Galaxy Digital has disclosed the sale of greater than 80,000 Bitcoin—value over $9 billion—on behalf of a long-term investor.

The transaction, revealed on July 25, is likely one of the largest ever executed in Bitcoin’s historical past.

Analysts Hint Galaxy’s $9 Billion BTC Sale to Early MyBitcoin-Period Pockets

Based on Galaxy, the Bitcoin belonged to an unnamed consumer who acquired it throughout Bitcoin’s earliest days and had held the cash for greater than a decade.

The agency described the transfer as a part of the consumer’s property planning, hinting at a strategic determination to appreciate good points after years of holding.

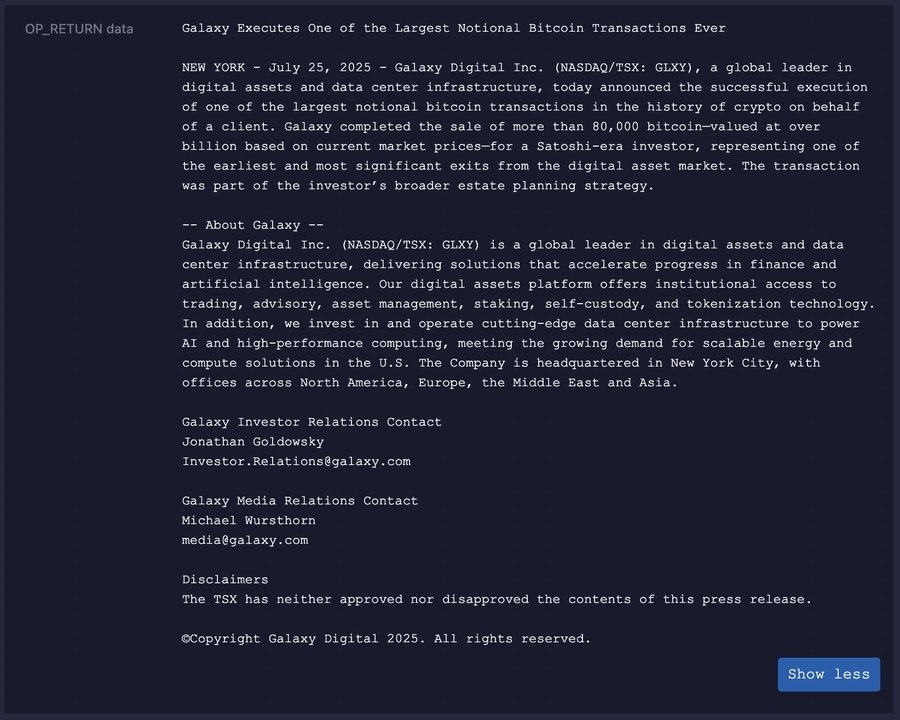

Notably, Galaxy additionally made the announcement on-chain, utilizing an op_return discipline to embed the message in transaction metadata.

The transaction included 1 satoshi—Bitcoin’s smallest unit—being despatched to every recipient deal with. This symbolic act captured the eye of blockchain analysts.

“if the press launch isn’t on-chain, did it even actually occur? this transaction is funded with 80,000 sats from a Galaxy Digital deal with, and pays 1 sat of mud to every of the addresses concerned within the 80,000 BTC sale,” pseudonymous Bitcoin analyst Mononaunt mentioned.

Following the disclosure, blockchain investigators traced the cash to addresses tied to MyBitcoin, one of many earliest Bitcoin pockets companies. The platform shut down in 2011 after a infamous hack, leaving many cash unaccounted for.

CryptoQuant CEO Ki Younger Ju famous that the wallets had been dormant since April 2011, simply earlier than the platform’s collapse. This has fueled hypothesis in regards to the vendor’s id.

“It possible belongs to the hacker or the nameless founder generally known as Tom Williams. It appears Galaxy Digital purchased the #Bitcoin from them, however I’m undecided in the event that they did any forensics,” Ju added.

In the meantime, market analysts additionally questioned the technique behind unloading such a big quantity in a single transaction.

Bloomberg’s Eric Balchunas prompt the size of the Bitcoin sale would have triggered important slippage. He added that the urgency behind the transfer raised vital questions in regards to the vendor’s motive.

“Have they misplaced religion that badly that they need to take that a lot cash out that rapidly? Except they plan to purchase the LA Lakers in money, it appears odd/even regarding,” Bachunas questioned.

Nevertheless, Eliezer Ndinga of 21Shares prompt that if Galaxy facilitated the transaction, it possible performed stringent KYC checks, lowering the possibilities that the vendor was an unidentified dangerous actor.

“It’s a habits akin to a hacker but when that quantity was processed by Galaxy I assumed they’d a stringent KYC course of to allow transaction to undergo,” Ndinga mentioned.

Different market observers praised Bitcoin’s swift restoration from the sell-off. They famous that the rebound displays its rising maturity as an unbiased asset class.

As of press time, BTC is buying and selling above $117,000, a exceptional turnaround for a digital asset that had fallen to a multi-week low below $115,000 amid the sell-off.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.