- Coinbase is buying Solana-based Vector to spice up its on-chain DEX buying and selling velocity and asset entry.

- Solana dropped 9% amid heavy derivatives liquidations regardless of the acquisition announcement.

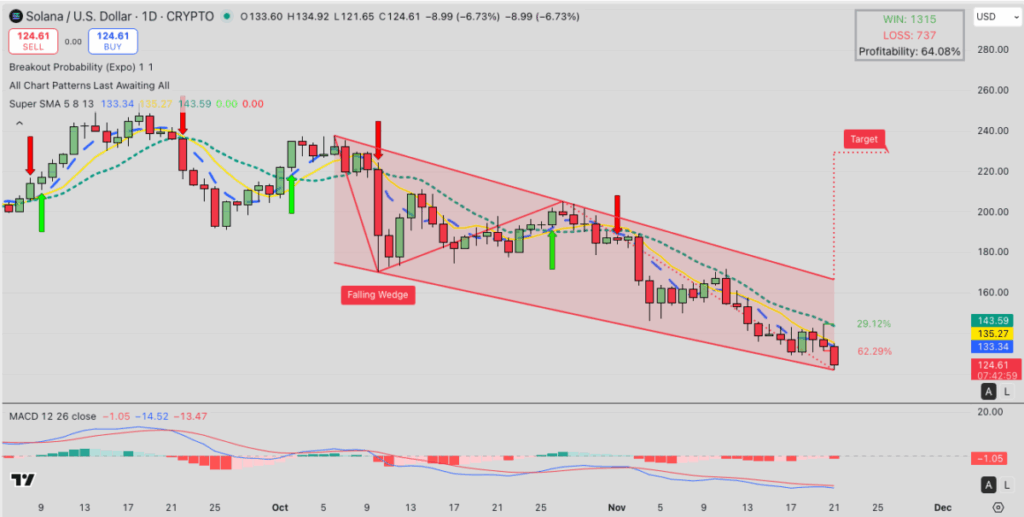

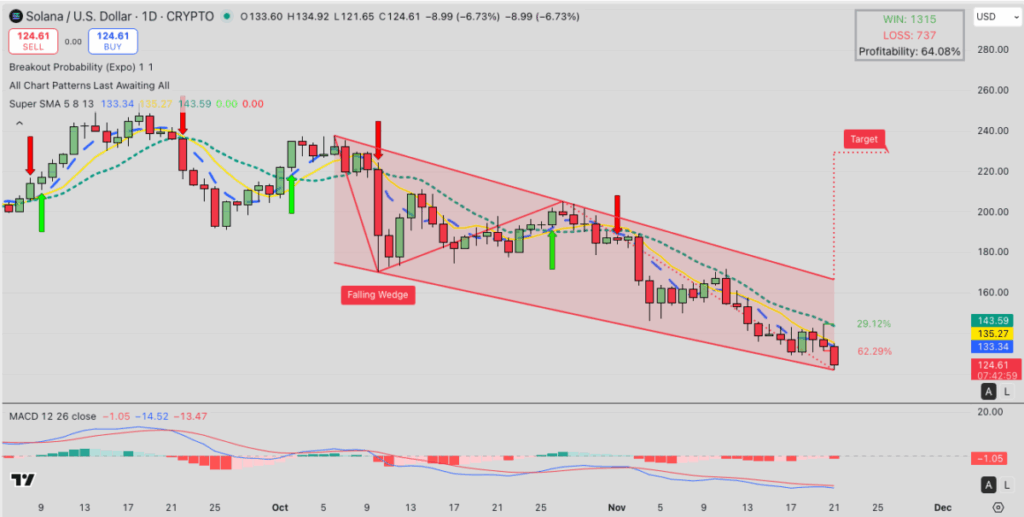

- A falling wedge sample exhibits SOL may rebound practically 29% if bulls defend the $124 assist degree.

Coinbase has made one other fairly daring transfer this week, revealing that it’s buying Vector, a Solana-native social buying and selling platform that’s been popping up throughout crypto Twitter these days. The change says Vector’s tech will get folded into its major shopper buying and selling stack, primarily to present customers sooner entry to high-velocity DEX markets… y’know, the stuff folks love Solana for. It’s one other step in what Coinbase retains calling its 2025 growth push, and truthfully, it suits proper into the entire “on-chain all the pieces” theme the market’s been drifting towards.

What’s fascinating is how huge Solana DEX exercise has change into in 2025 – volumes cruising over $1 trillion already this yr – making it type of apparent why Coinbase would need tighter hooks into the Solana ecosystem. Of their announcement, Coinbase talked about that Vector’s engineering staff (all Solana-native builders) might be becoming a member of the change to assist combine Vector’s working system into its DEX interface. The thought is to spice up execution velocity, deepen liquidity, and provide far more belongings with out forcing customers to hop throughout a number of apps. As a part of the transition, Vector’s personal cell and desktop apps will slowly shut down, which feels bittersweet however anticipated.

The deal doesn’t contact Tensor or the Tensor Basis in any respect, though some of us on-line had been speculating a couple of greater Solana land seize. Coinbase made it clear Tensor stays unbiased. The acquisition nonetheless must go the standard closing checks, nevertheless it’s anticipated to wrap up earlier than the top of the yr. The market, although… didn’t precisely rejoice.

Solana Drops 9% as Market Liquidations Hit Onerous

Even with the Coinbase announcement, Solana couldn’t dodge the heavy wave of end-of-week promoting. SOL slid one other 9%, proper alongside different high altcoins like ETH and XRP, which took related hits as derivatives markets flushed out overleveraged positions. Liquidations piled up quick, dragging costs decrease throughout the board whereas institutional buying and selling desks closed their books for the week.

Derivatives information painted a fairly demanding image. In line with Coinglass, buying and selling quantity for SOL jumped 46%, however open curiosity fell 9% right down to $6.75 billion. That combo normally alerts aggressive unwinding, which matched the worth motion virtually completely. The long-to-short ratio slipped to 0.91 — one other signal merchants had been loading up on draw back bets anticipating the weak spot to bleed into the weekend. The momentum wasn’t delicate; it was simply… down.

Solana Value Outlook: Falling Wedge Hints at 29% Bounce if $124 Holds

Heading into the weekend, Solana is sitting proper on the base of a two-month falling wedge, hovering round $124.51 after that sharp day by day drop. Since early October, SOL’s been carving out decrease highs and decrease lows in a construction that normally hints at an eventual bullish breakout — assuming patrons don’t let assist collapse beneath them.

Brief-term technicals aren’t tremendous pleasant, although. The SMA 5 at $143.58, SMA 8 at $135.26, and SMA 13 at $133.32 are all stacked above value, making a kind of overhead strain zone that SOL might want to chew via on any restoration bounce. The MACD isn’t serving to both, with the road at –14.53 nonetheless under the sign line at –13.48, whereas the histogram retains dipping deeper into the pink.

If the wedge resolves absolutely to the upside, Solana may theoretically stretch all the way in which towards $220. However for now, the extra grounded goal sits round a 29% aid bounce, which turns into lifelike provided that bulls defend $124 and push value again above $160 — the extent that mainly breaks the bearish spell. Till then… it’s endurance time.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.