- ETH dropped practically 11% to a five-month low, however whales gathered over $241M price of ETH through the pullback.

- Alternate reserves sank to a 55-month low, tightening sell-side liquidity and hinting at long-term bullish strain.

- Worth motion stays bearish for now, however sustained whale demand may assist ETH reclaim the $3,000 stage.

Ethereum hasn’t had the best stretch these days. The world’s greatest altcoin slipped practically 10.9%, falling all the best way to a five-month low round $2,650 earlier than managing a small bounce again towards $2,720. It’s been caught inside a descending channel all through This autumn—principally grinding decrease week after week, as broader market volatility retains squeezing altcoins tougher than Bitcoin. The decline isn’t refined anymore; it’s the sort of gradual bleed that normally shakes out weak arms. However apparently… this exact same drop has opened a window for patrons who’ve been ready on the sidelines.

Whales deal with the correction as a cut price

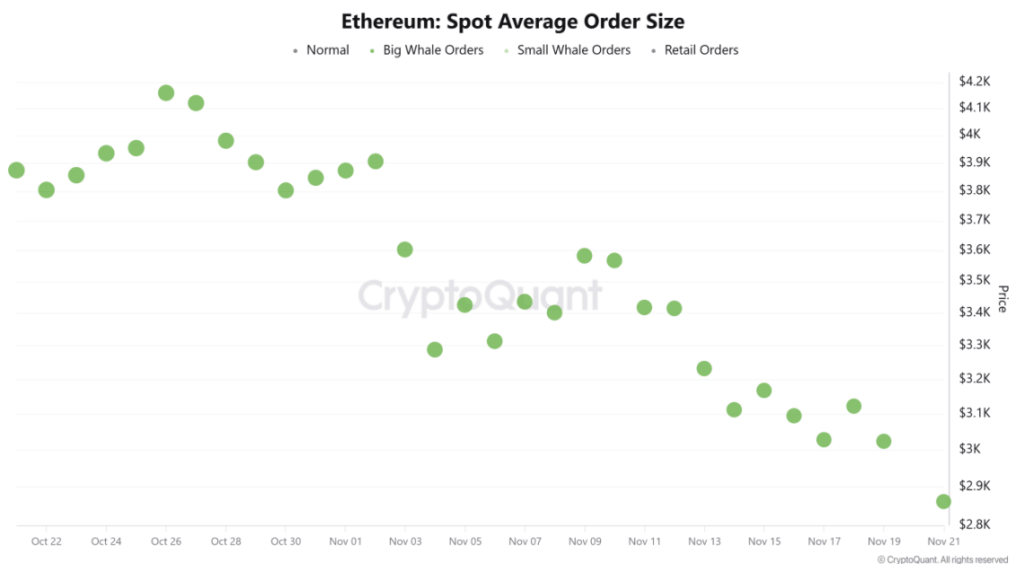

Whereas retail merchants panicked, Ethereum whales did the exact opposite—they doubled down. All through November, whale exercise stayed unusually excessive whilst ETH saved dropping. CryptoQuant’s Spot Common Order Measurement knowledge confirmed repeated giant orders hitting the books, an indication that massive gamers weren’t scared off by the downtrend. As a substitute, they regarded nearly desirous to scoop up ETH at a reduction.

One of many standout strikes got here from the so-called “66,000 Borrowed Whale,” who grabbed one other $162.77 million price of ETH from Binance after which provided it straight into Aave V3. That purchase pushed his whole stash to 432,718 ETH—roughly $1.23 billion. Three different whales picked up practically 10,000 ETH (~$30 million) from Binance. After which there was Bitmine, tied to Tom Lee’s group, including one other 17,242 ETH (about $49 million) sourced from FalconX and BitGo. In whole, these high-conviction gamers gathered roughly $241.84 million in recent ETH.

When whales step on this aggressively throughout a downtrend, it normally means they’re betting that the correction is short-term—and that the upside will outweigh the worry.

Alternate provide tightens sharply as accumulation rises

Whale shopping for hasn’t simply been loud—it’s truly reshaping provide dynamics. Ethereum’s change reserves simply dropped to a 55-month low, hitting 15.6 million ETH in accordance with CryptoQuant. That’s round $42.9 billion price of provide successfully pulled out of the open market. When change balances sink like this, sell-side liquidity dries up. And traditionally, skinny sell-side liquidity units the stage for large worth swings upward as soon as demand kicks in.

In easy phrases: whales have absorbed a large chunk of the floating provide. If this continues, ETH turns into tougher to purchase at present costs, and the market usually reacts by repricing larger.

However the charts nonetheless scream bearish — for now

Right here’s the twist: even with all that accumulation occurring behind the scenes, Ethereum’s worth construction hasn’t flipped bullish but. On the charts, vendor dominance continues to be sturdy. The Stochastic Momentum Index fell all the best way to –74.69, which is deep in bearish territory. The Advance-Decline Ratio has stayed underneath 1, confirming that downward strain nonetheless outweighs upward momentum.

So the market sits at this bizarre crossroads. On one aspect: whales are loading up, change reserves are thinning, and long-term indicators appear like early accumulation. On the opposite: the downtrend hasn’t technically damaged.

If bears hold management, ETH may retest the $2,535 space. But when whale demand lastly overpowers the slide—and it usually does after heavy accumulation phases—Ethereum may regain $3,000 within the quick time period, flipping sentiment nearly in a single day.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.