Bitcoin is buying and selling at a decisive degree after surging to recent all-time highs, touching $124,000 earlier than pulling again. Bulls stay in management, however the market now reveals indicators of hesitation, with BTC struggling to substantiate momentum above $120,000. This value motion displays indecision amongst merchants because the market balances profit-taking with renewed accumulation.

Associated Studying

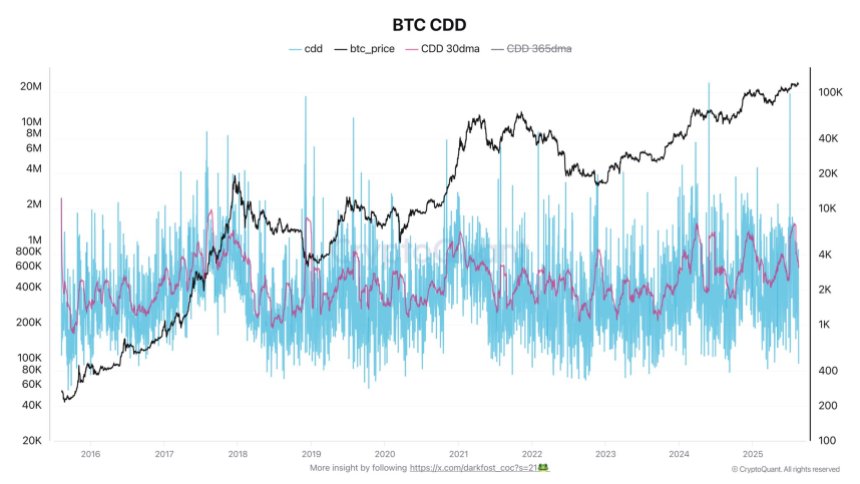

On-chain knowledge highlights a key shift in dynamics. After a pointy improve within the 30-day common Coin Days Destroyed (CDD) — a metric usually used to trace long-term holder exercise and promoting stress — the indicator has now dropped considerably. This decline means that promoting stress from older cash has eased, even after current profit-taking.

For buyers, the message is evident: whereas Bitcoin stays in a strong uptrend, the lack to remain firmly above $120K highlights a crucial juncture. If promoting stress continues to ease, BTC might consolidate and put together for an additional breakout try. Nonetheless, failure to carry these ranges could embolden bears who’re already speculating on a possible prime. The approaching periods will likely be pivotal in defining Bitcoin’s subsequent transfer.

Bitcoin Promoting Stress Eases As CDD Drops

In keeping with prime analyst Darkfost, the Coin Days Destroyed (CDD) indicator stays some of the dependable instruments for gauging promoting stress, significantly from long-term holders (LTHs). The metric measures how lengthy a Bitcoin has been held earlier than being moved, primarily combining each quantity and coin age. Generally, older BTC are moved in preparation for promoting, making CDD spikes a powerful indicator of distribution phases out there.

On July twenty third, the 30-day transferring common of CDD surged to its highest degree of this cycle, reaching almost 1.35 million. This instructed {that a} vital quantity of long-held Bitcoin was moved — and sure bought — as buyers seemed to lock in income at or close to file costs. Regardless of this wave of promoting, nevertheless, Bitcoin’s value motion has held up remarkably effectively, signaling strong demand and the power of the market to soak up provide with out main breakdowns.

Since late July, this promoting stress has notably eased. The 30-dma CDD has been steadily declining all through August, indicating fewer older cash are hitting the market. This pattern highlights renewed stability and suggests accumulation is regaining dominance over distribution.

For Bitcoin’s broader outlook, the decline in CDD is a bullish sign. It reveals that regardless of profit-taking, sturdy demand underpins present value ranges, permitting BTC to consolidate close to highs. If this pattern continues, the groundwork could also be laid for an additional leg greater within the ongoing bull cycle.

Associated Studying

Worth Evaluation: Testing Key Help Degree

Bitcoin is consolidating slightly below its current all-time excessive, with the chart exhibiting clear resistance at $123,217. After briefly touching the $124K area, BTC retraced and is now buying and selling round $117,497, sitting on prime of key transferring averages. The 50-day SMA (~$117,337) is appearing as rapid short-term help, whereas the 100-day SMA (~$115,366) offers a further security web for bulls. The 200-day SMA (~$110,551) stays far beneath, reflecting the sturdy momentum of the present uptrend.

The construction suggests indecision, with patrons defending help however failing to interrupt above the $123K–$124K zone. A clear breakout above this degree might open the trail towards $130K and past, confirming continuation of the bull run. Conversely, a breakdown beneath $115K would sign weak spot and expose BTC to deeper retracements.

Associated Studying

Momentum indicators counsel consolidation, not distribution, which aligns with the broader narrative of long-term holders promoting into energy whereas new patrons step in. This wholesome churn has allowed Bitcoin to maintain excessive ranges with out collapsing, an indication of structural resilience.

Featured picture from Dall-E, chart from TradingView