Bitcoin surged previous the $120,000 mark, reaching an intraday excessive of $122,300 — simply shy of its all-time excessive at $123,000. The transfer marks a powerful bullish continuation after weeks of upward momentum, fueling hopes amongst merchants {that a} new report could possibly be imminent. Nevertheless, seasoned buyers are approaching the rally with warning, warning that present worth motion may characterize a reduction rally earlier than one other consolidation part.

Associated Studying

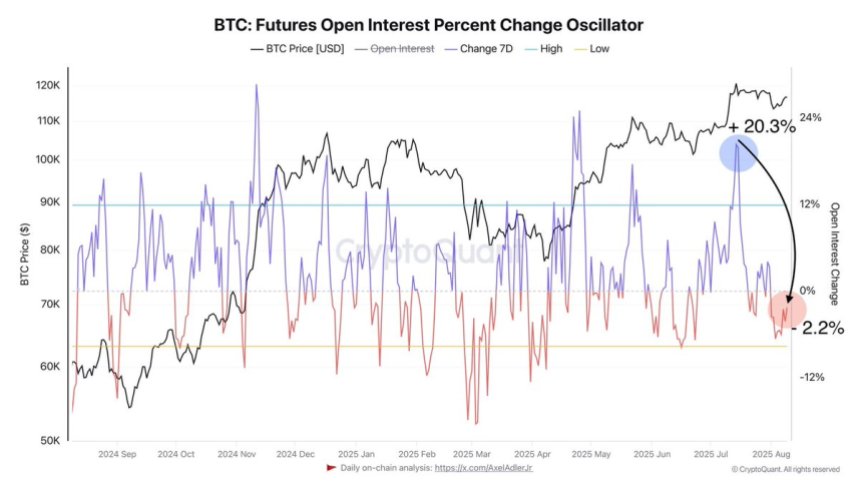

Contemporary information from CryptoQuant provides a layer of complexity to the market outlook. After a pointy rise in common weekly open curiosity to over 20% — peaking on July 14 — the metric has since dropped considerably, now turning unfavorable. This shift means that short-term danger urge for food has diminished, probably lowering speculative momentum within the close to time period.

Whereas open curiosity declines aren’t inherently bearish, they will point out a cooling part after intervals of aggressive leverage. In some instances, such pullbacks in open curiosity, particularly when paired with elevated liquidations, have preceded enticing shopping for alternatives. For now, Bitcoin’s place close to report highs gives each promise and danger, with the following few periods prone to decide whether or not the market pushes greater or pauses for consolidation.

Open Curiosity Alerts Cooling Threat Urge for food

Prime analyst Darkfost has shared contemporary market insights, highlighting a notable shift in Bitcoin’s derivatives panorama. In keeping with his evaluation, the present weekly common for open curiosity change sits at -2.2%, marking a pointy reversal from the +20% ranges seen simply weeks in the past. This drop indicators that short-term danger urge for food amongst merchants has clearly diminished, with many members lowering leveraged positions after an prolonged bullish run.

Liquidations are a key issue on this growth. Darkfost factors out that when open curiosity experiences a pointy short-term drop alongside a spike in liquidations, it usually presents a window for worthwhile lengthy entries. This setup sometimes happens when overleveraged positions are worn out, permitting stronger palms to build up at extra favorable ranges. Whereas not a exact purchase sign, it stays a helpful device for gauging market situations and figuring out probably favorable entry zones.

The present backdrop is especially intriguing as Ethereum pushes towards all-time highs, drawing elevated consideration to the broader crypto market. Bitcoin’s stability above the $120K stage, mixed with bettering sentiment throughout altcoins, units the stage for probably robust follow-through within the coming weeks. Nevertheless, merchants might be watching derivatives metrics intently for indicators of renewed leverage or additional cooling earlier than committing to bigger positions.

Associated Studying

Bitcoin Exams Key Resistance Simply Under All-Time Excessive

Bitcoin has surged to $121,337, marking a powerful breakout from its latest consolidation part and pushing to its highest stage since setting the all-time excessive at $123K. The day by day chart exhibits a decisive transfer above the $119K zone, confirming bullish momentum after holding assist on the 50-day shifting common close to $114,155.

This rally brings BTC inside putting distance of the $123,217–$124,000 resistance space, a essential zone that beforehand capped upside makes an attempt in July. A clear break and day by day shut above this stage may open the door for a brand new all-time excessive, probably triggering additional upside momentum as merchants chase the breakout.

Associated Studying

With Ethereum nearing its personal report highs and altcoins exhibiting renewed power, Bitcoin’s efficiency within the coming periods might be pivotal for broader market sentiment. If BTC manages to safe a sustained transfer above $124K, it may gasoline a market-wide surge. Nevertheless, failure to interrupt greater might even see a interval of consolidation earlier than the following decisive transfer.

Featured picture from Dall-E, chart from TradingView