Be part of Our Telegram channel to remain updated on breaking information protection

Japan’s monetary regulator is planning laws to require crypto exchanges to take care of legal responsibility reserves to guard prospects towards hacks or safety breaches.

A report by The Nikkei mentioned the Monetary Companies Company (FSA) plans to submit laws to parliament in 2026.

The laws would require crypto exchanges to satisfy necessities just like these for securities companies, which at present maintain reserves starting from $12.7 million to $225 million, relying on buying and selling quantity.

Till now, crypto exchanges have been in a position to work round reserve necessities by storing a portion of buyer property in chilly storage, that are wallets that aren’t related to the web.

The brand new framework will create formal procedures for returning property to shoppers within the occasion a crypto trade enters chapter. It would embody permitting court-appointed directors to deal with buyer repayments.

To ease the monetary burden, the FSA is contemplating permitting trade platforms to buy insurance coverage quite than holding full money reserves.

Japan Has Been Rocked By A Sequence Of Crypto Hacks

The deliberate mandate follows a sequence of safety breaches that focused Japanese crypto exchanges.

Maybe essentially the most notable hack, which Japan continues to be recovering from, is the collapse of now-defunct platform Mt. Gox. Hackers had drained 850,000 BTC from the platform in 2014, which had pushed the trade into chapter 11. Some repayments solely began a decade later, with repayments now operating by way of October 2026.

BREAKING: Mt. Gox has delayed BTC repayments to the subsequent 12 months.

Much less promoting strain available on the market.

That is very bullish. pic.twitter.com/3vWJrgFIEy

— Ash Crypto (@AshCrypto) October 27, 2025

Initially of 2018, Coincheck suffered one the most important crypto trade hacks on the time after roughly $530 million value of NEM tokens have been stolen. Shortly after the incident, the FSA raided Coincheck’s Tokyo Workplace.

In September that very same 12 months, the platform Zaif was hacked for round $62 million. Japan’s FSA went on to challenge a enterprise enchancment order, citing inadequate rationalization of how the hack occurred. The regulator additionally highlighted the platform’s shortcomings in danger administration.

Extra just lately, DMM Bitcoin misplaced 4,502 BTC valued at roughly $305 million in Could final 12 months. With this incident, North Korean hackers had compromised an worker at Ginco, which was the pockets software program supplier DMM had contracted for transaction administration.

Simply final month, an estimated $21 million in Bitcoin and different cryptos was stolen from addresses linked to SBI Crypto, a mining pool owned by SBI Group. Blockchain investigations had recognized laundering exercise through the transaction mixer Twister Money in addition to potential North Korean connections.

Earlier this month, Japan’s FSA began weighing a rule that will require any agency that gives crypto-management techniques, such because the software program that was utilized by DMM Bitcoin previous to its breach, to file prior discover with regulators.

Asia Ranked Second In Bitcoin Thefts, Japan Has One Of Highest Sufferer Counts

On-chain analytics agency Chainalysis mentioned in a mid-year report that Asia ranked second for Bitcoin thefts and had a record-breaking variety of digital heists.

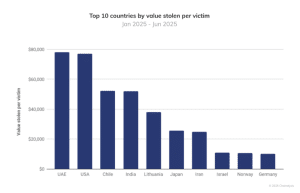

High 10 nations by worth stolen per sufferer (Supply: Chainalysis)

It mentioned that Japan, Indonesia, and South Korea rank among the many high nations for sufferer counts, whereas Asia ranks third when it comes to Ethereum losses.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection