- Bitcoin ETFs noticed a pointy $115M outflow, breaking their latest streak, with main losses from Ark and Constancy regardless of inflows from BlackRock and others.

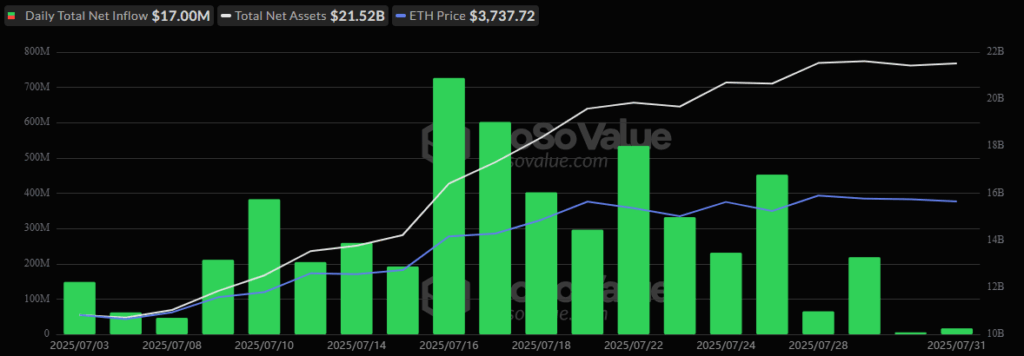

- Ether ETFs prolonged their successful streak to twenty consecutive days, pulling in $17M and showcasing regular institutional confidence in ETH.

- XRP futures on CME hit document highs in quantity and open curiosity, with $788M in OI, signaling rising institutional demand for regulated XRP publicity.

Bitcoin ETFs Bleed Out as Momentum Slips

The crypto ETF recreation simply threw everybody a curveball. Whereas Bitcoin ETFs misplaced steam with over $115 million in outflows, Ether quietly locked in its twentieth straight day of inflows — not flashy, however constant. After which there’s XRP, quietly blowing previous data in futures quantity and curiosity over at CME.

After a streak of constructive days, Bitcoin ETFs lastly cracked on July 31, watching $114.83 million vanish into the void. Some gamers — like BlackRock’s IBIT — nonetheless pulled in respectable chunks ($18.6M), and a handful of others managed minor inflows. However massive bleeds from Ark’s ARKB (-$89.9M) and Constancy’s FBTC (-$53.6M) wiped all that out after which some.

Buying and selling quantity stayed sturdy at $3.56 billion, however the temper? Cautious. Bitcoin ETF web property are holding regular at $152B, however that pink ink would possibly spook just a few desks if the development continues.

In the meantime, ETH ETFs Simply… Preserve Going

Ether may not be making headlines each day, nevertheless it’s been stacking wins. On July 31, it chalked up Day 20 of steady inflows, including one other $17 million to the pile. BlackRock’s ETHA dominated once more, bringing in $18.2 million, whereas Constancy’s FETH added a stable $5.6M.

Even with Grayscale’s ETHE dropping $6.8 million, the inexperienced streak lives on. ETH ETF quantity hit $1.28 billion, with whole web property climbing to $21.5 billion. Quiet energy. That’s the vibe.

XRP Futures Are Going Nuclear

Whereas everybody’s watching BTC and ETH, XRP is quietly taking on the derivatives recreation. Futures on the Chicago Mercantile Change (CME) are seeing a full-blown surge — volumes exploding, open curiosity reaching all-time highs.

CME reported document motion via July:

- On July 18, XRP futures hit 14,612 contracts, totaling $126M in quantity.

- Simply 4 days later, open curiosity hit a peak of 4,812 contracts = $43M.

- And on July 24, one other open curiosity document — 4,766 contracts, price $788M.

The kicker? That is occurring inside a regulated, institutional framework — not some degen offshore on line casino. CME’s XRP contracts are cash-settled, clear, and compliant, making them engaging to larger gamers who need publicity with out regulatory complications.

CME says its XRP futures “supply a cheap option to achieve publicity” with the added advantages of value discovery, transparency, and actual danger administration instruments. It’s not simply sizzling air — the debut noticed $19.3 million traded throughout 15 corporations, from ETF giants to retail br