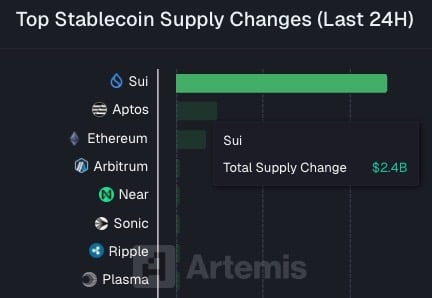

Based on information from Artemis, an internet site that publishes metrics for digital property, Sui has seen a staggering $2.4 billion value of stablecoins move into its community inside the final 24 hours.

That is considerably greater than the second and third place cash, Aptos and Ethereum, which registered $472 million and $345.8 million respectively.

What’s SUI?

Sui is its personal stand-alone blockchain, it’s not a layer 2 constructed on Ethereum, and it makes use of a distinct programming language referred to as Transfer, whereas Ethereum makes use of Solidity. Sui staking is out there because it runs a Proof of Stake consensus.

Bitcoin staking can also be doable on Sui by way of LBTC, a liquid staking token representing staked Bitcoin, permitting customers to earn staking rewards with out locking up BTC instantly.

Why Has So A lot Cash Flowed Into Sui?

Launch of Two New Stablecoins

It appears to be like like there are a number of causes nonetheless the principle one is that in October Sui introduced that it might be launching two stablecoins on its community by the top of 2025.

These stablecoins are suiUSDe and USDi. SuiUSDe will likely be powered by Ethena and can supply a staking yield, whereas USDi is backed by a BlackRock fund.

The large influx of $2.4 billion in stablecoins may very well be in preparation for the launch of those new stablecoins by the top of 2025, particularly as suiUSDe pays yield to holders.

Yield Alternatives on SUI

Staking on SUI has been providing excessive returns recently, particularly by way of protocols, this influx of stablecoins may very well be a transfer to benefit from excessive yield returns.

Rotation from Different Chains

Some capital has been rotating from Solana and Ethereum into newer excessive pace chains. At any time when a sequence begins gaining momentum, funds check it with stablecoins first as a result of they carry no market danger. The stablecoin stays pegged to the Greenback, whereas different cash can fluctuate in value considerably.

Sui is usually quicker than Ethereum, partly as a result of its programming language permits parallel transactions whereas Ethereum blocks are processed one by one.

Hypothesis

Hype round a sequence can appeal to billions in stablecoins even earlier than a selected product launches. This seems to be occurring with Sui as its development charts have been trending upward.

Sui Staking Alternate options

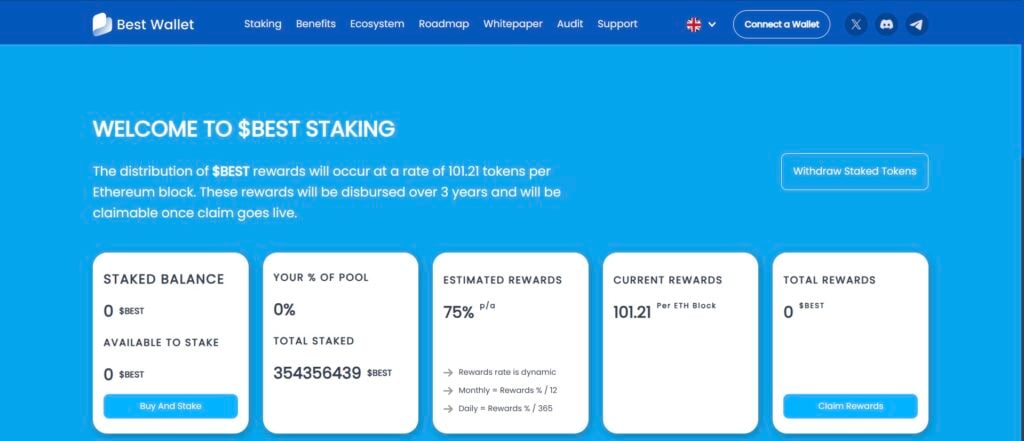

With stablecoin inflows surging and Sui staking attracting consideration, the deal with high-yield alternatives in rising cash is barely rising. One other token gaining traction on this house is BEST, which additionally presents staking rewards for holders.

Though its token sale is billed to finish in a number of days, early buyers are nonetheless accumulating as much as 75% staking yields, giving the mission the sort of traction that would drive important development after itemizing.

BEST’s spectacular staking perks, coupled with the truth that it’s a part of a quickly rising DeFi pockets make it top-of-the-line picks for early movers trying to maximize their investments this yr. The token powers Greatest Pockets, one of the standard self-custodial wallets round, with over 500,000 customers and 50% MoM development.

One of many key highlights of this pockets is that it encompasses all of the options one must successfully handle and develop their property, from fiat fee, self-custodial storage, and multichain performance to iGaming perks, portfolio administration, staking, and a token launchpad, making it a complete hub for each day-to-day merchants and long-term buyers.

Being the utility token of this platform, BEST enhances all of those options. Holders will take pleasure in high-yield APYs not solely by way of its native staking program but additionally by way of third-party amenities supported by the pockets. Along with this, holding BEST unlocks low transaction charges, entry to different high-potential tokens, and governance rights.

Crypto YouTubers like Alessandro De Crypto have highlighted how BEST’s multi-utility design might make it an acceptable crypto funding in 2025.

Obtain Greatest Pockets | Go to BEST Token Sale

This text has been supplied by one among our business companions and doesn’t replicate Cryptonomist’s opinion. Please remember our business companions could use affiliate packages to generate revenues by way of the hyperlinks on this text.