An in depth take a look at the rising odds of a December Federal Reserve charge minimize, how merchants reacted and why Bitcoin holders grew extra assured.

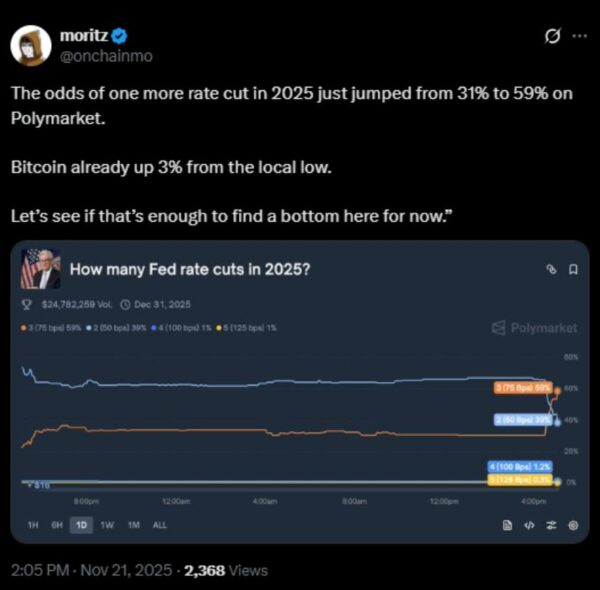

Bitcoin merchants noticed a uncommon change in tone this week, after the chances of a December Federal Reserve charge minimize climbed virtually twice as excessive as the day prior to this.

The change introduced a wave of recent dialogue throughout crypto circles, as many argued that a better coverage stance might assist Bitcoin gradual its current slide.

Rising Price Minimize Odds Carry New Consideration From Bitcoin Merchants

Bitcoin has had a tough week. The value dropped greater than 10% over seven days, falling towards $85,000 in line with CoinMarketCap. Merchants watched the regular decline and waited for one thing to shift the temper.

That change in development arrived on Friday. The CME FedWatch Device confirmed the chances of a December charge minimize rising to 69.40%. This was an enormous soar from the 39.10% studying the day earlier than. The change created a direct response from many merchants who observe macro indicators.

Crypto analyst Moritz posted that the transfer is likely to be sufficient to assist Bitcoin discover a native backside. A number of others echoed that view and the concept the Federal Reserve might minimize charges within the close to time period created hope that sellers would possibly ease their stress.

Fed Remarks Set off Quick Market Repricing

The surge in expectations got here after feedback from New York Fed president John Williams.

He acknowledged that the Fed might minimize charges quickly with out harming progress towards its inflation aim. Bloomberg analyst Joe Weisenthal mentioned these remarks had been seemingly the primary purpose behind the sudden soar in charge minimize expectations.

Analysts are warning merchants to not transfer too quick. They are saying that markets typically react strongly to early indicators earlier than the complete image turns into clear. Some merchants agree, although many nonetheless took the change as a promising signal.

I really feel completely silly posting at this level.

I don’t know why we maintain going decrease, I’m genuinely scratching my head.

Nonetheless if you happen to zoom out the setup is unfathomably bullish.

We’re going from a tightening cycle into an easing cycle.

Price minimize odds have flipped again to…

— Jesse Eckel (@Jesseeckel) November 21, 2025

Crypto analyst Mister Crypto mentioned charge cuts often align with stronger value motion for danger belongings.

Bitcoin usually advantages when conventional investments provide decrease returns. Bonds and time period deposits turn into much less interesting throughout easing cycles, which may push traders towards various belongings.

Associated Studying: What Are The Odds Of One other Price Minimize In December?

Extra Fed Voices Add To The Market Dialog

New particulars from a number of Federal Reserve officers have added gas to the market’s development.

Williams mentioned he sees room for a near-term adjustment that strikes coverage nearer to impartial. His place carries extra weight as a result of he serves as vice chairman of the Federal Open Market Committee.

The percentages of a charge minimize subsequent month at the moment are at 69.5%

It has virtually doubled at the moment after the NY Fed hinted in the direction of a charge minimize.

I nonetheless assume that odds will go down because the Fed has no current information to take a charge minimize resolution. pic.twitter.com/XTbBVhYQvs

— Ted (@TedPillows) November 21, 2025

Fed governor Stephen Miran provided one other notable sign. He instructed reporters he would vote for a 25 foundation level minimize if he had been the swing vote, although he prefers a 50 foundation level minimize. His feedback pushed expectations increased as a result of he has been extra aggressive than most officers.

Present pricing now exhibits a greater than 75% probability of a minimize subsequent month. That is far above readings from earlier within the week.

Fed information from current months has been combined. September payrolls rose by 119,000, properly above the anticipated 51,000. The unemployment charge ticked upward to 4.4% Some officers noticed this as an indication that previous charge hikes have slowed the labor market.

Miran mentioned the roles report ought to push unsure officers towards easing. He pointed to rising everlasting layoffs and mentioned restrictive coverage will not be wanted on the identical stage anymore.

Not all officers shared that view.

Boston Fed president Susan Collins mentioned she prefers to carry charges regular for now. She sees regular demand in her area and worries about firms passing increased prices to clients.

Dallas Fed president Lorie Logan expressed comparable warning. She mentioned she must see softer inflation or a weaker job market earlier than supporting one other minimize.

Philadelphia Fed president Anna Paulson additionally urged warning. She famous that every earlier minimize raises the usual for the subsequent one.

Vice chair Philip Jefferson mentioned he sees increased danger in employment than inflation in the mean time. He didn’t rule out a minimize however mentioned he favors a gradual method.

In all, the FOMC meets on December 9 and 10 and merchants at the moment are monitoring every remark from Fed members as they put together for the ultimate assembly of the 12 months.