- Lengthy-term SOL holders are doubling down, with a 102% spike in internet accumulation since July 30.

- Most up-to-date sellers exited at a loss, signaling potential capitulation and cycle-bottom conduct.

- Technicals recommend promoting stress is fading, with RSI close to oversold and OBV flattening out.

Solana’s been sliding currently, little doubt about it. Value motion hasn’t been fairly. However right here’s the twist—a number of the greatest SOL believers? They’re not flinching. In truth, they’re scooping up extra.

Whereas short-term merchants are panic-selling into crimson candles, long-haulers are treating this drop like a cut price bin. They’re stacking, not stressing. And if previous patterns imply something, we is perhaps nearer to a backside than most people notice.

Sensible Cash Strikes In as Others Bail

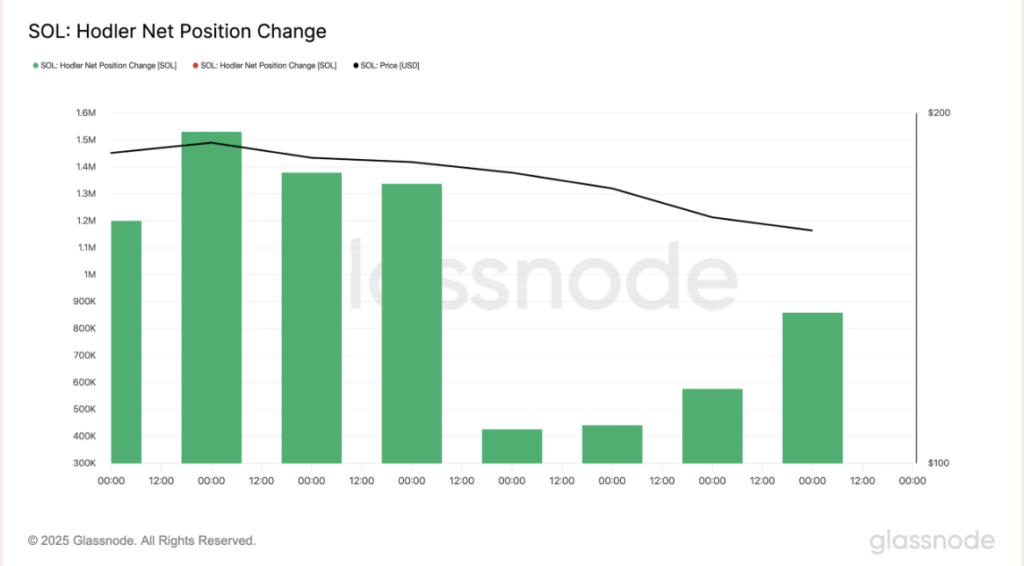

So what’s actually occurring behind the scenes? In accordance with Glassnode, Hodler Web Place Change for SOL surged 102% since July 30. Translation? Lengthy-term wallets are loading up—quick.

This stat principally tracks how a lot SOL is transferring into arms that don’t are likely to promote fast. And a spike right here? That normally screams accumulation. Not worry, not capitulation—simply quiet conviction.

So yeah, costs are down… however cash are going chilly. That’s a narrative in itself.

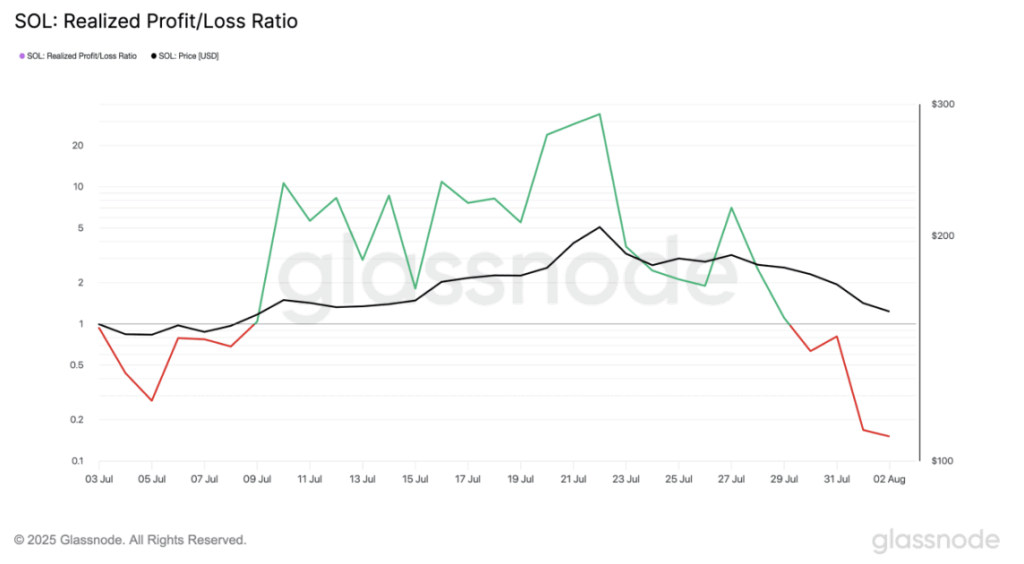

Sellers Are Bleeding, However That May Be Good Information

One other signal we is perhaps bottoming out? The Realized Revenue/Loss Ratio simply tanked to 0.15—the bottom it’s been in a month. Meaning most people who bought currently did it at a loss. Not superb for them, however traditionally? That’s what shakeouts seem like proper earlier than a reversal.

Give it some thought—when everybody who wished out already bailed, what’s left? Dry powder and affected person arms.

Much less promoting stress means much less gravity pulling SOL down. Possibly we’ve hit the ugly half. Now comes the half the place issues settle… perhaps even bounce.

Reversal Coming? Not But, However It’s Brewing

Technicals aren’t screaming “moon” simply but, however they’re displaying hints of life.

The newest every day candle didn’t collapse—lastly. Value remains to be caught underneath $165, however RSI’s down at 41.65, virtually touching oversold. Promoting quantity? Slowing. OBV’s gone flat after weeks of decline, which tells us sellers are shedding steam.

Is that this the backside? Too quickly to say. However is it shaping up like one? Kinda appears prefer it.