What to Know:

- Technique’s $836M Bitcoin purchase throughout a drawdown reinforces institutional conviction in $BTC at the same time as volatility spikes and macro indicators keep noisy.

- Renewed expectations for additional Fed charge cuts in 2025 assist the broader risk-asset case, doubtlessly extending the present crypto cycle into subsequent 12 months.

- Pockets infrastructure, Bitcoin scaling, and stablecoin fee rails are positioned as structural winners if on-chain exercise and ETF-driven adoption continue to grow.

- Greatest Pockets Token, Bitcoin Hyper, and Tron every faucet into these narratives with totally different threat profiles: high-yield presales on one aspect, a revenue-generating Layer-1 on the opposite.

The crypto market simply wrapped up considered one of its wildest weeks in months. Bitcoin slid arduous early on, dragging altcoins with it as threat belongings reacted to shaky macro indicators and fading confidence in one other Fed reduce this 12 months.

Midweek, the tone flipped. Technique revealed an $836M Bitcoin purchase, including 8,178 $BTC and taking its treasury to 649,870 $BTC – greater than 3% of Bitcoin’s whole provide.

That’s a critical ‘buy-the-dip’ assertion from the largest company $BTC holder and a transparent sign that institutional conviction hasn’t gone anyplace, even with spot costs below stress.

On the macro aspect, rate-cut odds, which had been fading, began to agency once more as merchants repriced the possibilities of one other transfer decrease from the Fed.

Mixed with ongoing ETF flows and company accumulation, the narrative for December is shifting from ‘is the bull market lifeless?’ to ‘how a lot threat does one wish to tackle the subsequent leg up?’

In that form of setting, the most effective crypto to purchase isn’t simply extra $BTC. Pockets infrastructure, Bitcoin scaling performs, and high-throughput stablecoin rails all stand to learn if establishments hold stacking sats and retail comes again in measurement.

That’s the place Greatest Pockets Token ($BEST), Bitcoin Hyper ($HYPER), and Tron ($TRX) enter the dialog.

1. Greatest Pockets Token ($BEST) – Self-Custody Tremendous App With Yield

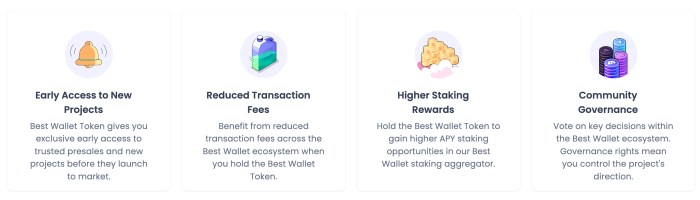

Greatest Pockets Token ($BEST) sits on the intersection of two massive developments: self-custody and ‘all-in-one’ Web3 tremendous apps. The challenge’s pockets is constructed as a non-custodial hub the place customers can retailer belongings, swap throughout dozens of networks, and plug into staking and DeFi with out leaving a single interface.

Distinctive to the Greatest Pockets app is the upcoming tokens choice. It is a fastidiously curated and vetted collection of the most effective crypto presales, which you should buy immediately. Meaning no searching throughout numerous websites for brand spanking new presale alternatives and – most significantly – no probability of falling sufferer to rugpulls or different scams.

The group’s ambition is aggressive: seize a 40% share of the fast-growing crypto pockets market by the tip of 2026.

💰 The $BEST presale numbers recommend that imaginative and prescient is resonating. It has raised greater than $17.3M, with a present presale value of $0.025995 per $BEST, and staking rewards at 75% APY.

Contemplate this: in keeping with our Greatest Pockets Token value prediction, $BEST has the potential to achieve $0.07 by 2030. That might imply a 169.3% ROI.

You don’t want to carry $BEST to benefit from the Greatest Pockets app’s distinctive options. However should you just like the sound of upper staking rewards, decrease transaction charges, and governance rights on the challenge’s course, then now’s the time to spend money on $BEST.

That’s as a result of, with simply 4 days left till the $BEST presale ends, the window of alternative to hitch one of many hottest presales of the 12 months is closing quick.

🚀 Be a part of the Greatest Pockets Token presale when you nonetheless can.

2. Bitcoin Hyper ($HYPER) – Bitcoin Layer-2 With Solana-Like Efficiency

If Bitcoin remains to be the asset establishments wish to personal, then scaling options round it are the leverage play.

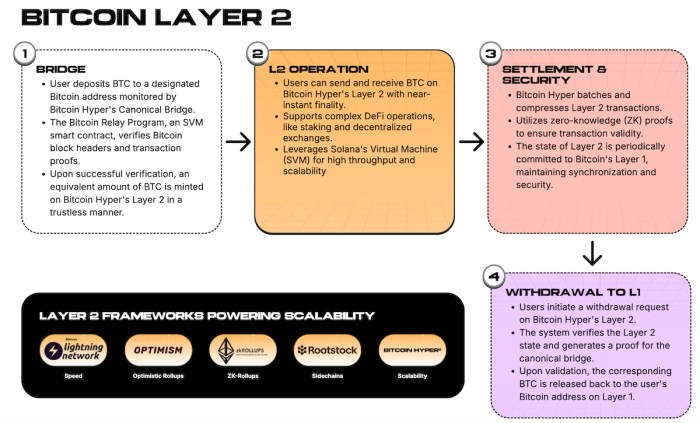

Bitcoin Hyper ($HYPER) is pitched precisely there: a Bitcoin Layer-2 that may use a canonical bridge and Solana Digital Machine (SVM) integration to ship quick, low-fee $BTC transactions and sensible contracts whereas retaining Bitcoin because the settlement anchor.

The bridge will join Bitcoin’s Layer-1 to Hyper’s Layer-2, locking your $BTC on the bottom chain and minting an equal as wrapped $BTC on the Layer-2.

The SVM, in the meantime, will present a high-performance execution setting, bringing Solana-style parallel transaction processing, quick affirmation, and scalable sensible contract capabilities.

That additionally means builders will have the ability to deploy high-speed dApps (unprecedented on the Bitcoin blockchain) on the Layer-2 whereas inheriting the effectivity and tooling of Solana’s ecosystem.

💰 Fundraising momentum has been robust, with greater than $28.37M raised within the presale and staking yields round 41% on supply to early consumers. That places Bitcoin Hyper firmly within the ‘big-ticket’ presale class for 2025.

Our Bitcoin Hyper value prediction suggests a possible excessive of round $0.08625 by end-2026 if the Layer-2 launches on schedule and listings land on main exchanges. From a present presale value of $0.013325, that will imply a large ROI of 547%.

In every week the place a single company treasury simply added $836M in Bitcoin on a drawdown, a $BTC-centric Layer-2 that guarantees quicker settlement and smart-contract flexibility provides a solution to lean into the identical thesis with extra upside and extra threat.

🚀 Be a part of the Bitcoin Hyper presale right this moment.

3. Tron ($TRX) – Stablecoin Rail With Actual Income And Deflation

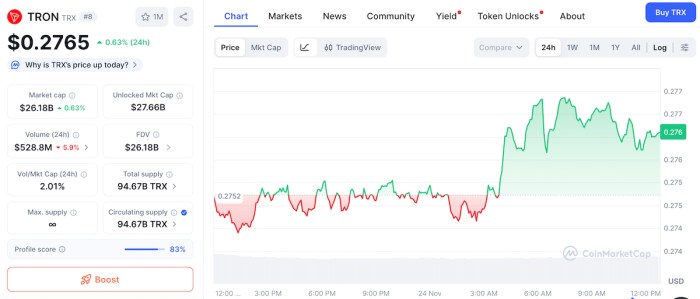

Whereas presales chase future narratives, Tron ($TRX) is already some of the used blockchains on the earth. The community persistently processes hundreds of transactions per second with negligible charges and has grow to be the first rail for $USDT transfers.

💰 Tron carries over $80B of $USDT – greater than half of worldwide provide – and commonly settles tens of billions of {dollars} in stablecoin quantity per day.

That utilization reveals up within the token’s fundamentals. Tron’s Delegated Proof-of-Stake design routes all transaction charges into burns, giving $TRX a net-deflationary profile when on-chain exercise is powerful.

Latest analyses present multi-percent annual deflation as burned charges outpace new issuance, whereas Tron ranks among the many most worthwhile chains by price and income metrics.

In parallel, the neighborhood just lately accredited a big network-fee reduce to maintain $USDT transfers low-cost and defend its lead as a funds rail.

At round $0.28 per token and a market cap close to $26.2B, $TRX is just not a micro-cap moonshot, nevertheless it provides one thing many Layer-1s lack: clear product-market match round stablecoin funds and a enterprise mannequin that throws off actual protocol income.

In a world the place rate-cut optimism and institutional $BTC buys pull liquidity again into crypto, the rails that transfer that liquidity for retail customers – usually in stablecoins – can profit in a quieter, compounding method.

🚀 Commerce $TRX on Binance and different main exchanges.

Recap: This week’s $836M Bitcoin accumulation by Technique and a tentative shift again towards Fed charge cuts have put macro wind again in crypto’s sails. Towards that backdrop, Greatest Pockets Token targets the self-custody pockets increase, Bitcoin Hyper goals to supercharge Bitcoin with a Layer-2, and Tron continues to monetize stablecoin flows at scale for individuals who choose a extra established play.

Disclaimer: This text is informational solely and never monetary recommendation; crypto belongings and presales are extremely risky and you’ll lose capital.

Authored by Aaron Walker, NewsBTC – https://www.newsbtc.com/information/best-crypto-to-buy-after-836m-btc-strategy-bet-and-fed-cut-hints