Meme coin SPX has tumbled 22% over the previous week to commerce at $1.30 at press time, elevating considerations about additional draw back dangers.

Technical indicators recommend that capital is flowing out of the market, hinting that the token may face even steeper declines quickly.

SPX Dips as Merchants Cut back Publicity

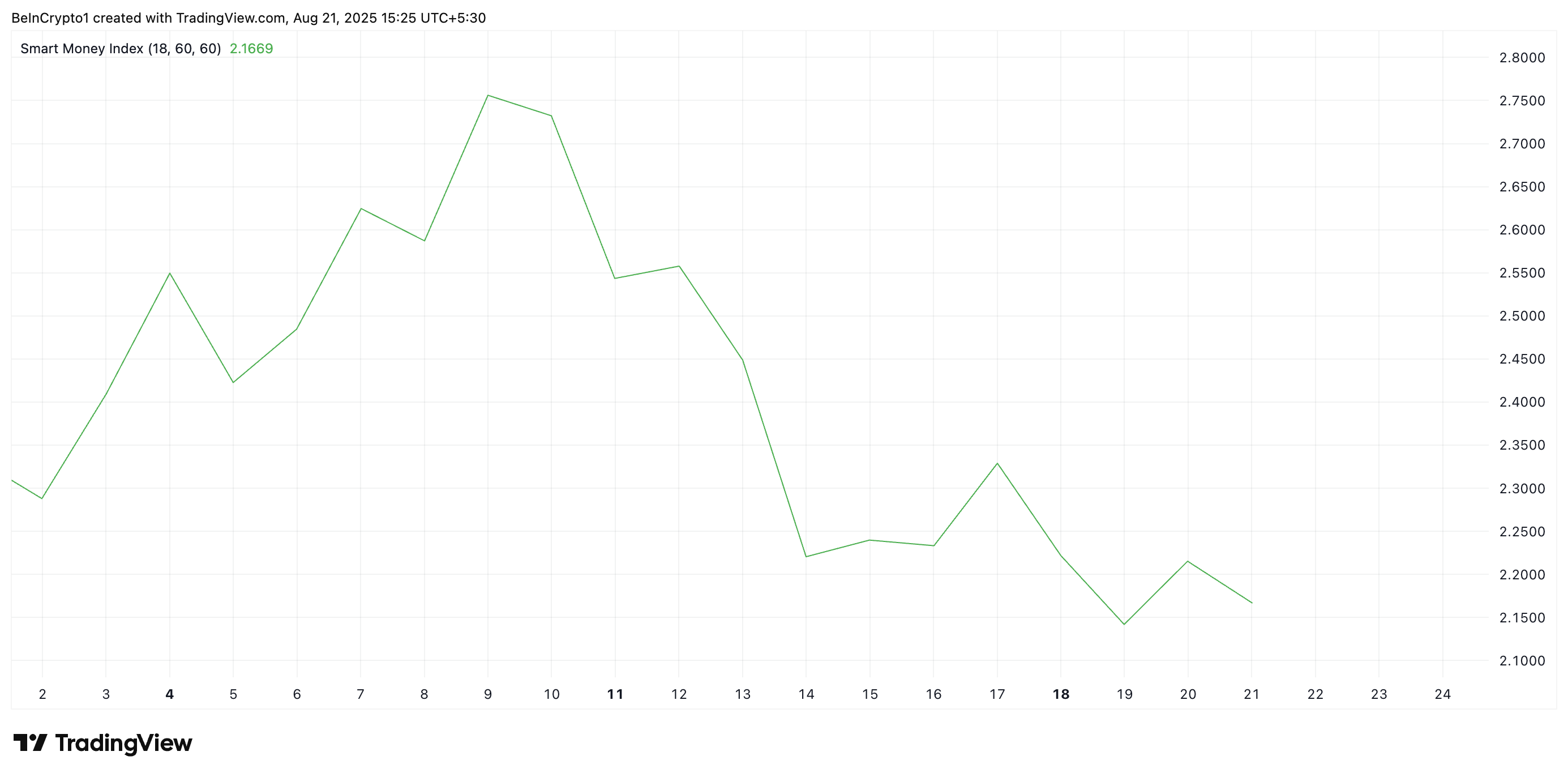

Readings from the SPX/USD one-day chart present a gradual dip within the token’s Good Cash Index (SMI) since August 10. As of this writing, it sits at 2.16.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Good cash refers to skilled traders or establishments akin to hedge funds, enterprise capitalists, {and professional} merchants who’re believed to have higher insights than the common retail investor.

The SMI tracks the conduct of those traders by analyzing intraday worth actions. Particularly, it measures promoting within the morning (when retail merchants dominate) versus shopping for within the afternoon (when establishments are extra lively).

A rising SMI indicators that sensible cash is accumulating an asset, usually forward of main worth strikes. However, when this indicator falls, key holders of an asset are distributing their tokens.

This means that SPX may face even steeper declines quickly if these traders preserve promoting.

Furthermore, SPX’s Parabolic Cease and Reverse (SAR) at present types dynamic resistance above its worth at $1.93, lending credence to the bearish outlook above.

The Parabolic SAR indicator identifies an asset’s potential development route and reversals. When its dots are positioned beneath an asset’s worth, the market is in an uptrend. It signifies that an asset is witnessing bullish momentum, and its worth may proceed to rally if shopping for persists.

However, when the dots lie above an asset’s worth, promoting stress is dominant. Merchants usually interpret this as a promote sign because it hints at a potential continuation of downward momentum.

SPX Might Slide to $1.19 if Promoting Persists

SPX trades at $1.30 at press time, hanging above assist fashioned at $1.27. If the decline deepens, the assist ground may give option to a fall to $1.19.

Conversely, a spike in accumulation may drive a rebound towards $1.51.

The publish Is the SPX6900 (SPX) Rally Over or Potential Rebound Awaits? appeared first on BeInCrypto.

Supply hyperlink