Timing the Bitcoin market stays one of many greatest traps for buyers—shopping for throughout euphoric highs and promoting throughout fearful lows.

However a current on-chain mannequin referred to as Good DCA (Greenback-Value Averaging) might supply a approach to flip that cycle solely.

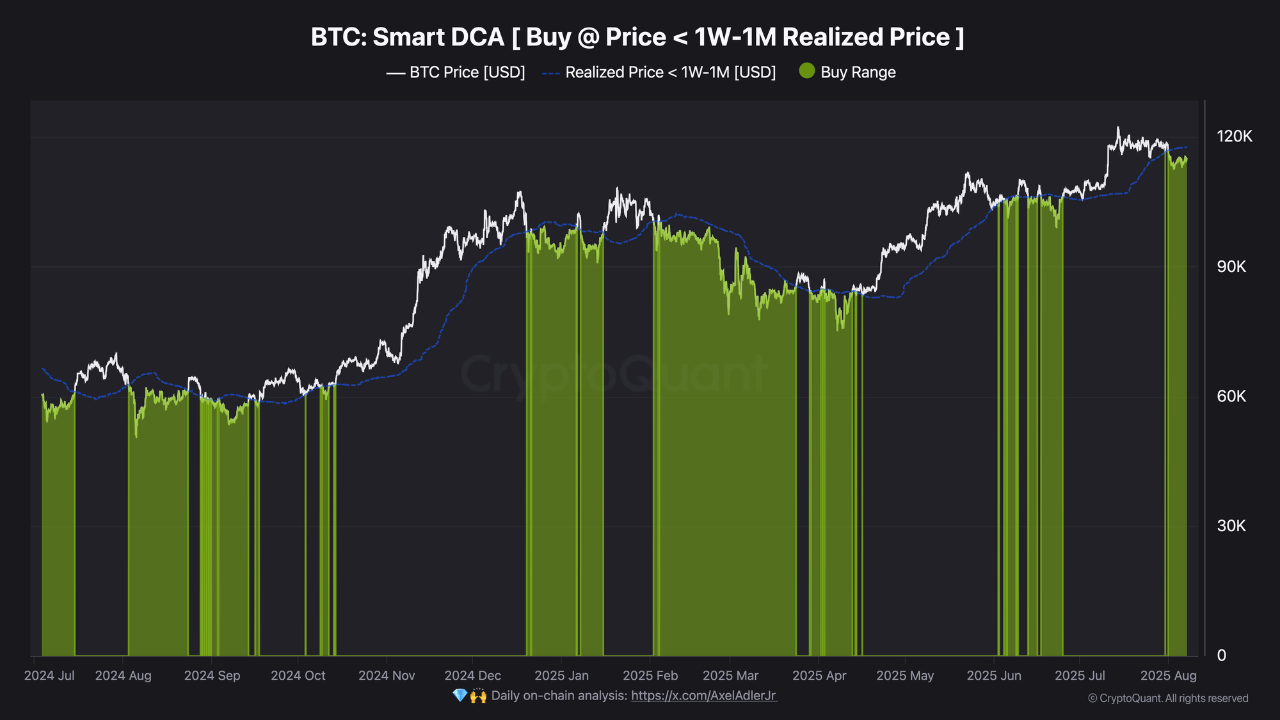

As an alternative of counting on emotion, Good DCA focuses on a key behavioral threshold: the typical value at which short-term holders (1 week to 1 month) acquired their Bitcoin.

When the present market value dips beneath this “realized” value, it typically alerts capitulation amongst short-term merchants and elevated promoting stress. In these moments, the mannequin robotically triggers staggered BTC purchases.

Based on CryptoQuant, that realized value at the moment sits close to $117,700. With Bitcoin buying and selling slightly below it at $116,000, the technique stays in accumulation mode, suggesting the market continues to be favoring patrons over sellers. If the worth climbs again above that degree, the mannequin regularly switches to a profit-taking part — not by chasing rallies, however by promoting pre-accumulated BTC into energy.

This strategy successfully turns volatility into alternative, utilizing selloffs as entry factors slightly than exit triggers. It additionally builds a extra balanced value foundation over time, insulating portfolios from sudden drawdowns.

Briefly, whereas worry and hype dominate headlines, Good DCA encourages a peaceful, methodical mindset: purchase weak point, promote energy, all backed by real-time on-chain habits.

Supply hyperlink