After a robust 26% achieve over the previous week, Pudgy Penguins (PENGU) is now hovering just under an important resistance degree.

Whereas a lot of the altcoin market cools down, PENGU value seems to be poised to interrupt out. Provided that it will possibly push previous one key wall. A deeper take a look at bullish energy, liquidations, and value charts exhibits the token would possibly nonetheless have room to run.

PENGU Bulls Are In Full Management

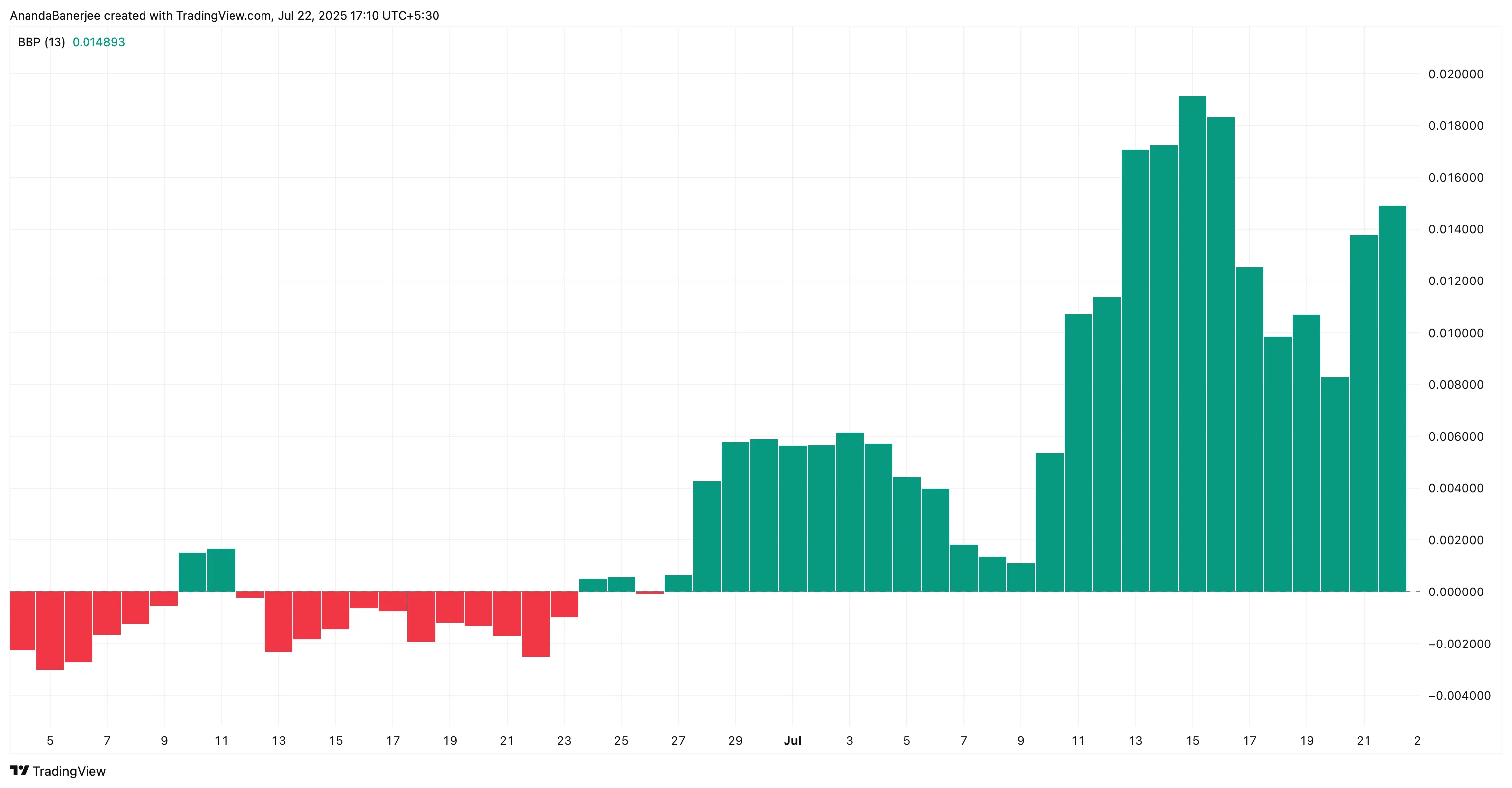

Despite the fact that PENGU dropped round 2% previously 24 hours, the bulls nonetheless appear to be holding the reins. The Bull-Bear Energy (BBP) index, which compares current highs and lows to measure market energy, is at the moment flashing inexperienced, at round 0.0148. This degree suggests patrons nonetheless have the higher hand, regardless of a short-term dip.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

In easy phrases, when BBP is optimistic, bulls are stronger than bears. And Pengu’s BBP has remained above zero since late June, at the same time as costs hovered under key resistance. That regular energy may very well be an indication that any dip is simply a part of a cooldown earlier than one other leg up.

If BBP stays optimistic whereas value climbs previous resistance, it would verify that PENGU nonetheless has momentum. But when BBP flips unfavorable, it might warn of a deeper pullback forward.

7-Day Liquidation Map Reveals Quick-Biased Setup

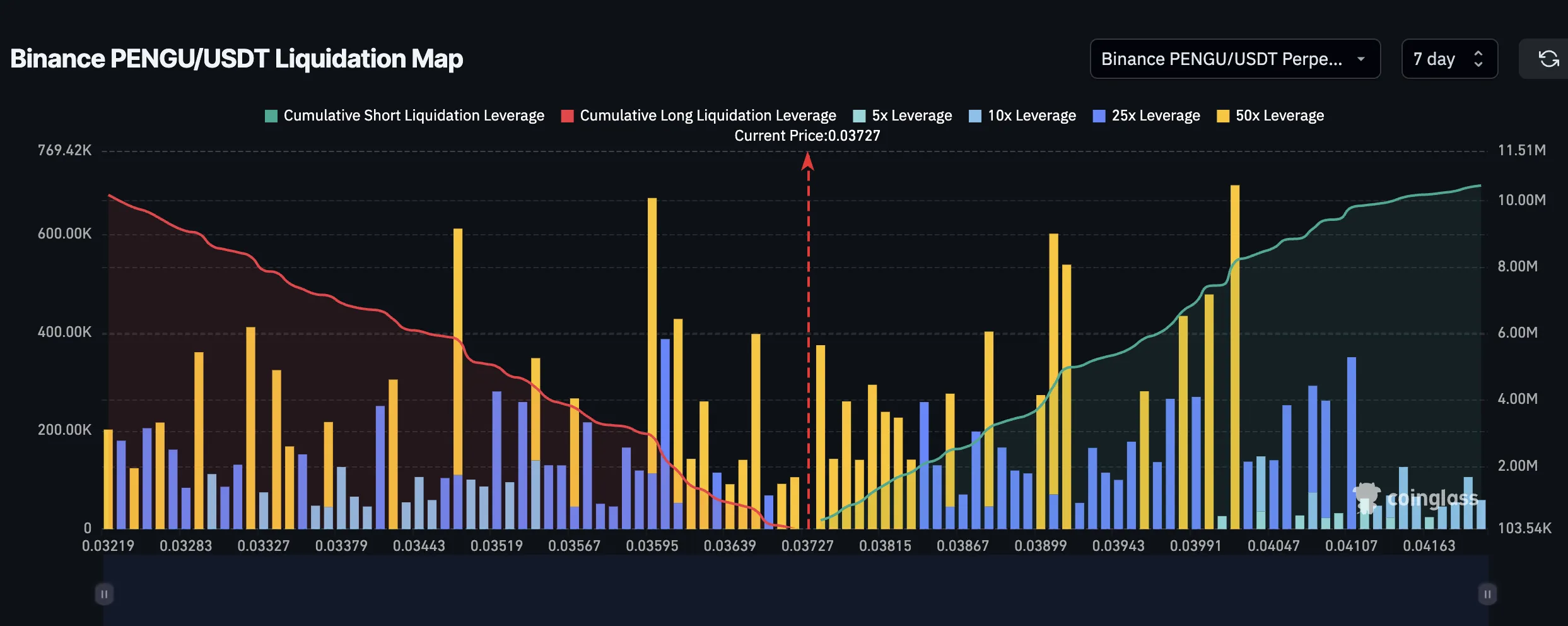

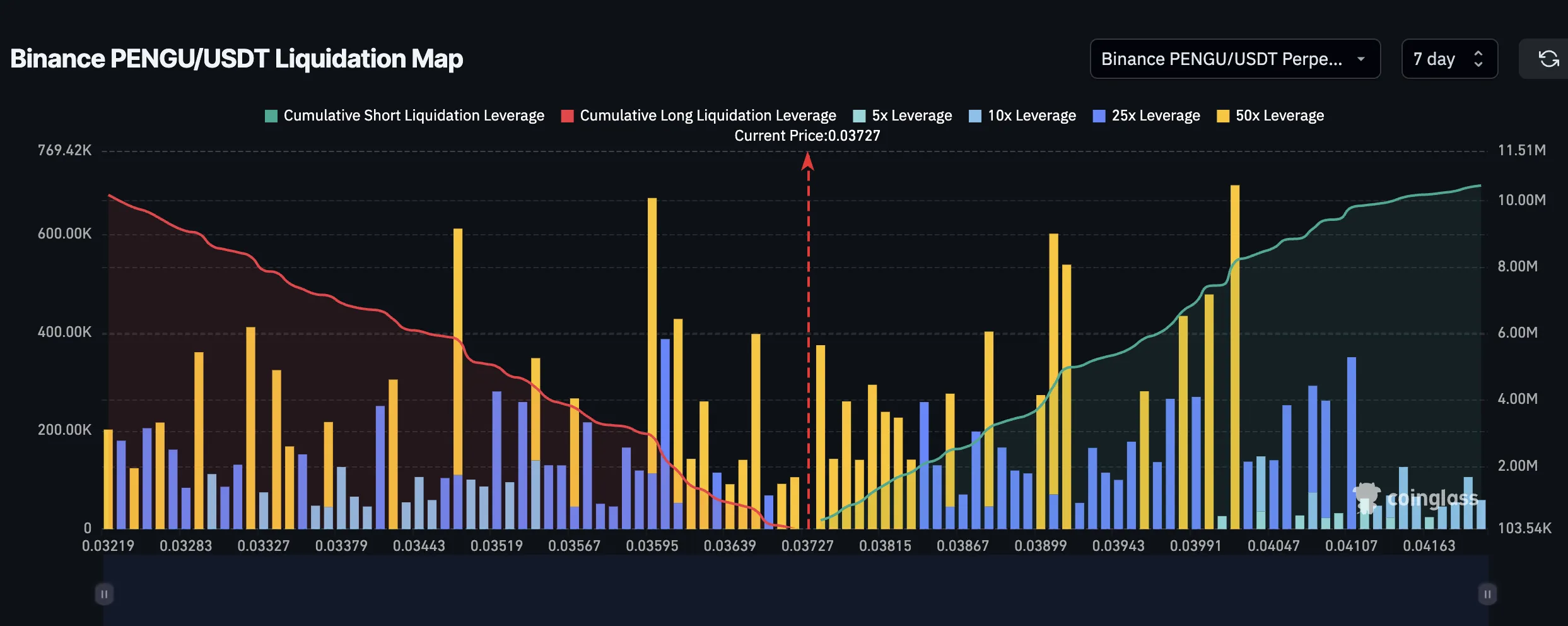

PENGU is at the moment buying and selling round $0.036. The 7-day liquidation map exhibits cumulative brief liquidation leverage constructing as much as $10.46 million versus $10.18 million for longs; a slight bias towards brief positions. Do word that there isn’t a lot to decide on between Longs and Shorts, and a value push in both route can determine the subsequent leg for PENGU.

Nonetheless, as bulls are in energy and that too by a large margin, as established by the BBP index, the value motion might impression the brief positions greater than the lengthy.

If the value crosses $0.039, led by bulls breaking key resistance degree, and even nears $0.042, a significant liquidation cluster of shorts will get triggered. That would scale back downward stress and doubtlessly propel the PENGU value to the subsequent key value degree.

The liquidation map exhibits a build-up of brief positions; if PENGU’s value strikes up quick, these betting in opposition to it might be pressured to purchase again, pushing the value even larger.

PENGU Value Motion Hints at a 38% Upside

Technically, the PENGU value has examined the 0.382 Fibonacci degree close to $0.039 twice and failed to interrupt above cleanly. It now trades just below that resistance. Do word that moreover the Fib extension resistance, a key resistance of $0.037 additionally exists.

The chart makes use of the Pattern-based Fibonacci extension software. It connects the swing low of $0.0077 to the final swing excessive of $0.035 after which to the instantly retraced value degree of $0.028. This software helps chart the subsequent value targets for a coin/token in an uptrend.

If PENGU value manages a clear breakout above $0.037, $0.039, after which $0.042 (the 0.5 Fib zone), it opens the trail to $0.045 first, a 25% surge. If that breaks, the subsequent key resistance level, or somewhat goal, could be $0.050, the 0.786 Fibonacci degree. That might be a 38% rally from present costs round $0.036.

Validation for this transfer comes from declining bear energy, constructing brief positions, and robust chart construction. The bullish development would get invalidated if PENGU breaks the $0.035 resistance-turned-support. Or if it continues to drop to the touch the retracement zone of the Fibonacci extension: the $0.028 mark.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.