Following a short dip to $112,200, Bitcoin (BTC) has recovered barely, buying and selling across the $116,300 stage on the time of writing. Whereas considerations stay about BTC’s incapability to decisively break the $120,000 resistance stage, on-chain knowledge suggests the asset could also be in an accumulation section – doubtlessly gearing up for its subsequent breakout towards a brand new all-time excessive (ATH).

Bitcoin At the moment In Accumulation Part, Analyst Says

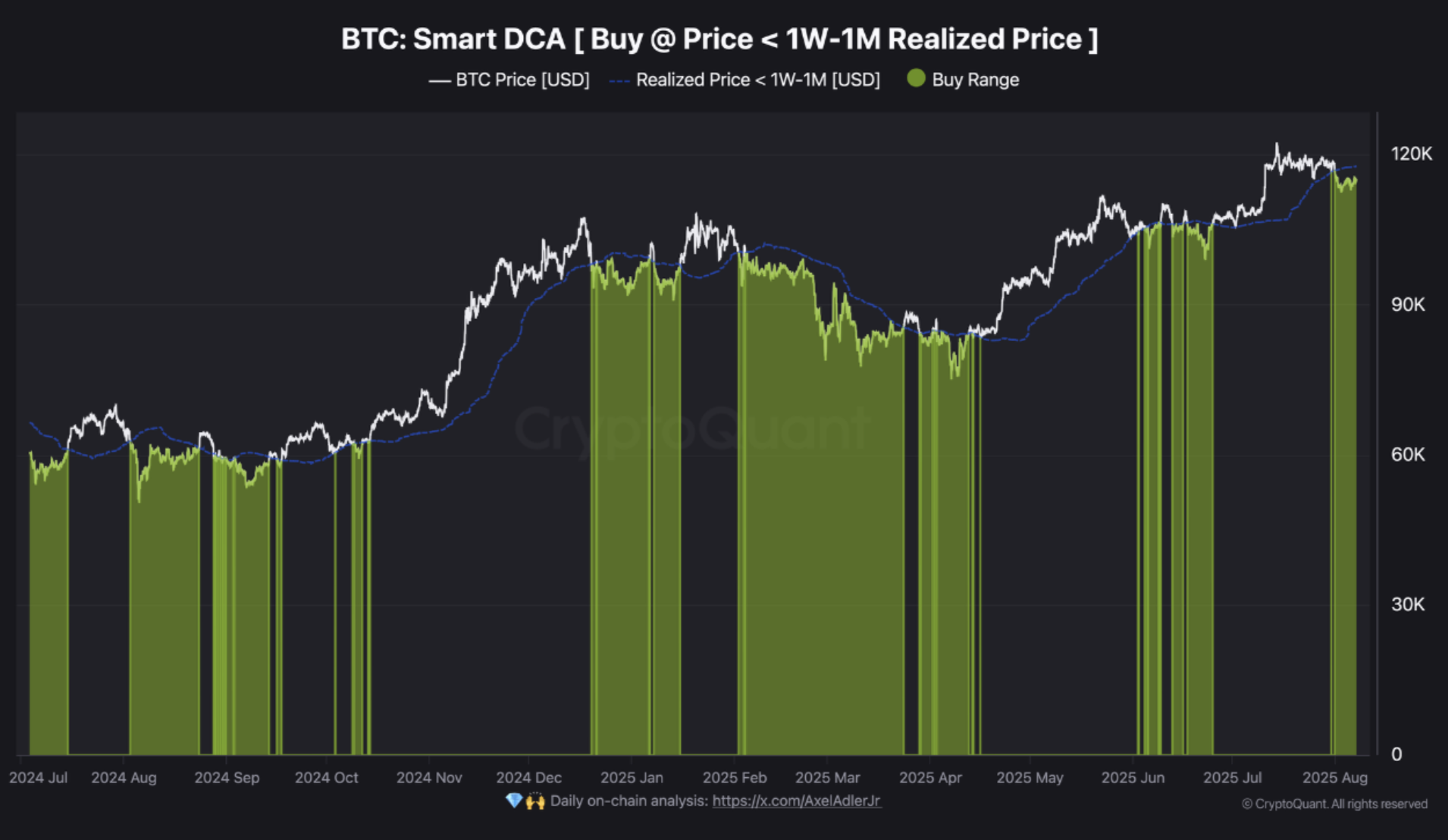

In response to a CryptoQuant Quicktake publish by contributor BorisVest, a technique referred to as Sensible Greenback-Price Averaging (DCA) could assist Bitcoin traders accumulate the asset extra strategically and enhance long-term efficiency.

Associated Studying

In his evaluation, BorisVest famous that traders usually battle to time their entries into BTC. Many have a tendency to purchase throughout native tops on account of worry of lacking out (FOMO) and keep away from coming into the market throughout bottoms out of worry of additional declines.

Sensible DCA presents a approach to bypass these emotion-driven choices. The technique recommends accumulating BTC when its market worth falls beneath the 1-week to 1-month realized worth – a interval throughout which short-term holders are sometimes in loss, leading to heightened sell-off. BorisVest defined:

At these ranges, short-term holders are normally underwater, resulting in elevated promote stress. Sensible DCA prompts hourly purchases throughout such durations, serving to to carry the BTC and USD price foundation nearer collectively.

At the moment, the 1-week to 1-month realized worth stands at roughly $117,700. So long as BTC trades beneath this stage, Sensible DCA continues to flash an accumulation sign. As soon as BTC climbs above this threshold, the technique advises progressively promoting beforehand accrued cash.

With Bitcoin now buying and selling close to $116,000, the analyst means that the asset remains to be in an accumulation section – although it’s approaching the realized threshold. In response to knowledge from CoinGecko, BTC stays about 5.2% beneath its ATH of $122,838, recorded on July 14.

Is BTC Unlikely To Hit A New ATH?

Regardless of holding regular round $115,000, some analysts warn that Bitcoin’s realized worth is slowly starting to indicate indicators of fragility. A drop beneath the $105,000 mark may result in elevated draw back momentum, doubtlessly triggering a bigger sell-off.

Associated Studying

Notably, Binance’s internet taker quantity has slipped again into adverse territory, elevating considerations a few near-term correction. Moreover, rising Bitcoin ETF outflows have proven indicators of weak point, including one other layer of uncertainty.

Nonetheless, not all indicators are bearish. Some on-chain metrics counsel BTC could merely be coming into a cooling-off interval after a short overheated section. At press time, BTC trades at $116,316, up 2.1% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com