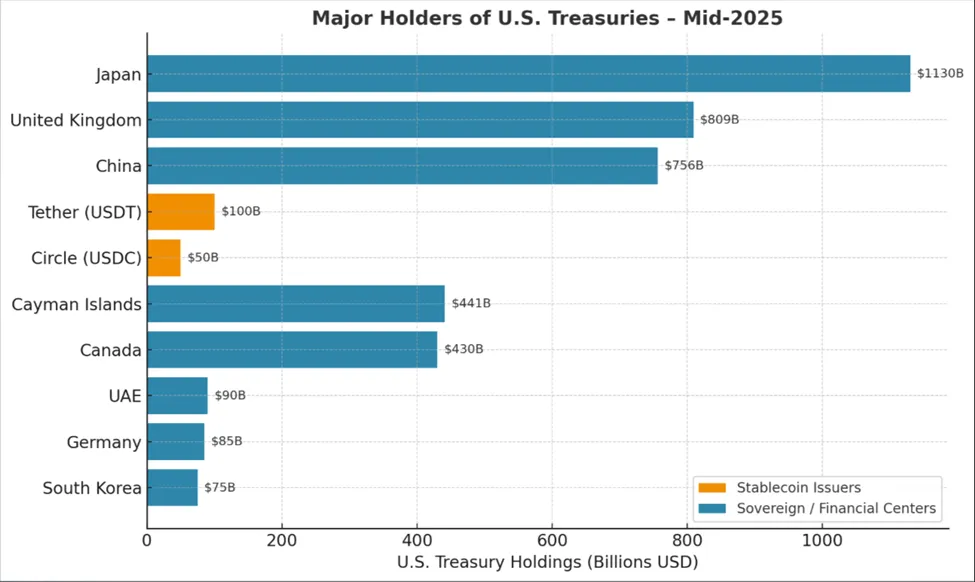

Once a niche tool for crypto traders, stablecoins have evolved into heavyweight players in global finance – now holding more U.S. Treasury debt than countries like Germany, South Korea, and the UAE.

Data shows that Tether (USDT) and Circle (USDC) collectively manage over $150 billion in Treasury bills, with Tether alone ranking as the world’s 18th-largest holder. This surge follows the GENIUS Act, which granted regulatory clarity to dollar-backed stablecoins and unlocked institutional adoption for payments and settlements.

Their appeal lies in speed and cost. Pegged 1:1 to the U.S. dollar, stablecoins enable instant, low-fee transfers across borders, rivaling – and in some cases surpassing – the throughput of traditional networks like Visa. USDC’s market cap has soared nearly 90% in the past year to $65 billion, reflecting surging demand.

The shift comes as major U.S. debt buyers like China and Japan reduce holdings, leaving room for new, unconventional buyers. Advocates see stablecoin issuers as reliable, long-term purchasers that can bolster the dollar’s global dominance. Skeptics, however, caution that such reliance on a still-young sector could amplify market risks if confidence falters.

From trading floors to corporate treasuries, what began as a crypto convenience is now influencing U.S. bond market dynamics – a sign that stablecoins’ role in mainstream finance is no longer a question, but an inevitability.

Source

Source link