The first Dogecoin ETF had actual exercise however not the explosive progress many merchants anticipated, and the day-one numbers ended up exhibiting the identical traits because the DOGE worth that has been caught in a downtrend for weeks.

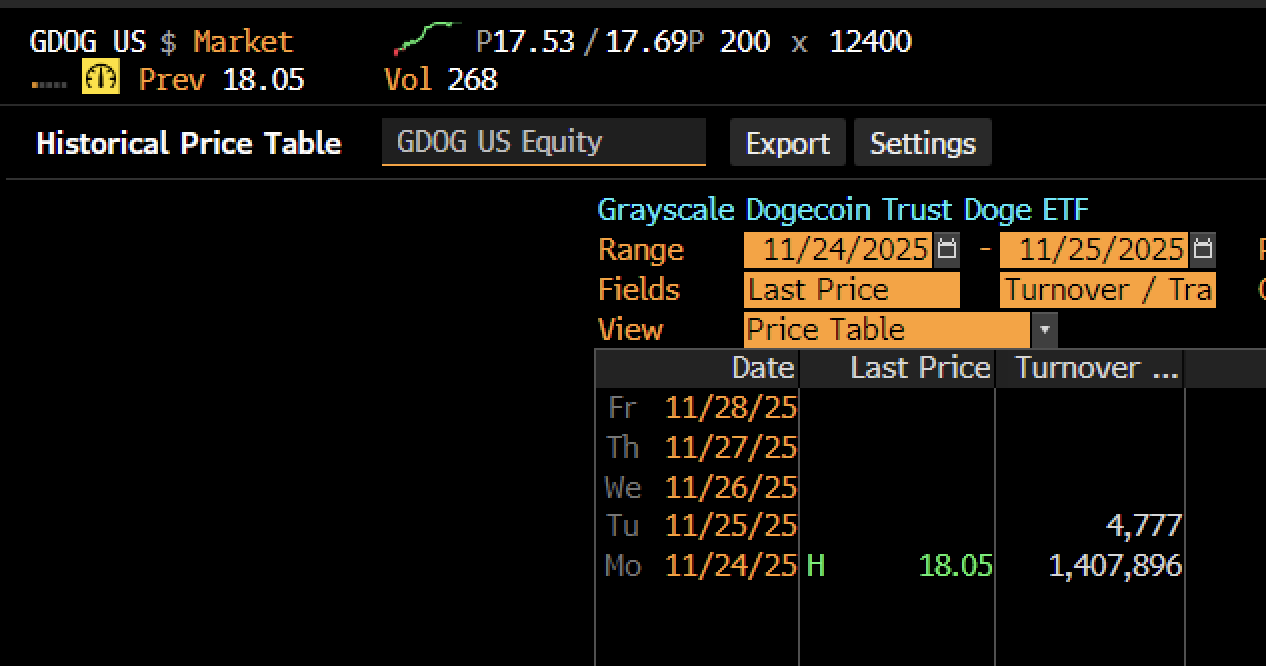

GDOG, the Grayscale Dogecoin Belief ETF, had about $1.4 million in turnover on its debut. Bloomberg’s display reveals the product closing at $18.05, with $1,407,896 in greenback turnover and solely 4,777 in commerce rely.

What it reveals is that that early curiosity was concentrated into a brief burst moderately than forming a large base of participation throughout the session. Eric Balchunas stated the result was “stable for a mean launch however low for a first-ever spot product,” and that’s in step with how DOGE has traded for the previous month.

Dogecoin’s worth chart, within the meantime, reveals a market that has had a tough time holding any stage above $0.17 since early November. Each time the worth bounces again up, sellers take benefit and convey it again all the way down to the mid-$0.14s.

The ETF debut didn’t change that a lot as a result of the spot market remains to be the primary driver of sentiment for meme belongings.

Backside line

The final huge candles on the chart are all crimson, together with that one deep flush wick in mid-October. That one nonetheless stands as a reminder of how rapidly liquidity can disappear round this coin when bigger names pull again.

Due to that background, the ETF’s first day isn’t robust or weak. It appears to be like just like the market is buying and selling decrease and ready for one thing to present it a lift. A complete of $1.4 million is sufficient to present the door opened however not sufficient to sign a wave of recent capital.

Supply hyperlink