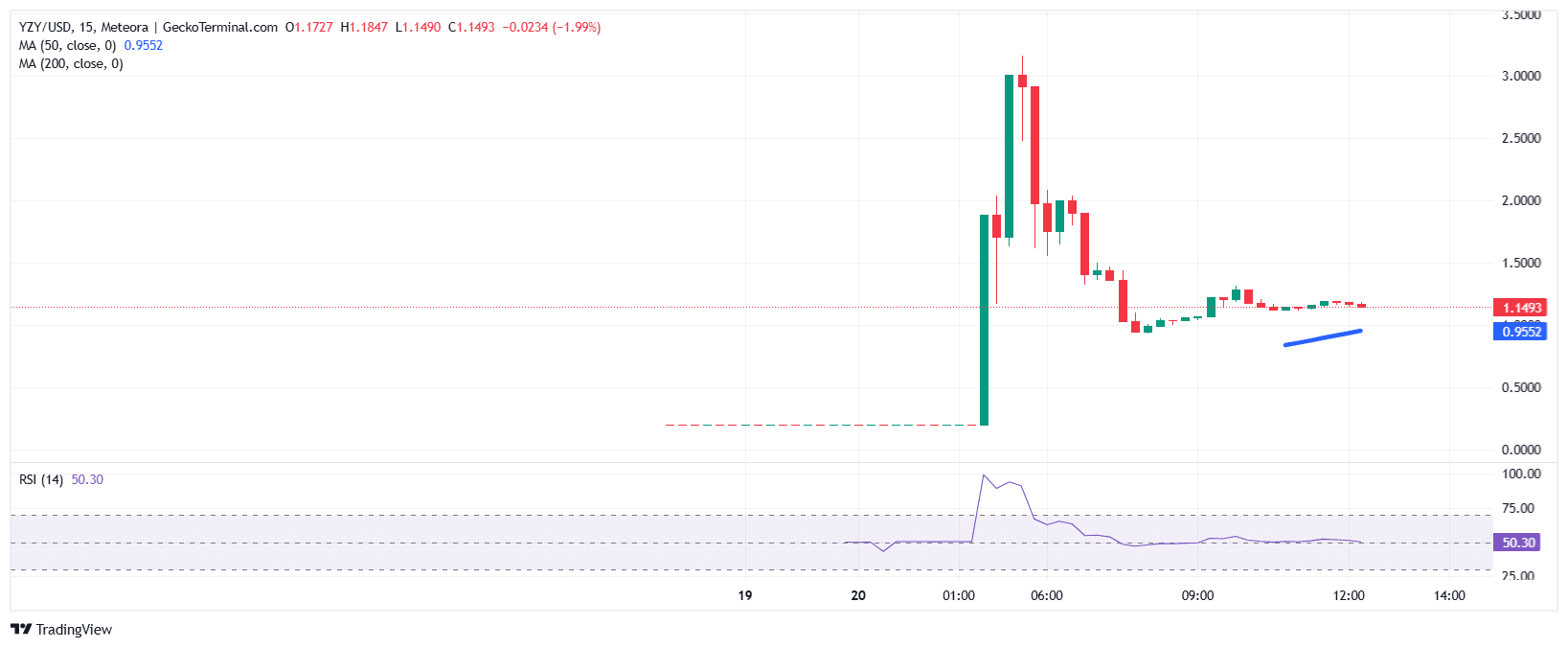

YZY on the 15-minute chart suggests a attainable restoration, with help round $1.0 holding agency after the crash. If Kanye West confirms his involvement, the joy might reignite, however many on social media consider his X account might have been hacked to advertise the token.

With the 50-period transferring common just under the worth of YZY, and the RSI simply transferring throughout the equilibrium degree, any motion up might renew curiosity for the bulls.

OKB Leads Gainers With A 50% Surge

The crypto market has surged a fraction of a % to succeed in a market capitalization of $3.94 trillion.

OKB (OKB) led gainers amongst main cryptos on CoinMarketCap after hovering 50% within the final 24 hours to commerce at $189.2. Different high gainers embrace Morpho (MORPHO), Conflux (CFX), and Tezos (XTZ), surging 13%, 6.5%, and 6%, respectively.

The OKB surge got here after the crew burned 65 million tokens to scale back provide to only 21 million, whereas additionally launching the X Layer blockchain. That elevated shortage and utility, serving to to draw extra buyers.

9/ Conclusion

$OKB’s rally is fueled by provide burns, rising buying and selling volumes, and OKX’s world growth. With change tokens making a comeback narrative on this altseason, OKB stands out as one of many strongest contenders 🚀📈#OKB #OKX #Crypto #Altseason

— LazyBear Crypto (@LazybearOFC) August 20, 2025

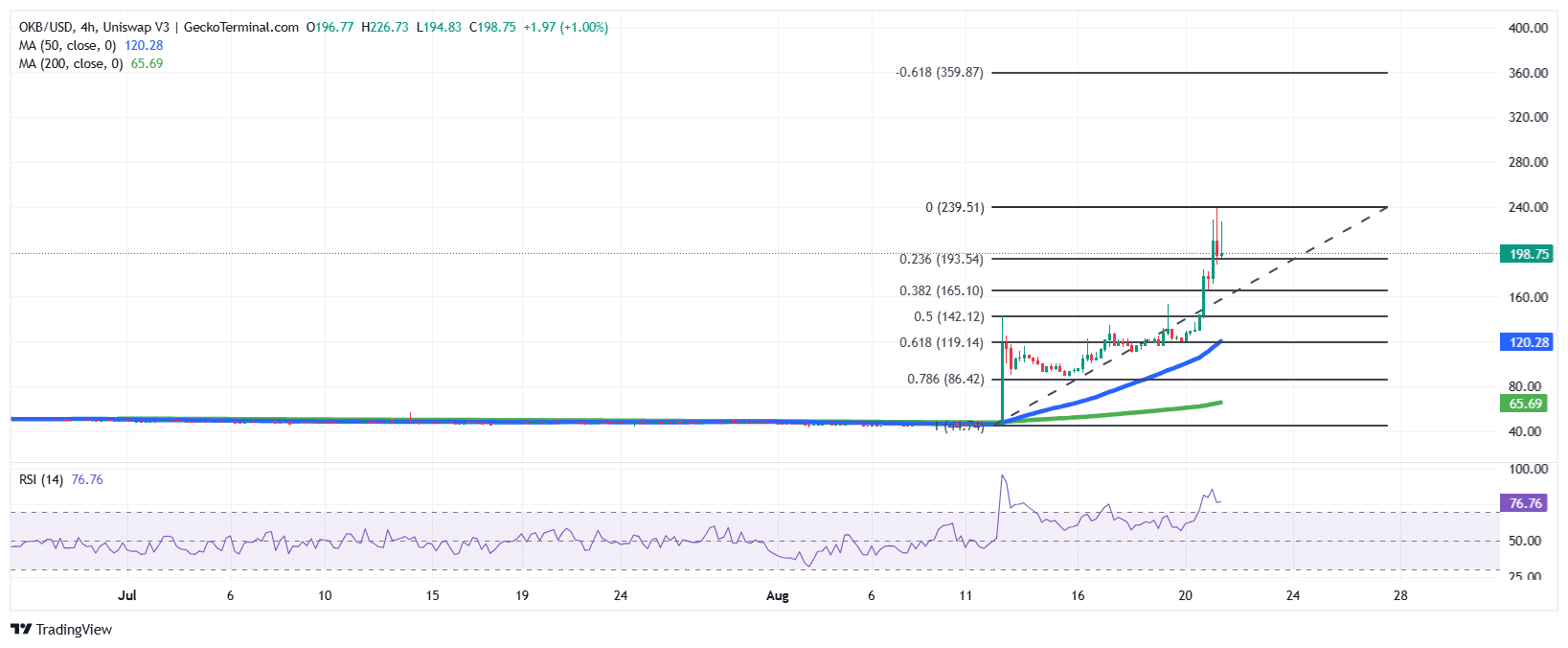

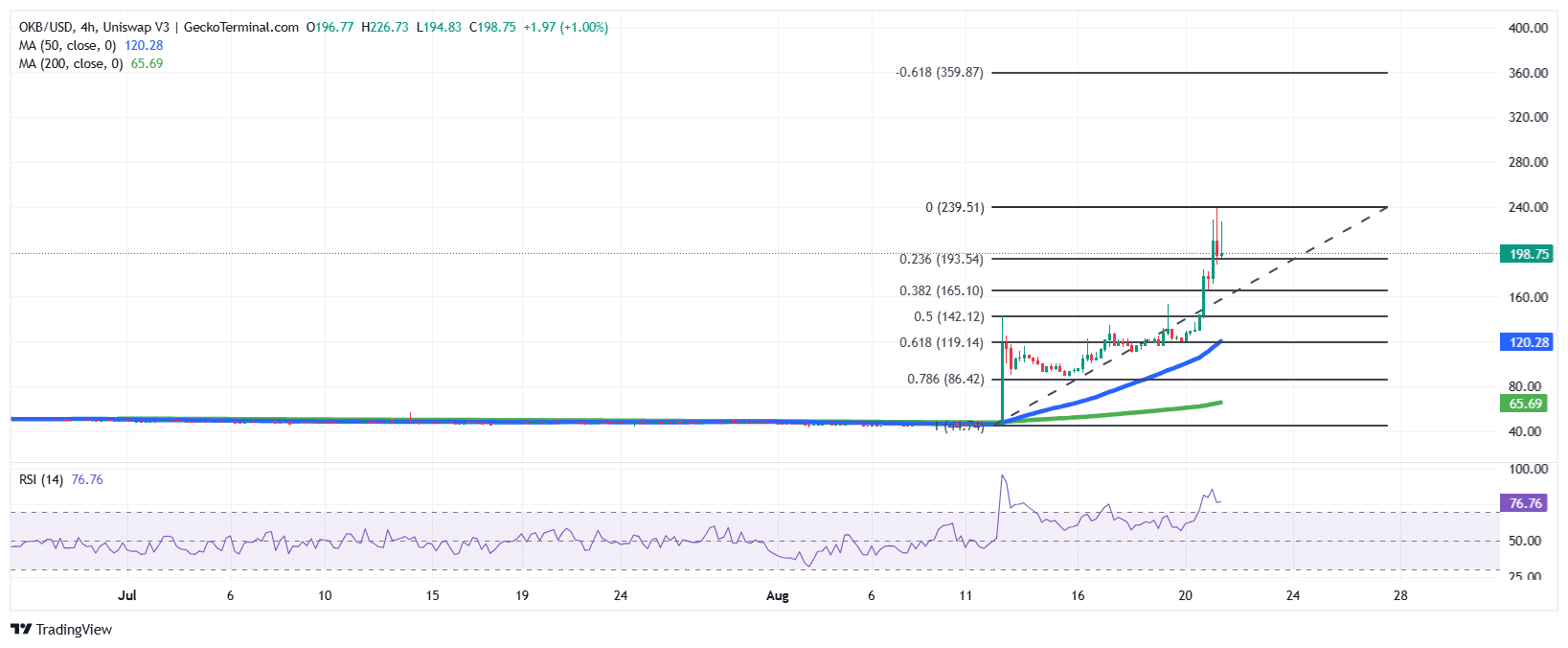

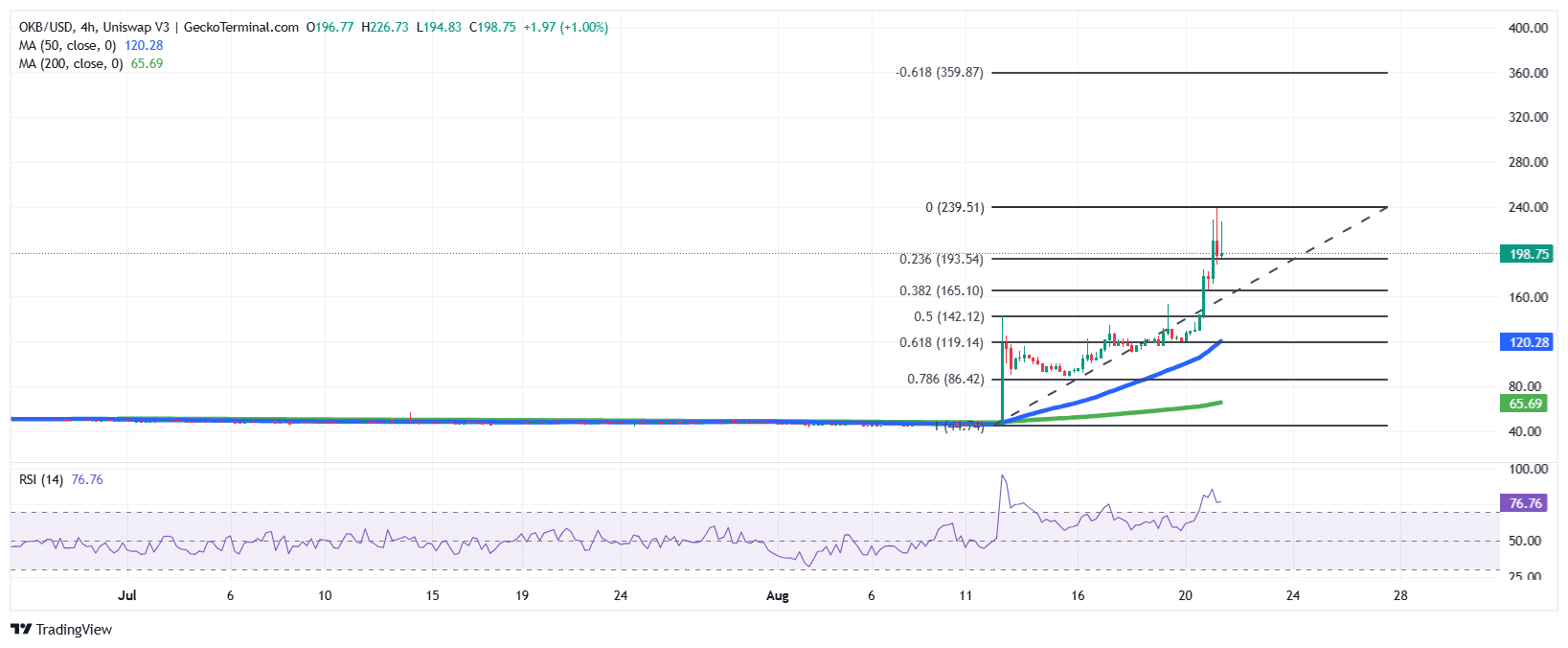

The surge has pushed OKB to interrupt above a number of Fibonacci ranges, with a current rejection close to $239 suggesting short-term resistance, whereas the general pattern stays strongly bullish.

In the meantime, the 50-day Easy Transferring Common (SMA) and 200-day SMA on the 4-hour chart are sloping upward, confirming momentum, however the RSI at 76.76 indicators overbought situations that would set off a pullback.

If patrons maintain momentum, the worth might retest $239 and doubtlessly purpose for $360, whereas help lies round $165 and $142 if a correction happens.

Binance Token BNB Hits A New ATH

BNB added 3% to its worth and hit a brand new all-time excessive, pushing its market cap to $118.6 billion.

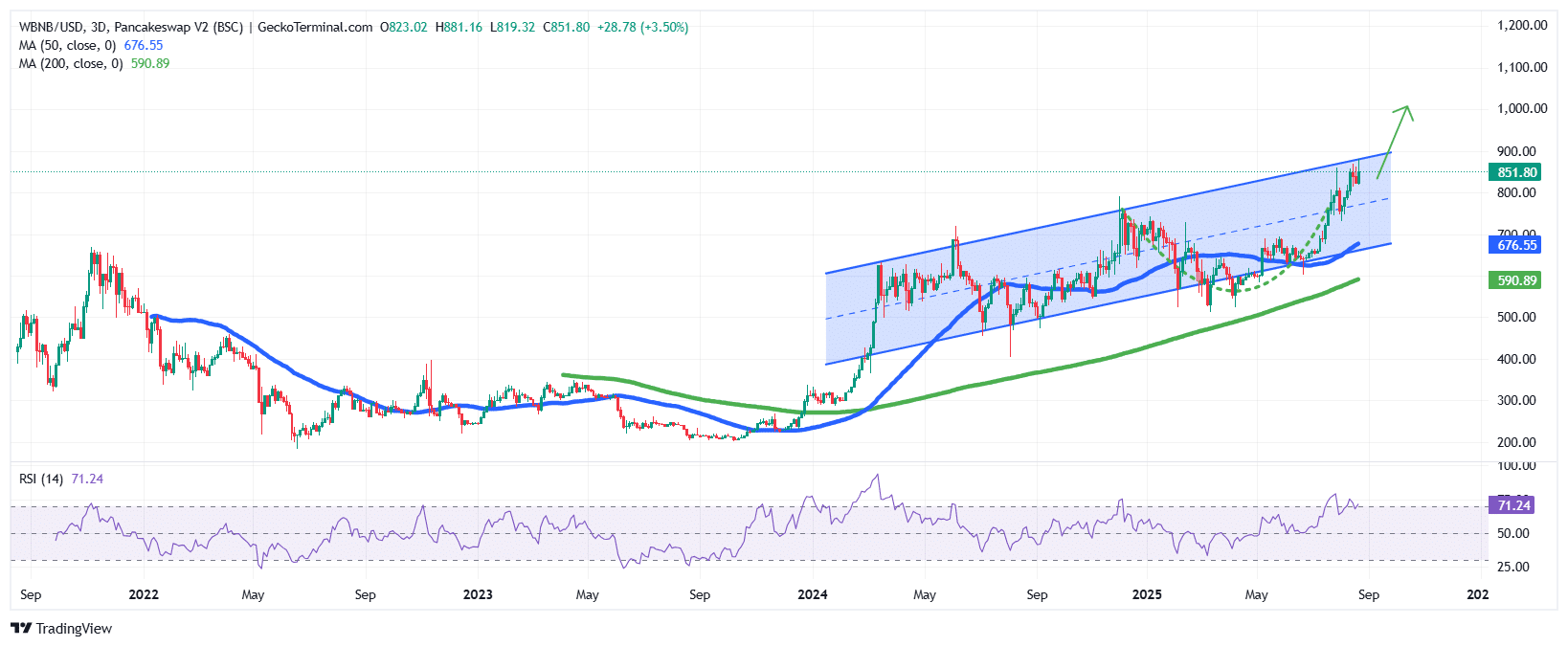

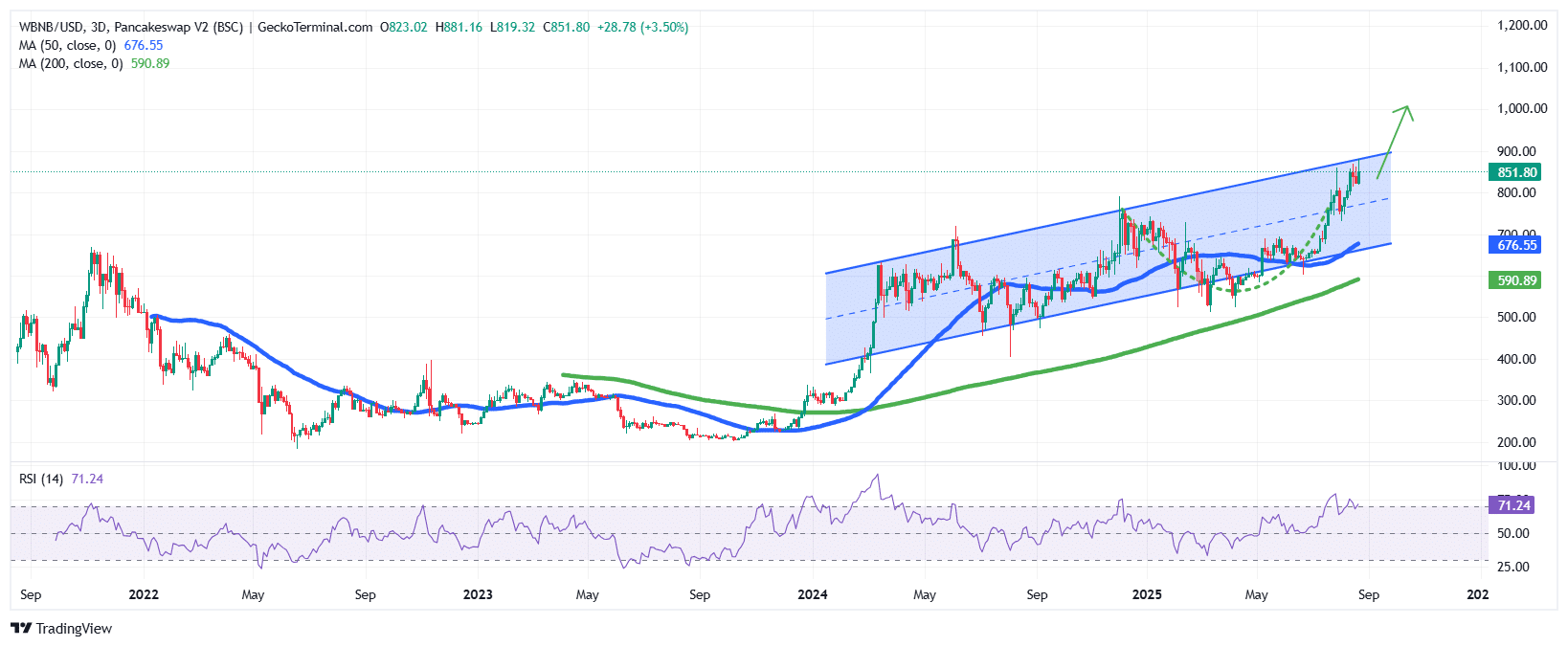

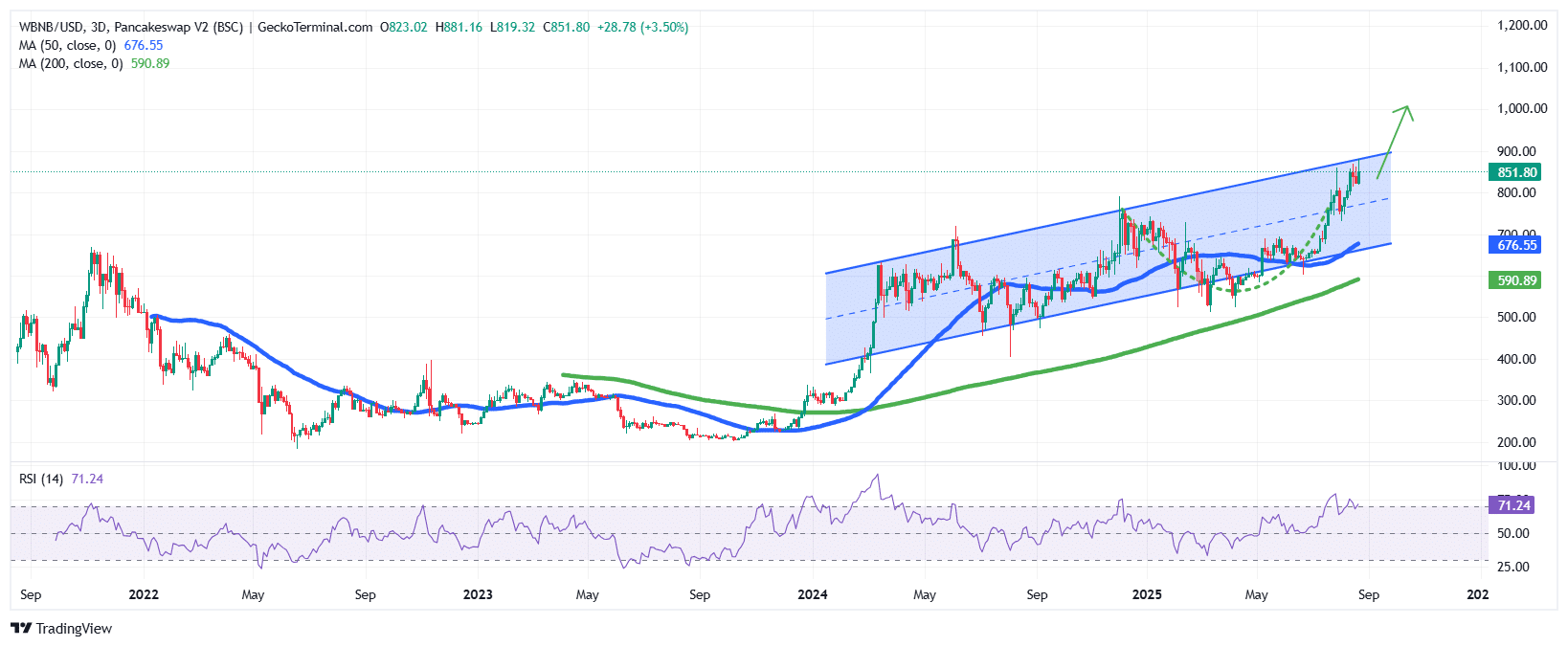

The BNB value on the 3-day timeframe exhibits a powerful transfer inside a rising channel sample. In line with the BNB/USD evaluation, the Binance token is preparing for an additional leg up.

With the worth now buying and selling above each the SMAs, bulls are assured of a transfer greater. In the meantime, the RSI can be gaining momentum, at present at 71 because it climbs up.

If the technicals play out, BNB is heading for one more ATH over $1,000.

Whale Swaps 400 BTC For Ethereum In Main Leveraged Transfer

A big market transfer noticed a Bitcoin whale swap 400 BTC into Ethereum by way of Hyperliquid. The whale then opened lengthy positions totaling 68,130 ETH ($295 million) throughout 4 completely different wallets, utilizing 3X and 10X leverage.

This #Bitcoin OG additional deposited 400 $BTC, value $45.5M into #HyperLiquid, and is promoting it to purchase $ETH on the spot.

OG additionally bridging $ETH again to @ethereum Community holding 11,744 $ETH value $50.57M.https://t.co/GqS7kjvfd0

Holding tackle:… https://t.co/AiFSBY8kYo pic.twitter.com/0gdMimRObv

— Onchain Lens (@OnchainLens) August 21, 2025

Ethereum has just lately outperformed Bitcoin, which has caught the eye of huge buyers. And the transfer by the whale underscores a broader shift, as some long-term BTC holders at the moment are transferring into Ethereum, pushed by rising momentum.

Ethereum dropped 9% within the final week, regardless of gaining a fraction of a proportion within the earlier 24 hours, which has been triggered by heavy promoting by ETF (exchange-traded fund) giants BlackRock, Constancy, and GrayScale.

In whole, Ethereum ETFs recorded over $240 million in outflows on August 20, in accordance with Coinglass knowledge.

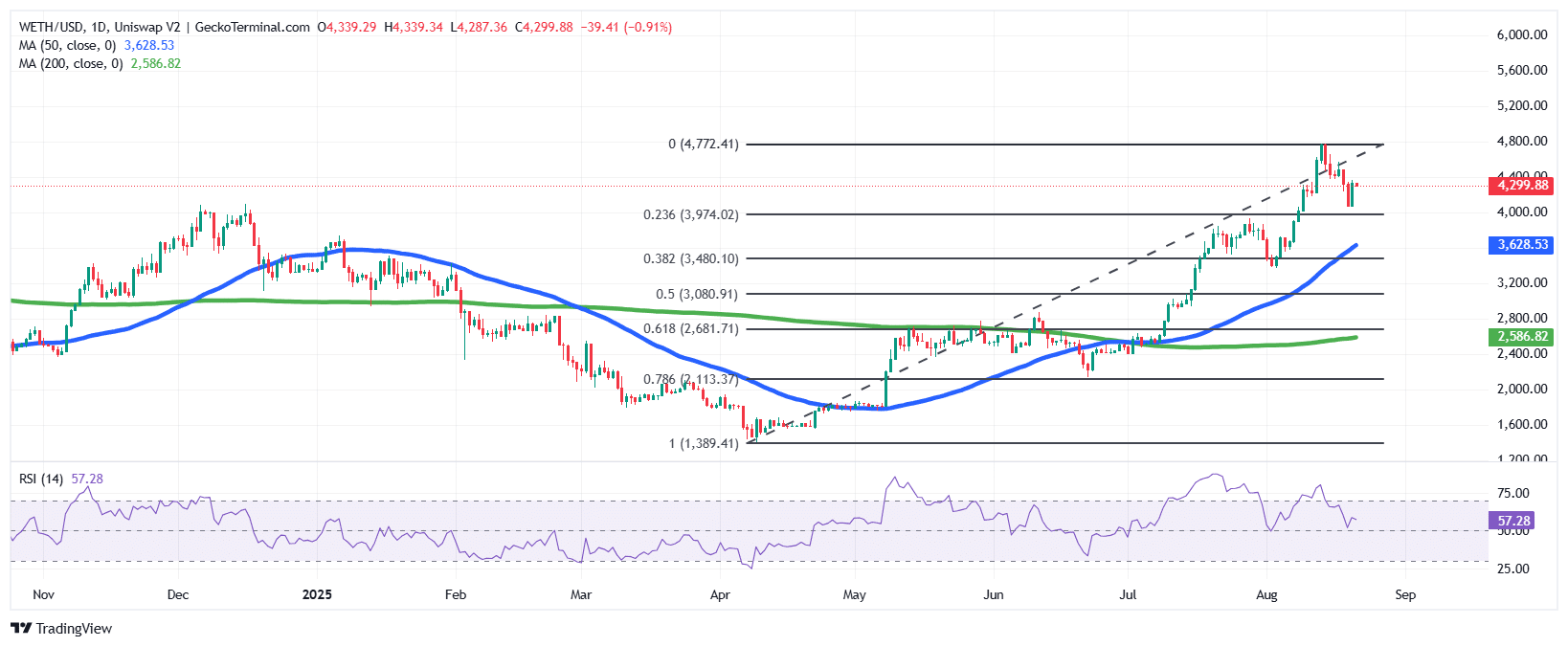

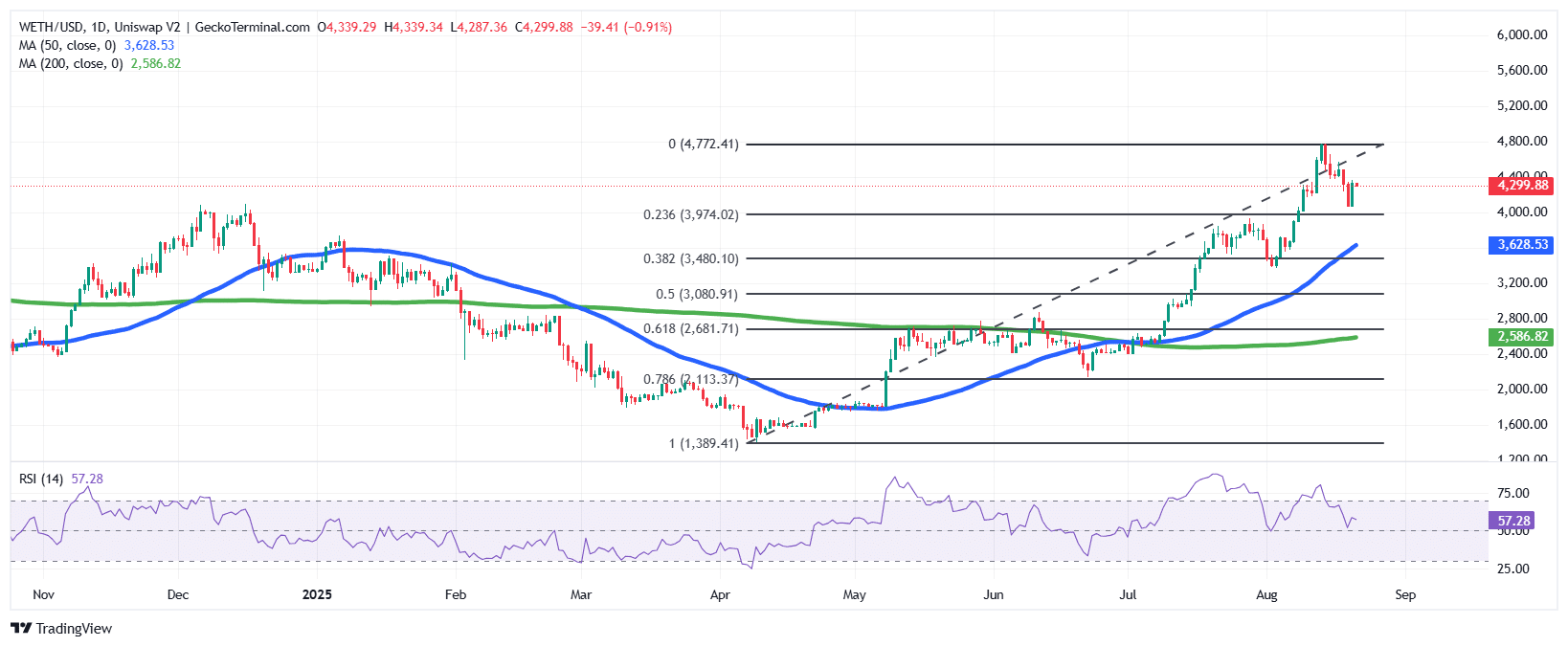

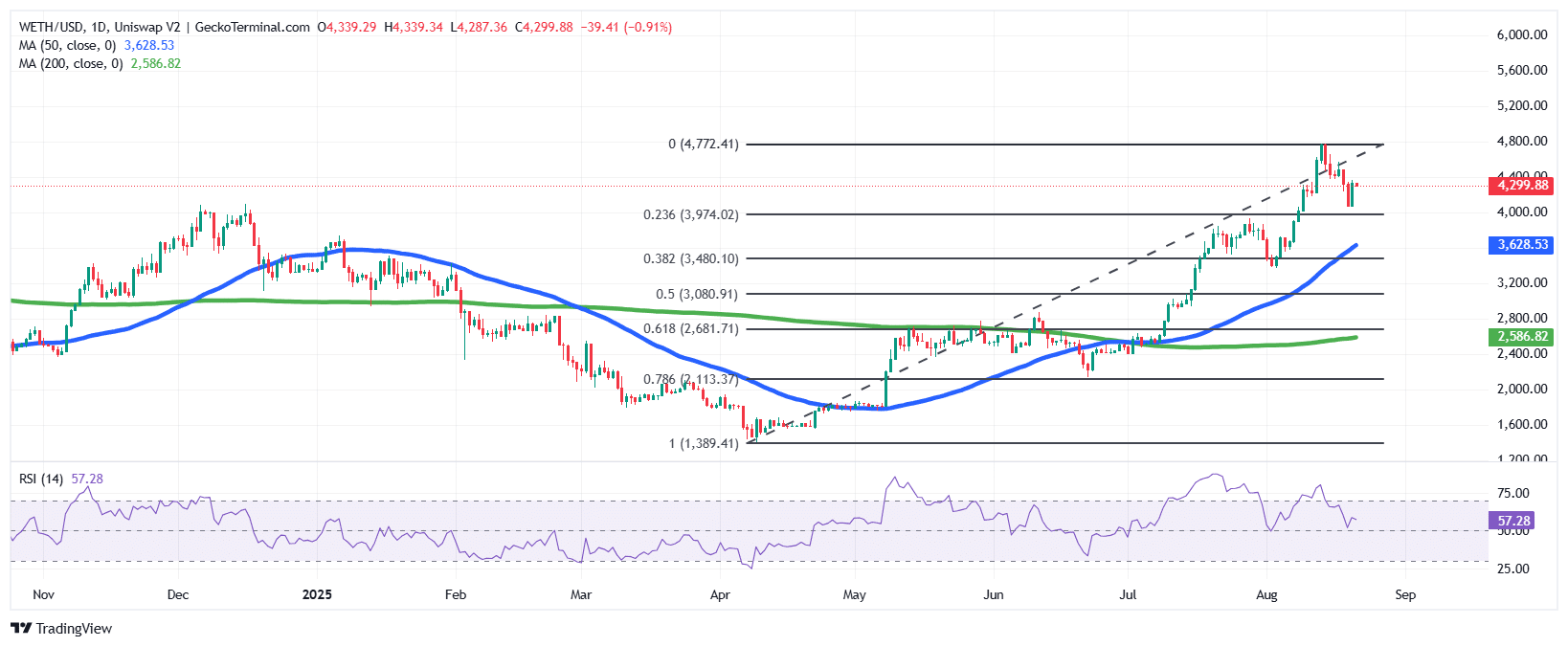

The ETH value chart exhibits a powerful uptrend since April, with the worth just lately pulling again after touching resistance close to $4,772, now consolidating above the important thing Fibonacci degree at $3,974.

The 50-day SMA has crossed properly above the 200-day SMA, confirming bullish momentum, whereas the RSI at 57.28 suggests impartial energy with room for additional upside. If the worth of ETH holds above $4,000 help, a retest of $4,700–$4,800 is probably going.

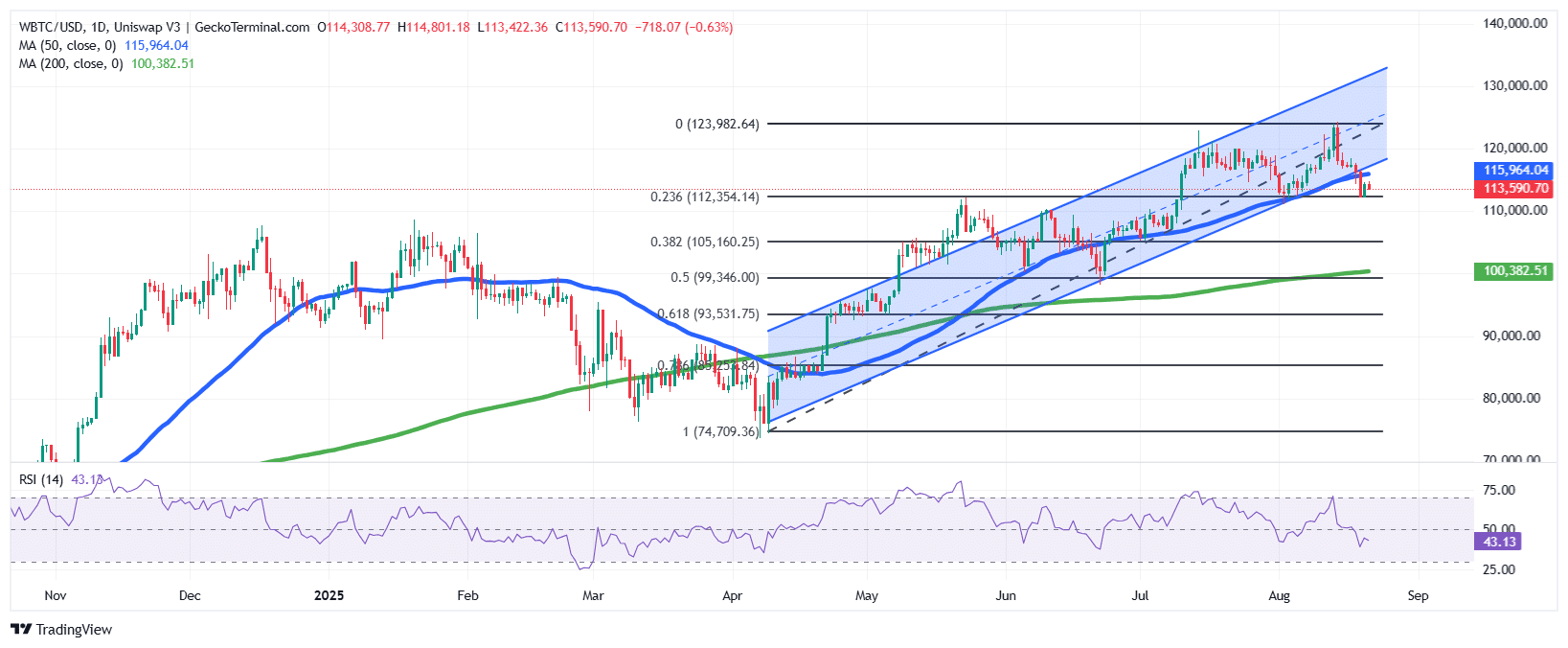

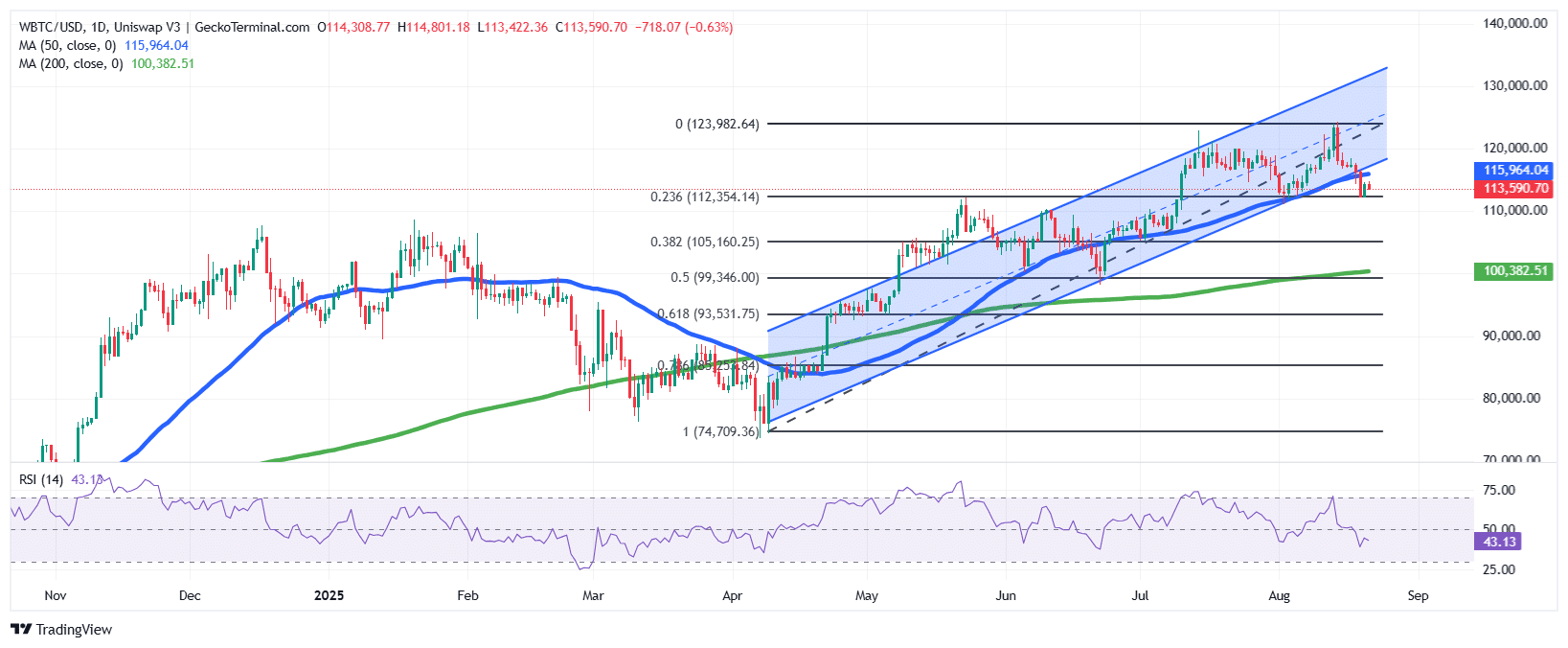

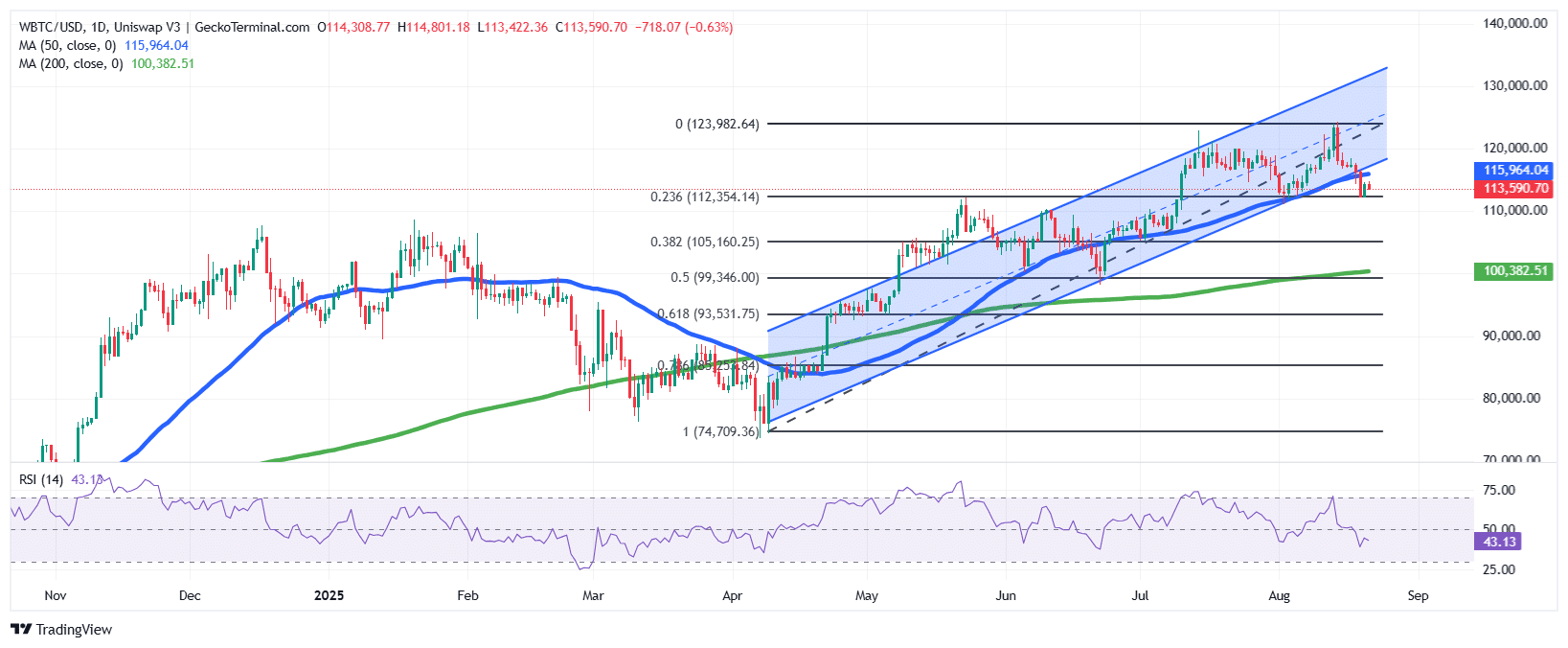

In the meantime, the BTC value has been transferring inside a rising channel sample however just lately broke beneath the decrease boundary of the sample, displaying weakening momentum as the worth now exams help close to $112,000.

The 50-day SMA stays above the 200-day SMA, signaling longer-term bullish sentiments. The RSI at 43.13 signifies bearish stress and an absence of robust shopping for energy.

If the worth of Bitcoin fails to reclaim the $116,000 resistance, it might drift towards $105,000 help, whereas a rebound above $118,000 might reopen the trail to $124,000.

Including to Bitcoin’s narrative, Hong Kong-based Ming Shing Group Holdings agreed to accumulate 4,250 BTC value almost $483 million to spice up the digital belongings in its company treasury.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection